Manual Index

-

Chapters

The Manual is divided into seven chapters. Click a chapter title to display that chapter's table of contents in the area below.

Chapter Four

Tools

- Intro to Tools

- Files, Forms & Templates

- Reports

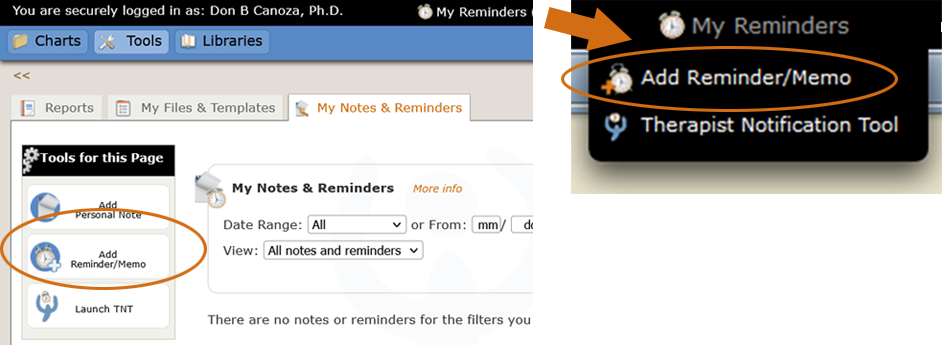

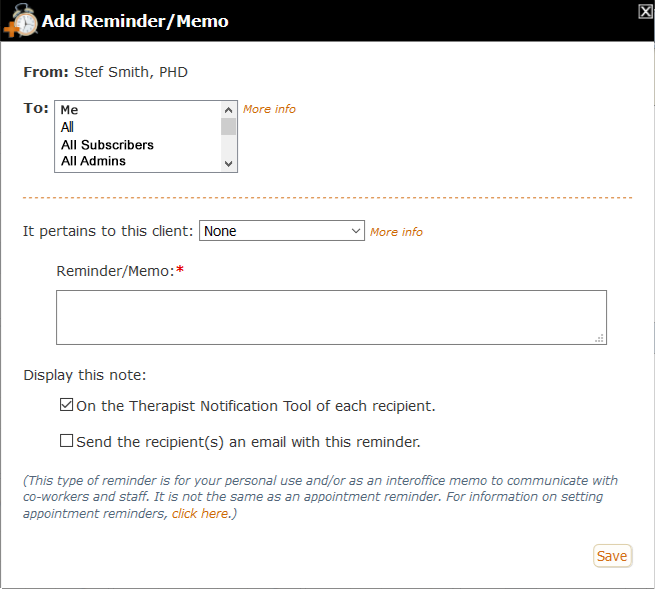

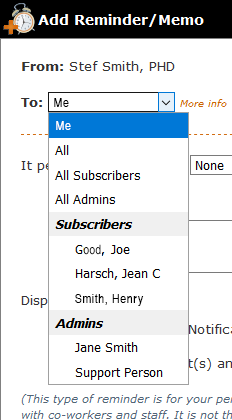

- My Notes & Reminders

PSYBooks Manual

Chapter Four

Intro to Tools

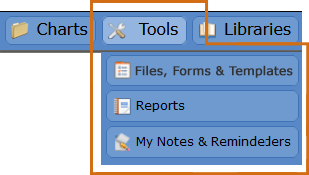

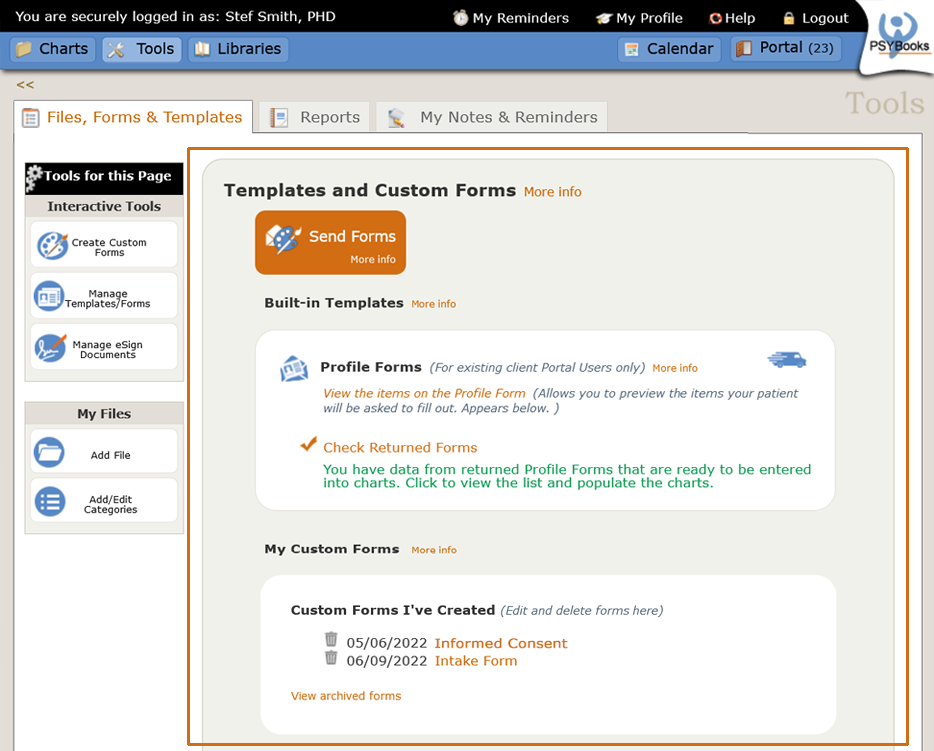

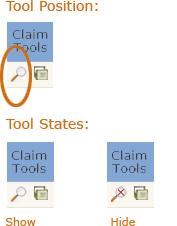

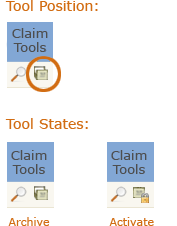

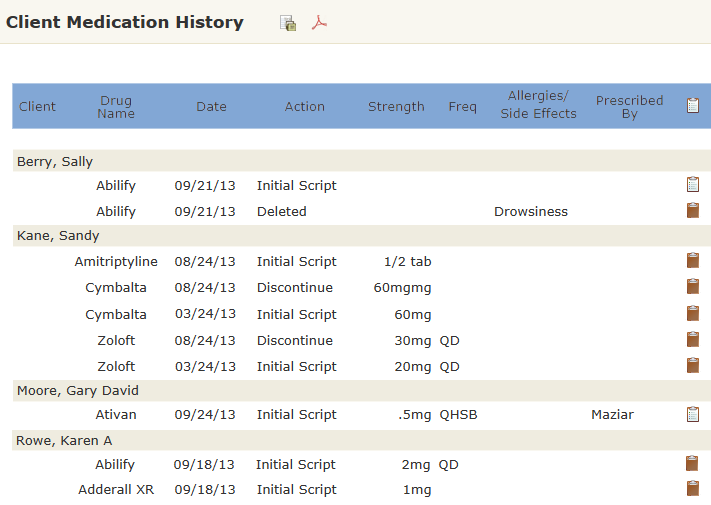

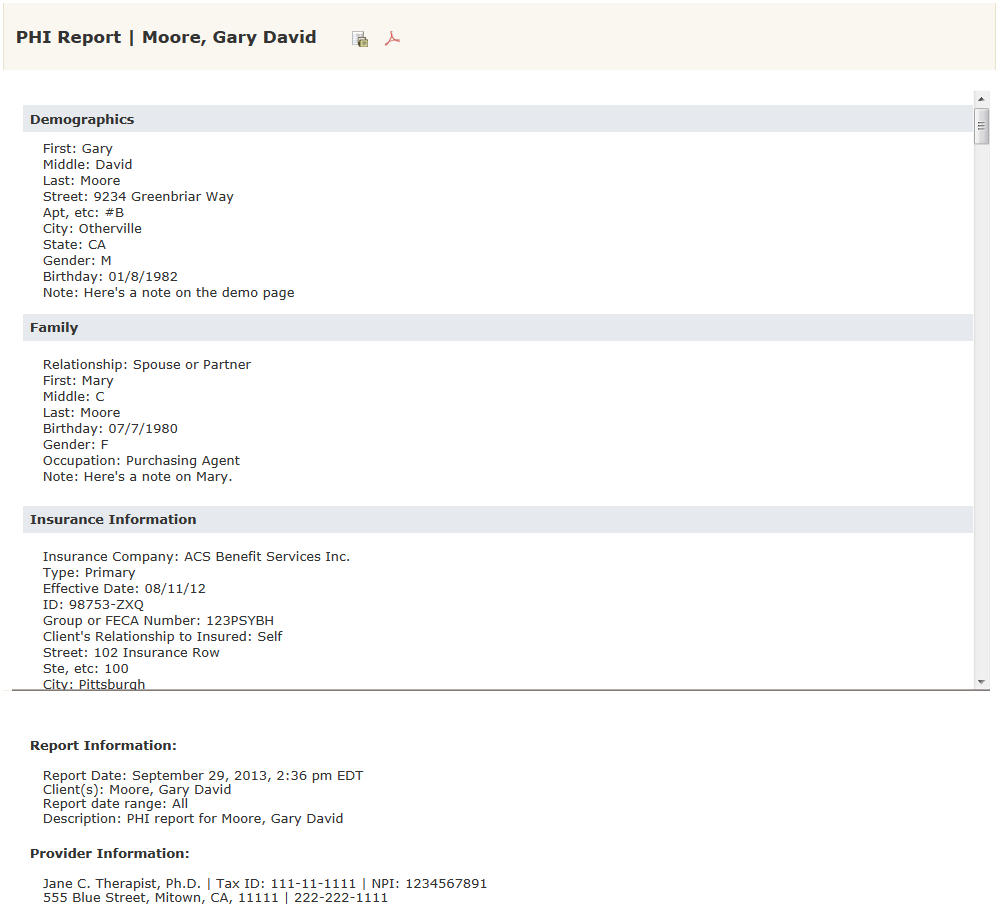

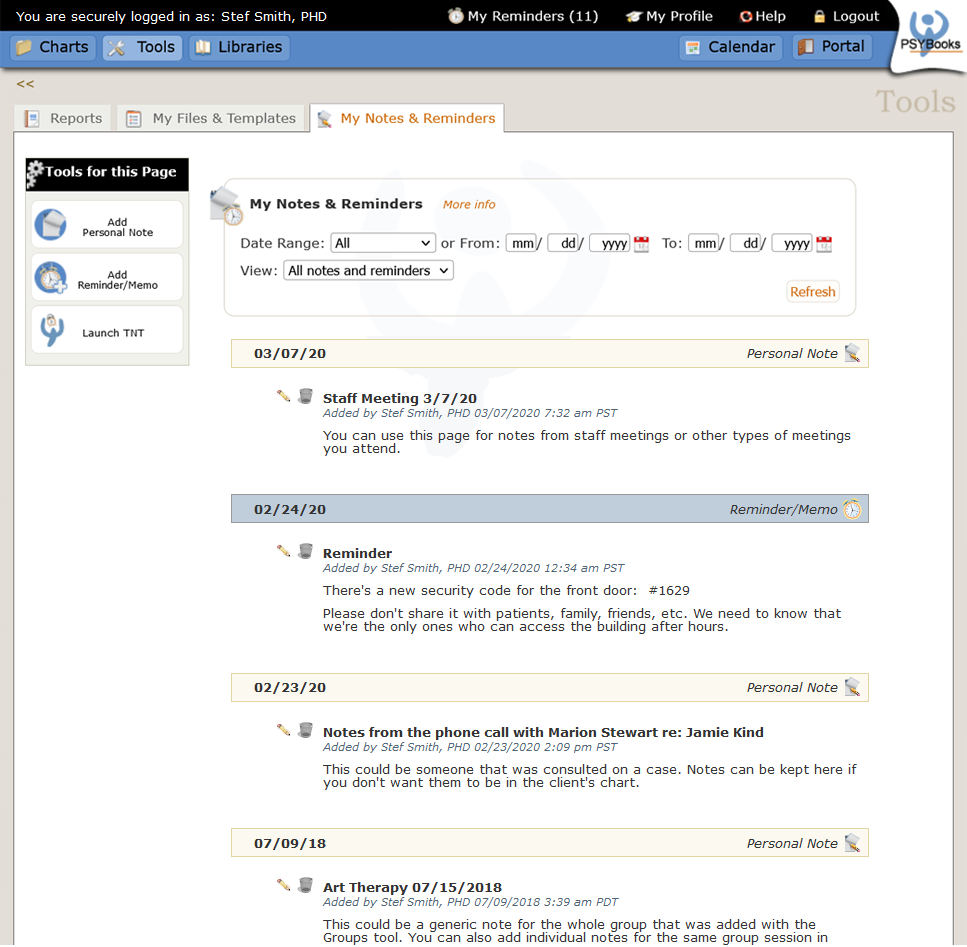

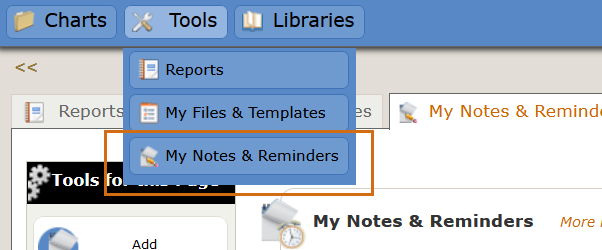

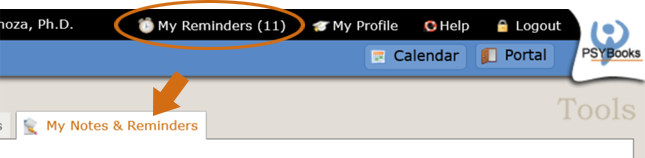

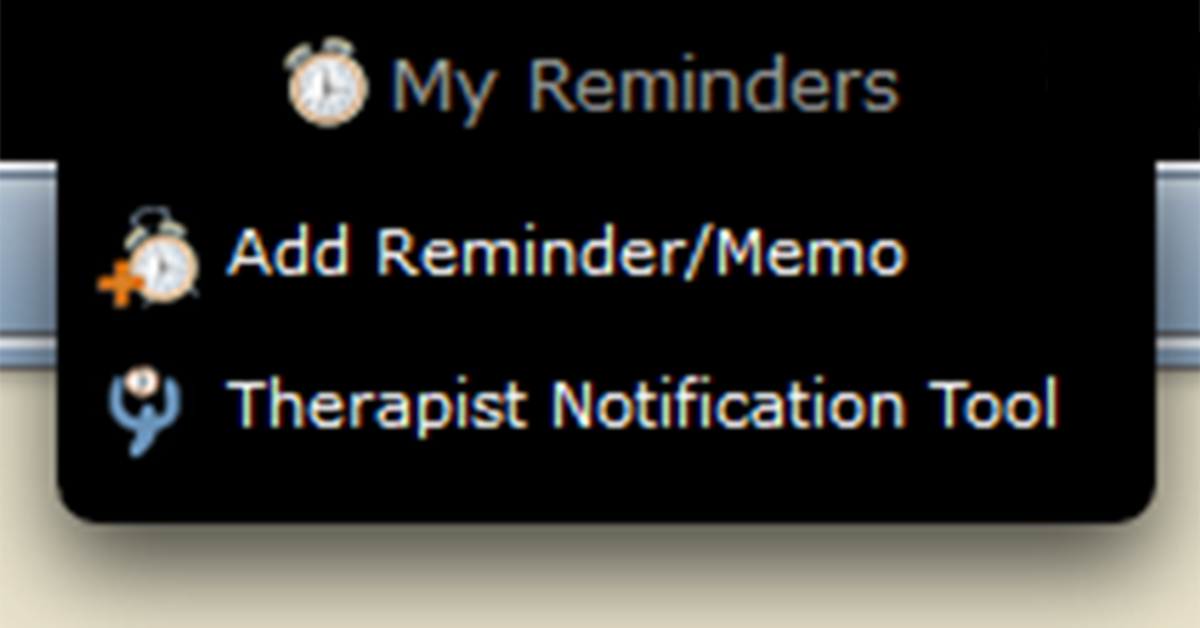

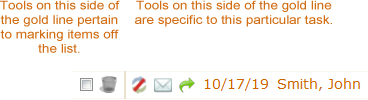

What this isTools is one of the sections of the global nav. The Tools section has three sub-sections: Files, Forms & Templates, Reports, and My Notes & RemindersWhat it looks like |

Where this isYou can access the Tools section from the global nav at the top of every page or from the Sitemap links at the bottom. |

The Tools section holds tools that pertain to your entire practice, as opposed to tools you might use with any one client. Tools has three local nav tabs: Files, Forms & Templates, Reports, and My Notes & Reminders:

Files, Forms & Templates has tools you can use to upload files from your computer so you'll have all of your practice documents in one secure location. This is equivalent to the Files tab of each client's chart, except that it holds the therapist's files. Also, when you've requested an eSignature on a document and your patient signs and sends it back to you, a copy of that file is automatically put on this page in a category called, "Documents That Have Been eSigned." Finally, when a patient uploads a file to you, those files are placed on this page in a category called, "Files Received from Portal Users." This is also where you create and send Custom Forms.

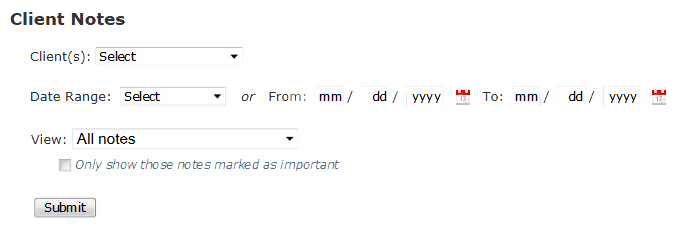

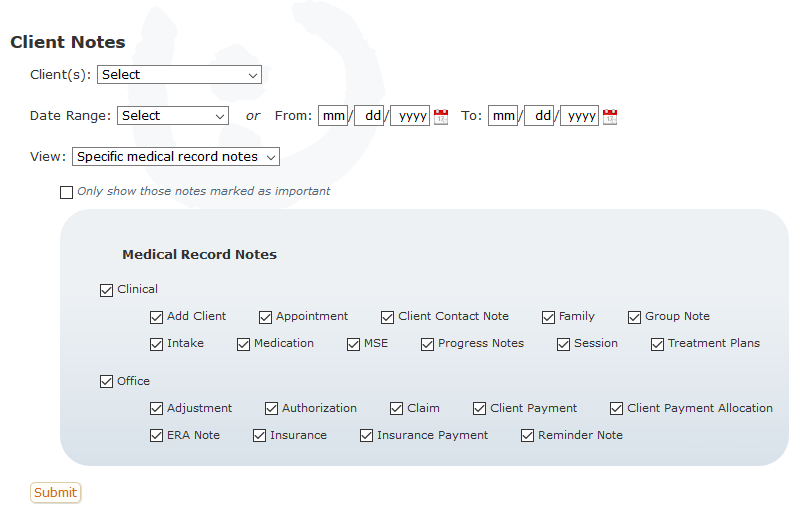

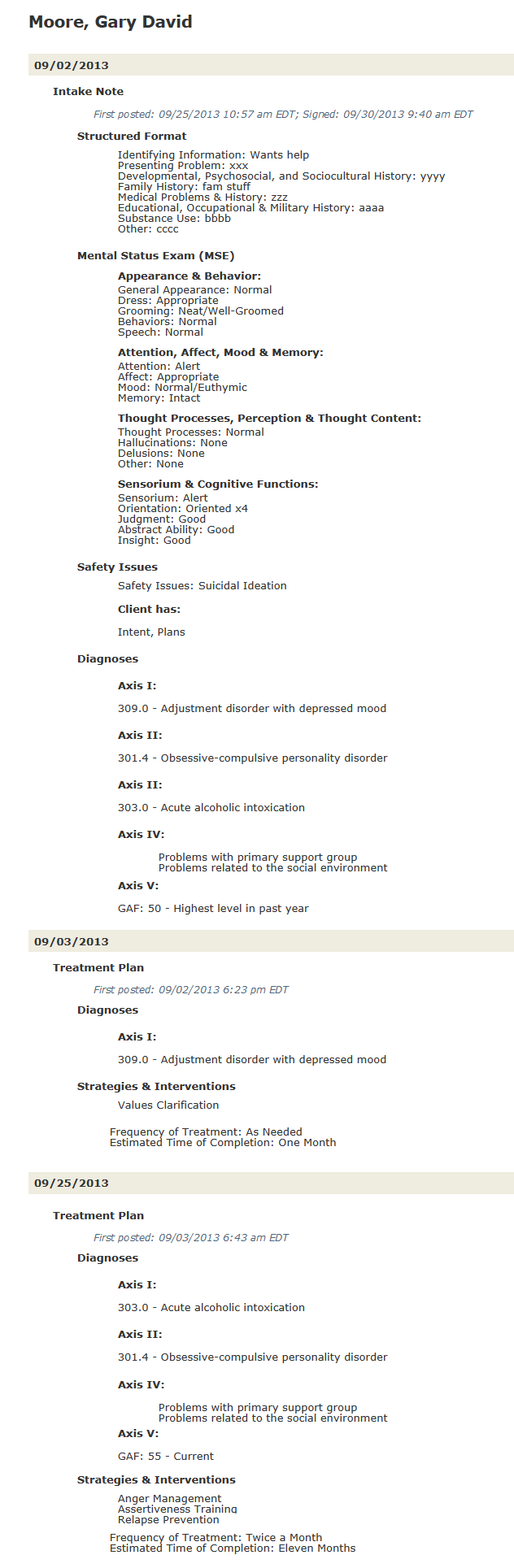

The Reports section allows you to create reports based on the data that's been entered throughout the program. Each report has a variety of filters which allow you to tailor the report to your specific needs. Once the report has been run, in most cases you can save a copy to the Files, Forms & Templates section if you need to keep a record of it.

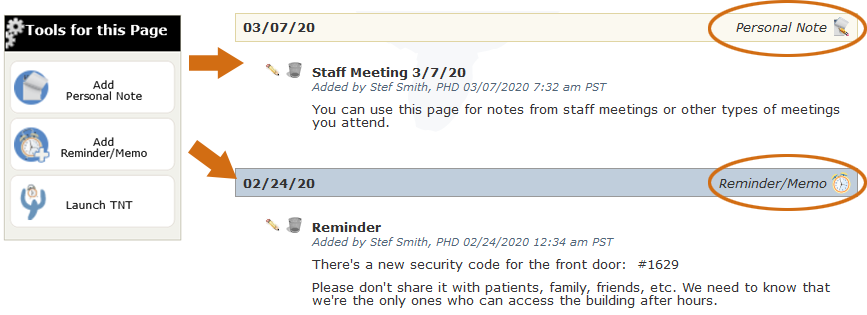

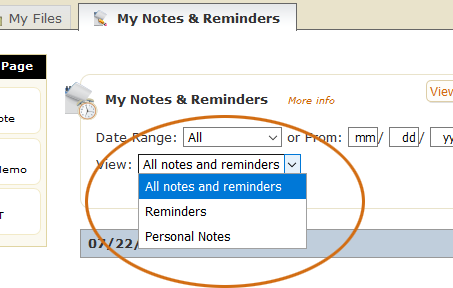

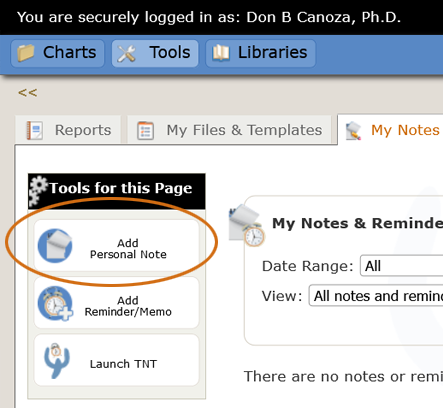

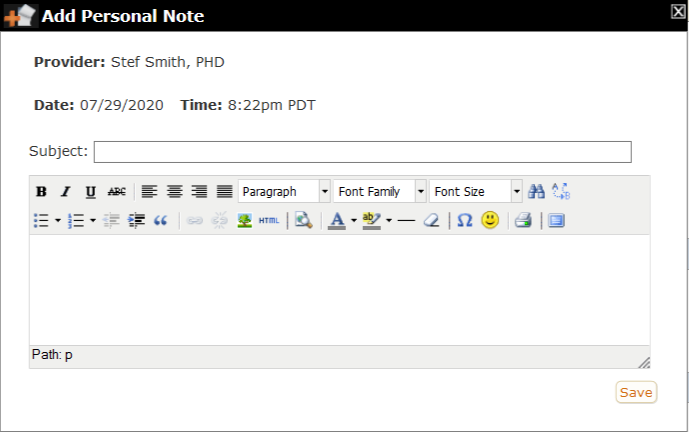

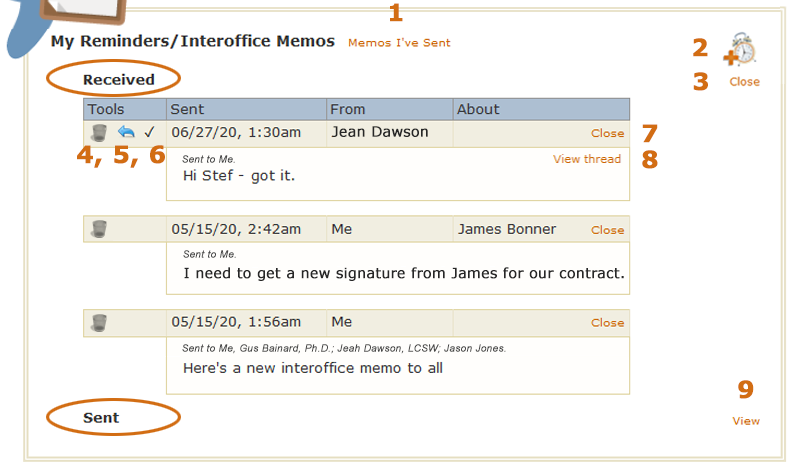

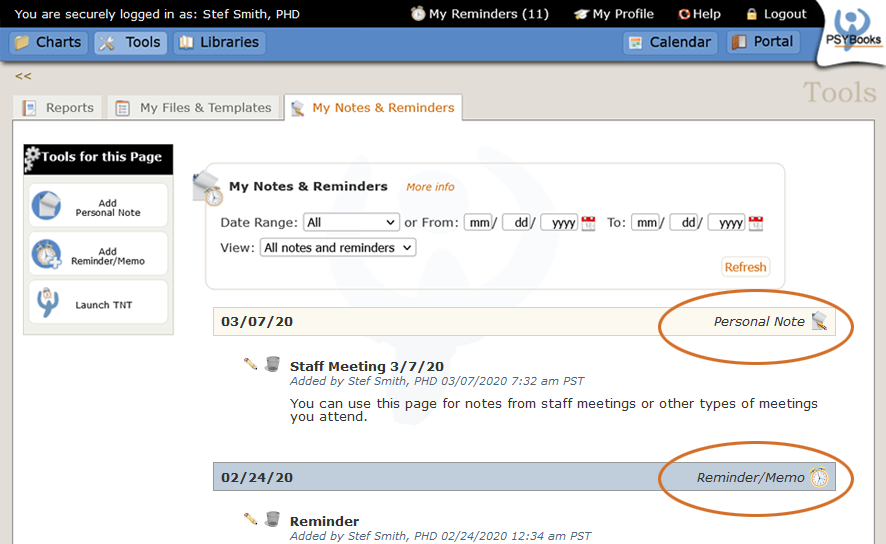

In the same way that the Files, Forms & Templates section is like the Files tab of a client chart, My Notes & Reminders is similar to the Notes tab in a client chart. My Notes & Reminders serves as a repository and set of tools for your personal notes and reminders as well as for interoffice memos you've exchanged with others in your office.

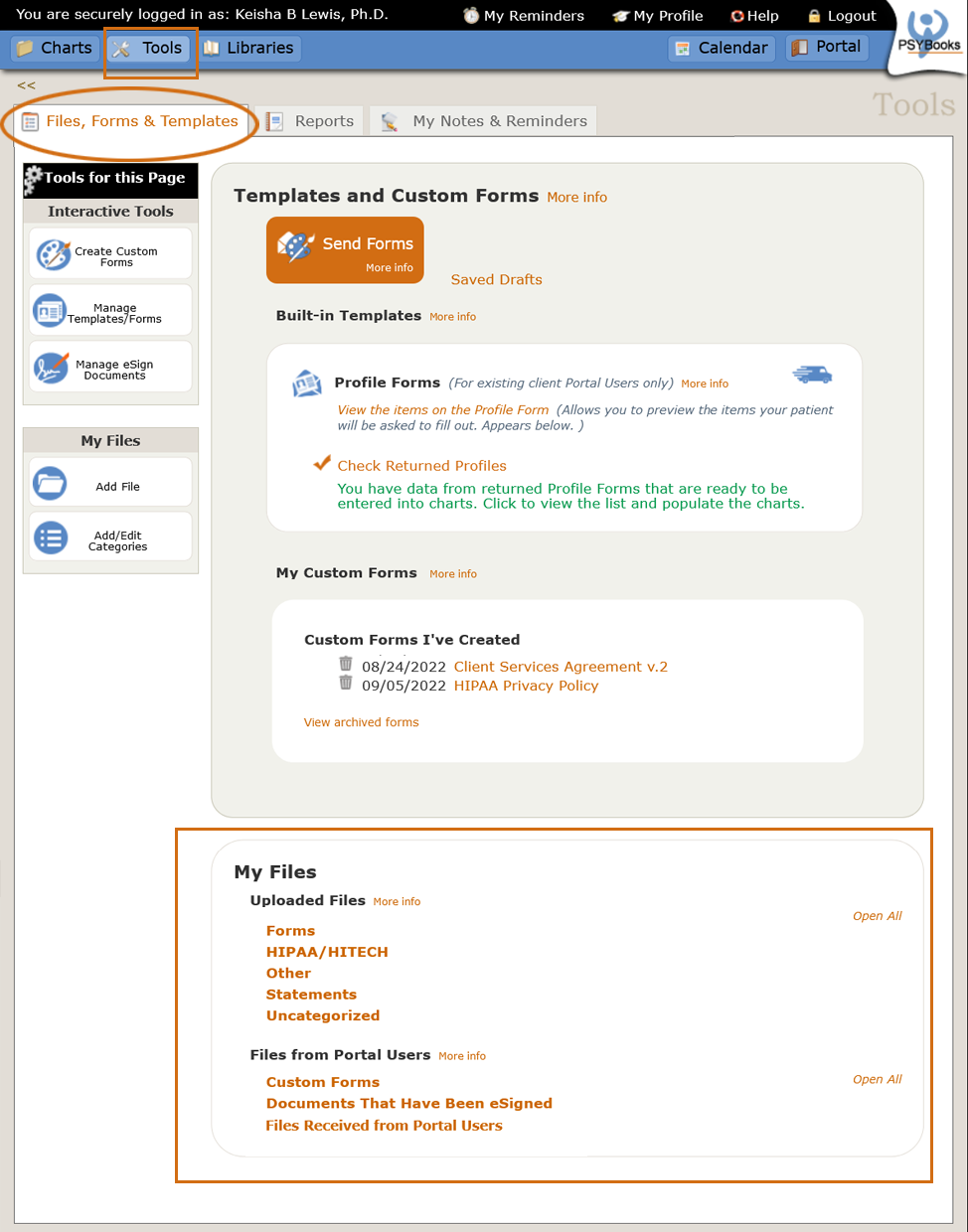

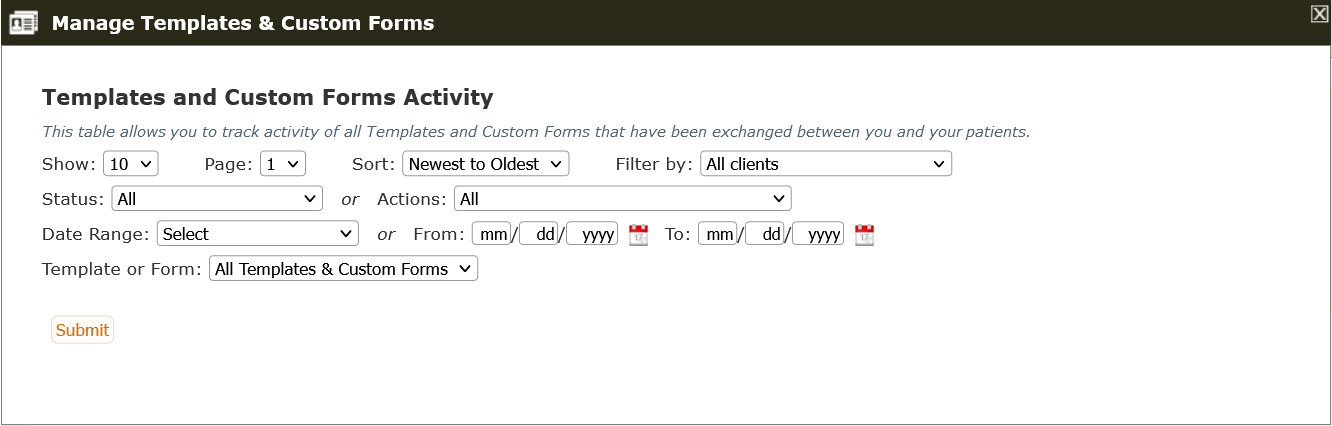

Files, Forms & Templates

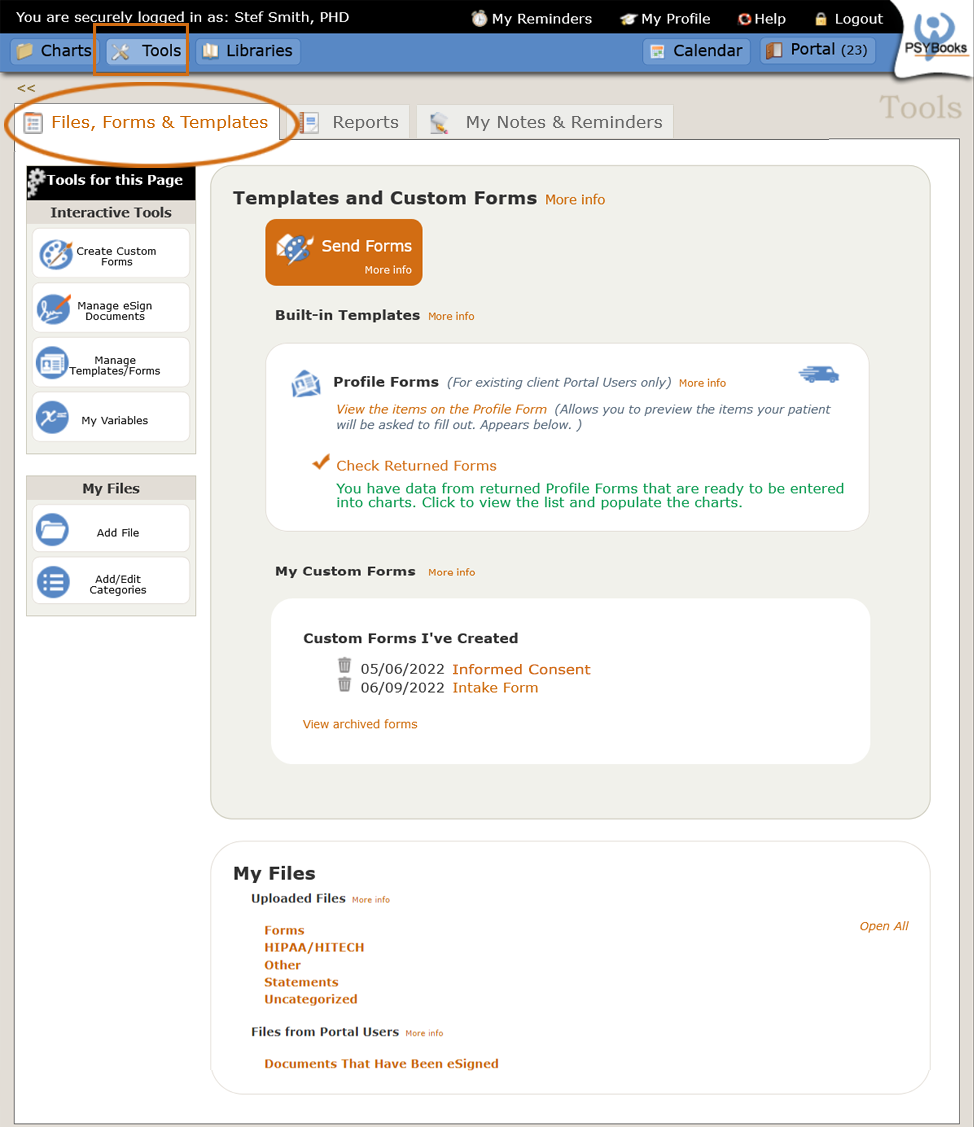

What this is"Files, Forms & Templates" is a tab in the Tools section of the app that allows you to create, send and receive both pre-formatted templates and also Custom Forms that you've made for your practice. There are two sections. The gold block at the top holds the PSYBooks built-in Templates plus any Custom Forms you've made. The gold section also holds the "Send Forms" tool to allow you to send forms and templates at any time. The white "My Files" section at the bottom holds files you've uploaded as well as a section for Files Received from Portal Users.What it looks likeReports > Files, Forms & Templates  |

Where this isYou can access Tools from the global nav at the top of every page or from the Sitemap links at the bottom. Files, Forms & Templates is the second tab. |

"Files, Forms & Templates" is a secure area for creating, storing and sending the various kinds of forms and files you might use in your practice. It has two sections: "Templates and Custom Forms" are in the gold area at the top, "My Files" are in the white section at the bottom.

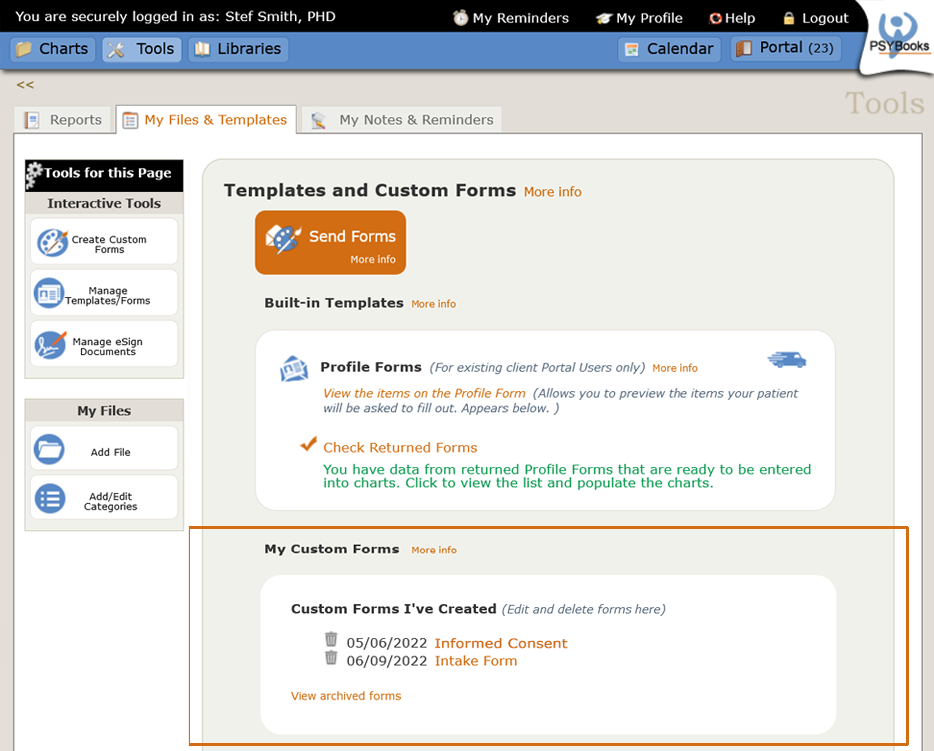

The "Templates and Custom Forms" section further subdivides into "Built-in Templates" and "My Custom Forms." Built-in templates are forms built in to PSYBooks that you can send your patients to allow them to fill out certain sections of their chart themselves. Currently, it holds the Profile Form, which allows patients to complete the Demographics and Insurance sections of their chart. The "My Custom Forms" section will not show until you have created at least one Custom Form.

The bottom white area outlined in gold, called My Files, is further subdivided into two sections: "Uploaded Files" at the top and "Files from Portal Users" at the bottom. The main difference between those two sections is that Uploaded Files are files that only you (and your Admin staff, if you give them permission) can access. You or someone in your office has added the files that are in this section. In contrast, the bottom section lists files that have been sent to you by Portal Users. A copy of each of those files is also in the Portal of whichever Portal User sent them to you so those are shared files. Additionally, when the Portal User is a client, in most cases, a copy of the file will also be placed in the client's chart as part of their medical record.

The tools on the left nav of the Files, Forms & Templates page are similarly divided, with those tools in the top section being more interactive in nature. Though there's not a 1:1 correspondence, tools in the Interactive Tools section tend to pertain to the Templates and Custom Forms section on the right. In contrast, the bottom section of left nav tools, Add File and Add/Edit Categories, are ONLY used with the My Files section at the bottom right. Each of those two sections - with their respective tools - will be discussed below, following a discussion of the PDF Preview tool, which is inserted here because it's used extensively throughout the "Files, Forms & Templates" section.

PDF Preview Tool

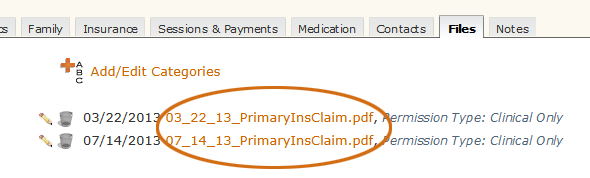

What this isThe PDF Preview Tool allows you to preview PDF files you've previously uploaded so you can view them without having to download PHI onto your computer or other device.What it looks likeThe tool for previewing PDFs is just the link of the file's name. In a client chart, it looks like this:  The presentation is similar in the therapist's "Files, Forms & Templates" area:  |

Where this isThe PDF Preview Tool is available on the Files tab of a client's chart and also in the Tools > Files, Forms & Templates section of the app. |

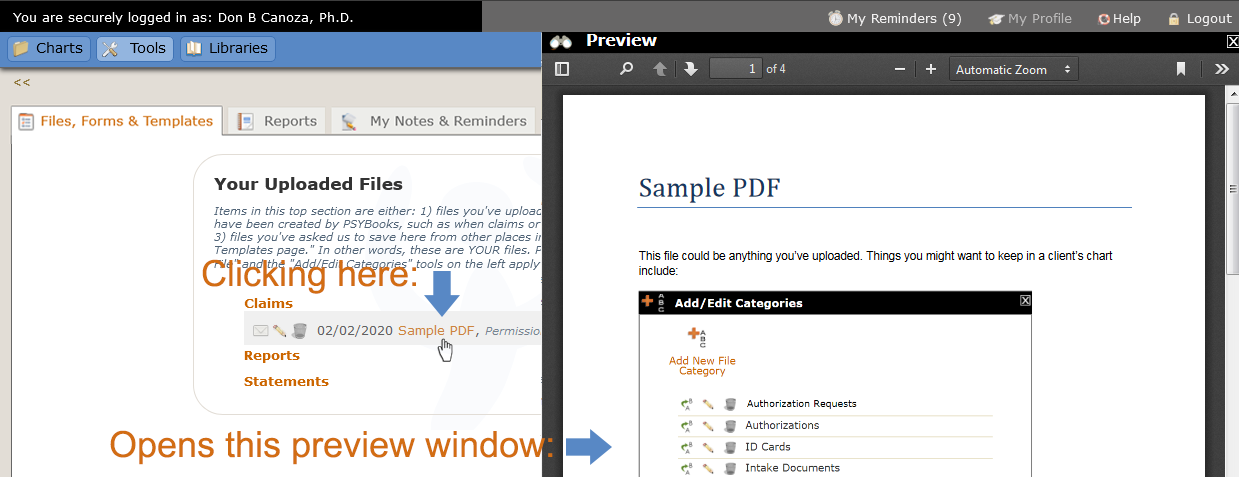

Often, you may want to preview a file's contents without having to download it to your computer. If the file you've uploaded is a PDF, clicking the link on the Files page (either in a client's chart or in the Tools > Files, Forms & Templates section of the app) opens the PDF Preview tool, which allows you to do just that:

Being able to preview a file allows you to view it while keeping PHI off of your device for maximum, HIPAA-compliant security. The preview window opens in the middle of the screen, but you can move it by dragging the black bar at the top. The window can be resized by dragging any edge or the lower right corner.

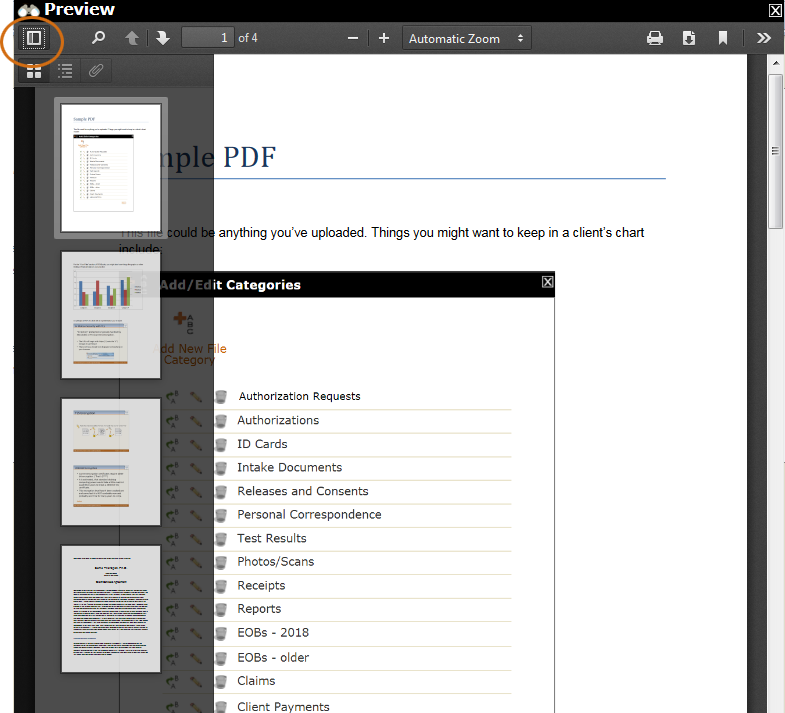

The Preview Tool offers a large number of features. At the top left is a tool that allows you to show thumbnails when the PDF has more than one page:

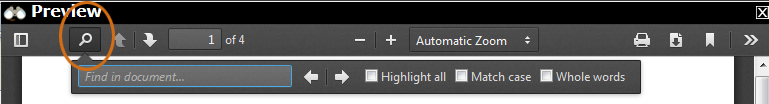

Following that is a search tool with options to highlight all, match case, and find whole words:

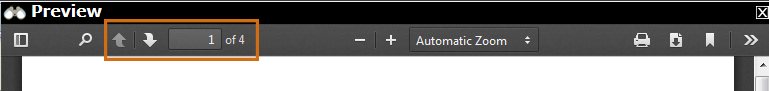

Following search are tools to go to the Next and Previous pages in the PDF and also a textbox that will allow you to specify the page you want to visit:

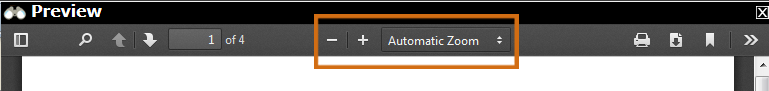

Tools for zooming and also for viewing at preselected sizes are located in the center of the window:

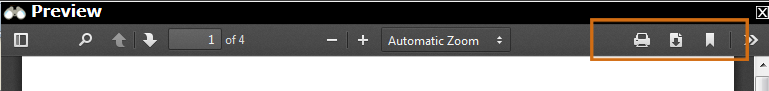

A little farther over are tools that allow you to print the document, download it to your device or open the preview in a new tab:

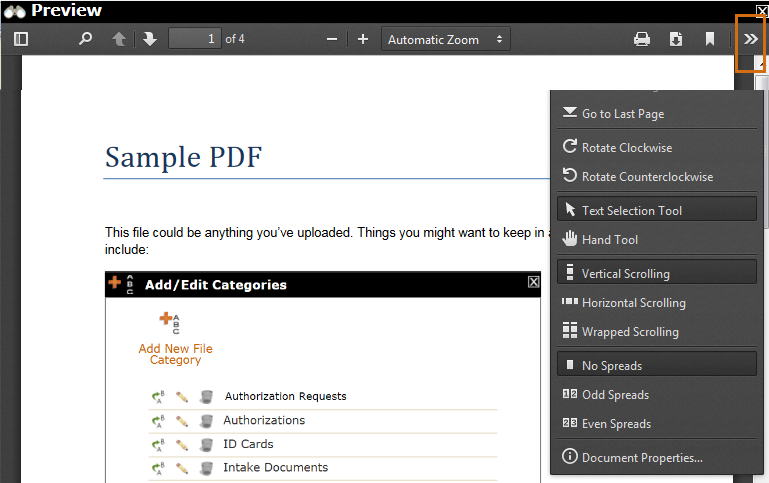

The double arrows on the far right open another whole menu of tools. You can easily navigate to the first or last page of the document and also rotate your view. The Text Selection Tool allows you to select text within the PDF, a feature that's often difficult or impossible to do. You can then right click to bring up the contextual menu and copy the text to your clipboard, which can then be pasted wherever you need it. If you use a mouse, the hand tool allows you to quickly scroll through the document. If you have a touchscreen you can use your finger to accomplish the same thing. There are also options for horizontal scrolling, wrapped scrolling and different types of spreads:

All in all, PSYBooks' PDF Preview Tool gives you both maximum security and a large set of features for working with your uploaded PDF files. Currently, if you click on the link for a file you've uploaded that is NOT in PDF format (e.g., an image file, Word doc, etc.), the file will be downloaded to your computer. We have future plans to add additional preview features for other common file types, similar to the current PDF Preview Tool.

PDF Preview Tool Troubleshooting

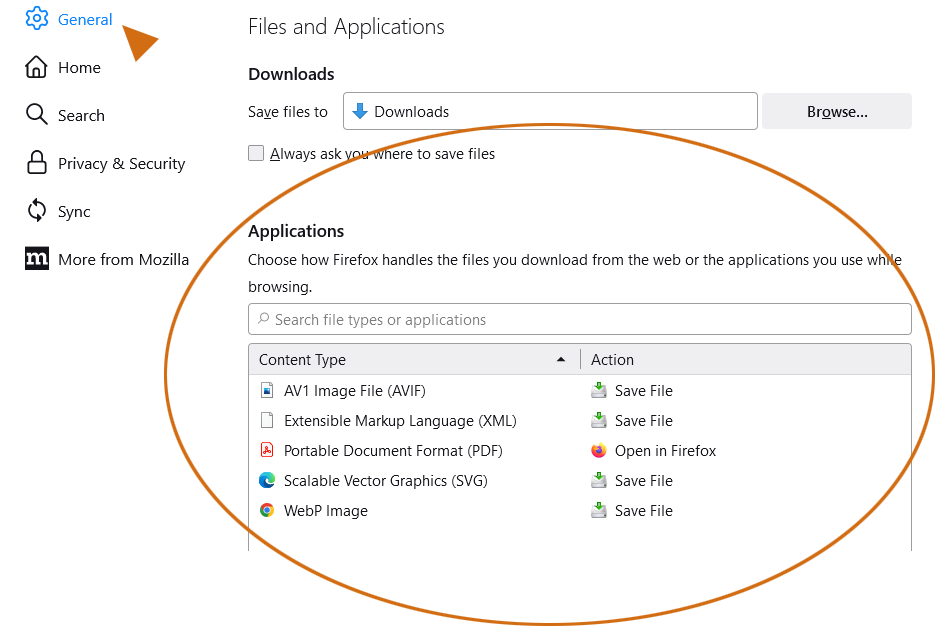

If your PDF Preview window is blank, the most likely cause is that your browser is set to download them instead of viewing them online. The solutions are either to use a different browser and/or to change the settings in your browser. Each browser has their own settings page, and each time a browser updates, the settings page may be a little different. Because of that, we can't give you exact directions on how to change the settings, but the image below was taken from a recent edition of Firefox:

PDF is short for Portable Document Format. PDFs are created by an application (program) called Adobe Acrobat. Since they're made by an application, Firefox has them lumped in with other application files and asks you how you want Firefox to open them. The setting in the screenshot is correct, i.e., if you want to be able to use the PDF Preview Tool in PSYBooks, you would have to have Firefox set to open PDFs within Firefox.

Notice that it is not essential to change your browser's settings to open PDFs in this way. If you choose, you can continue to have your browser download them. The PDF Preview Tool is for those users who want to be able to view a PDF without downloading them.

Templates and Custom Forms

What this isTemplates and Custom Forms is the top section of the Files, Forms & Templates page. Currently, it holds the Send Forms tool and one Built-in templates, the "Profile Form." If you have created Custom Forms, they will also be displayed in this area.What it looks likeThe Templates and Custom Forms area looks like this:  |

Where this isTemplates and Custom Forms is the top section of the Files, Forms & Templates page. |

The word "template" can be defined as a pattern for processes - or even a pattern OF processes - to help make a task easier. This section of PSYBooks is designed to hold both built-in templates (i.e., templates provided by PSYBooks) and a section where you can build and store your own custom templates, which are called Custom Forms. Both Built-in templates and Custom Forms are sent with the same tool, the Send Forms tool.

Your Custom Forms

The Custom Forms tool allows you to convert your paper forms into digital. You can also convert existing digital forms into forms your patients will be able to fill out online. The advantage of this is that when you send your forms to patients or other Portal Users, they'll be able to fill them out and return them online. They won't have to download your forms, fill them out, scan the completed forms and send them back to you.

Your Custom Forms can be as simple or as complex as you like. For example, you could write a single paragraph, then add one checkbox that says, "I agree to these terms." If you send that to your client and they check the box and add an eSignature, you'll have a legally binding document, complete with time and date stamp. Similarly, your form could consist of a single Large Q & A Box with a sentence saying that your client gives permission for you to discuss their case with the persons below. When the client gets the form, they could list the names in the textarea provided for them, eSign the document, and you have a legally binding release of information. You can also create larger projects. For example, you could put your entire HIPAA Privacy Policy into a Custom Form. Or even your Telehealth Informed Consent, which could quite possibly have a variety of form elements in it. You can add custom styles to your forms, or just leave them as the default. It's all up to you.

Similarly, you can create forms that you only need to send out once for new patients, or you can create things like mood trackers, ways patients can track their progress on therapeutic goals, or anything else you can think of that you might want to send more frequently.

Another thing to notice about Custom Forms is that, although they're restricted to Portal Users, they are NOT restricted to clients. For example, you could create legally binding documents for your office personnel, other therapists in your office, or even other uses you might have outside of your therapy practice. Since anyone can be a Portal User, you can create Custom Forms within PSYBooks for any needs you may have that involve sending an online form that the recipient can fill out and return to you.

The first step in this process is for you to create your forms. You only have to do this once per form. Once you've created the digital version of your form, you can send it out as many times as you wish to as many different individuals as you need. It's also easy to make updates or changes to your existing Custom Forms.

The next sections will discuss how to create Custom Forms.

Create Custom Forms

We have a short video on our Custom Forms tool which you can watch below. It will give you an overview - but may be enough to help some of you get started. After that, we go into complete detail about all aspects of the Custom Forms tool.

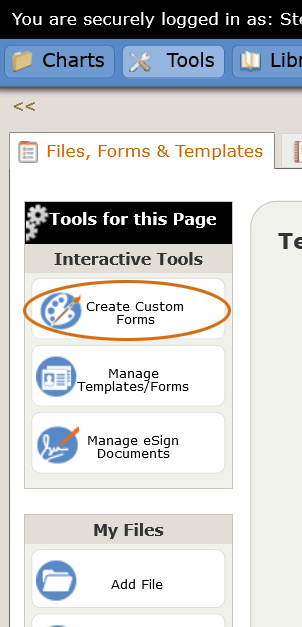

The Create Custom Forms tool is at the top of the left nav tools on the Tools > Files, Forms & Templates page in your app:

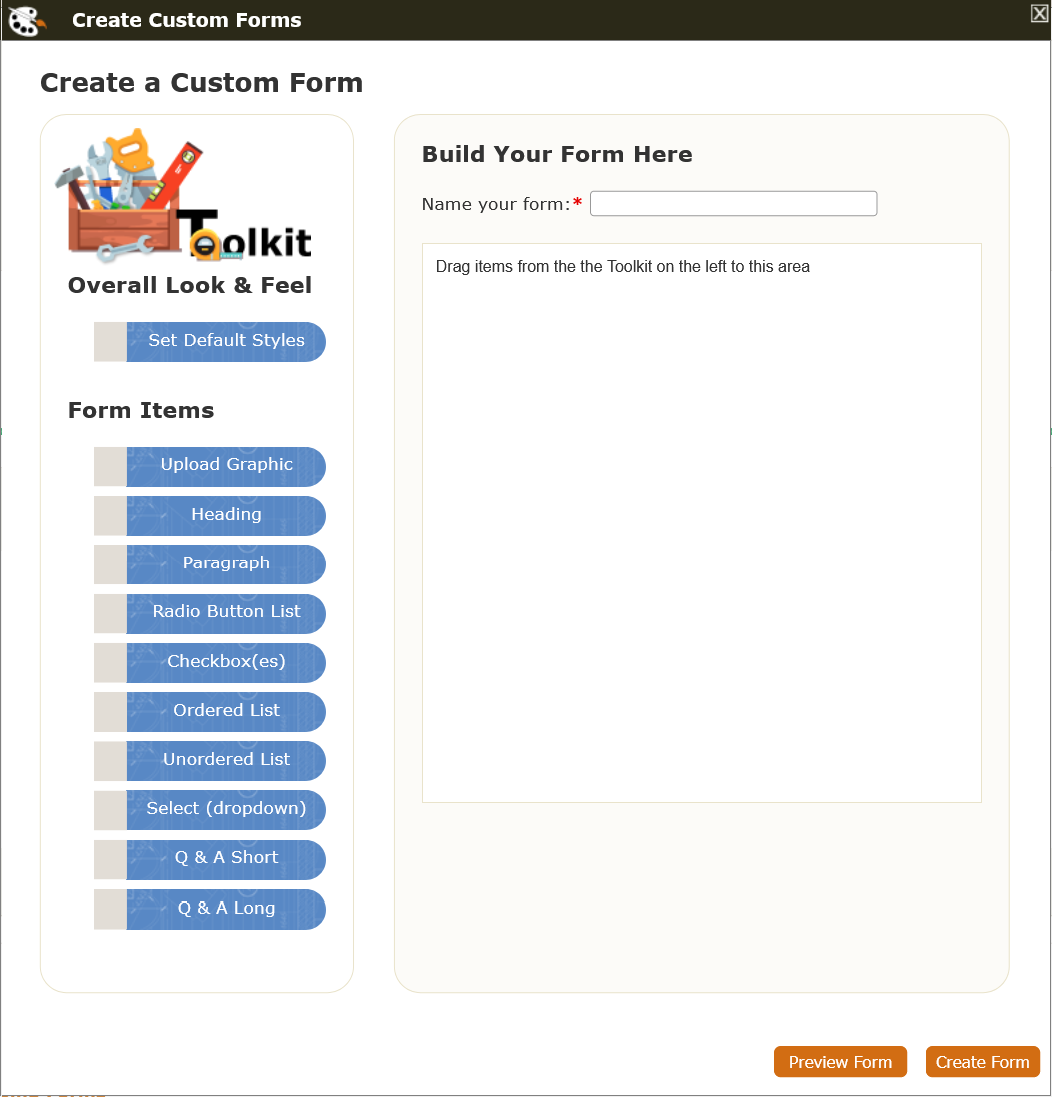

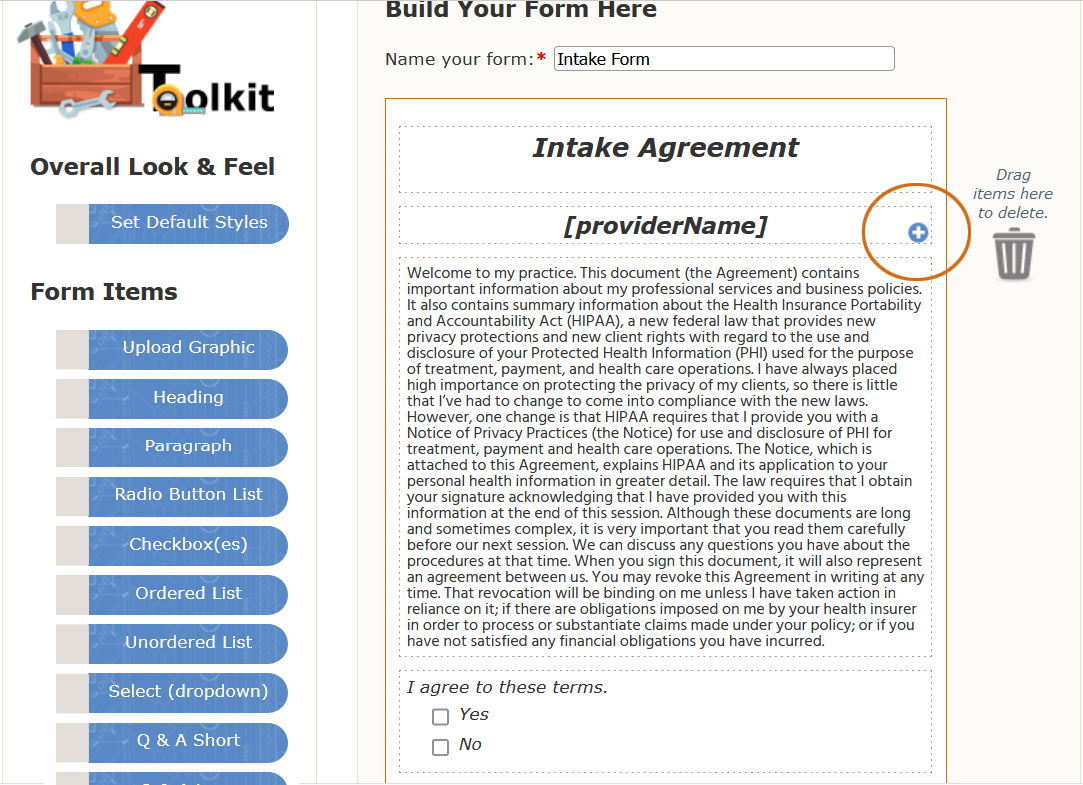

When you click the Create Custom Forms tool, you get a window similar to this:

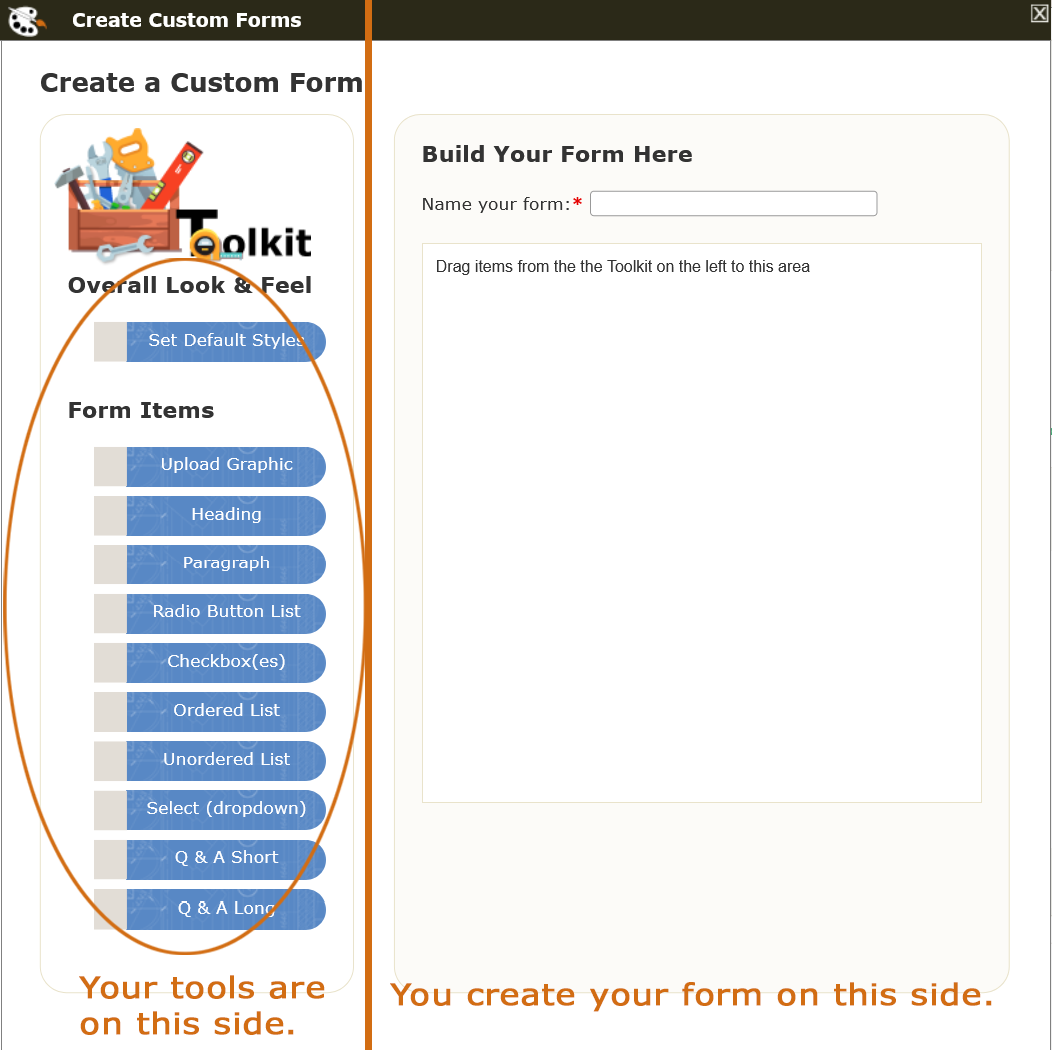

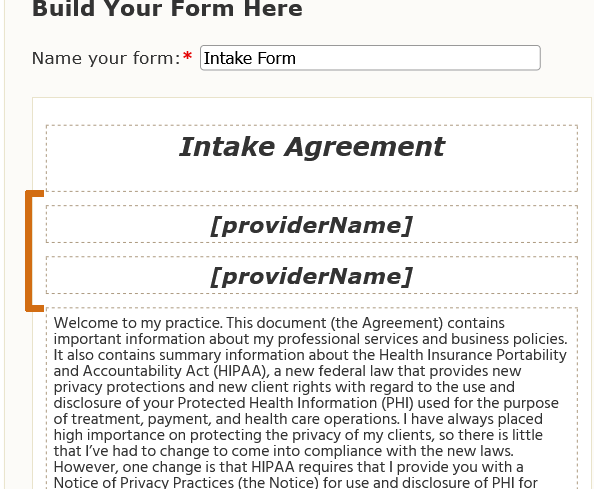

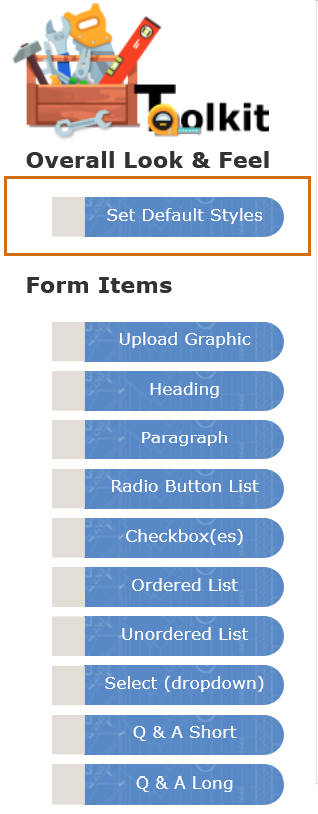

Think of this form as dividing in half vertically, with your tools on the left, in the Toolkit area, and the area where you'll build your form on the right, where it says "Build Your Form Here:"

Each of the blue buttons in the toolkit is draggable over into the edit area:

As can be seen above, once you drag a tool to the edit area, a window opens that has formatting options for that particular element. You can drag tools in any order. In other words, you can put all your paragraphs in your form and then go back and add headings and graphics. In the animation below, the user has created one paragraph and then decides they want to add a header. As they hover over the existing paragraph in the edit area, either orange bars (on the sides) or blue bars (for top and bottom) appear so they can see where the header will go. If they don't like where they position it, they can click the heading and move it:

The user can also delete, clone or edit any items they've placed in the edit area. To delete, just drag the item over to the gold area on the side where the trash can is. You don't have to hit the trash can itself. When you reach the gold area, the lid of the trash can will open, signaling that when you release the item, it will be deleted:

To clone an element, single click the item you want to clone. This will put a small blue circle with a + in it on the outer edge of the element:

Clicking the blue circle will create another item like the first:

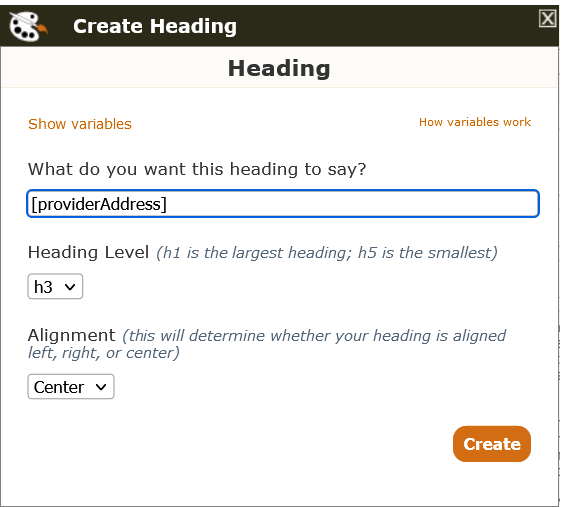

To edit an element, double click it. For example, if we want to edit the item we just cloned, we would double click the second "[providerName]" heading in the graphic above and change the interface that opens to whatever we want:

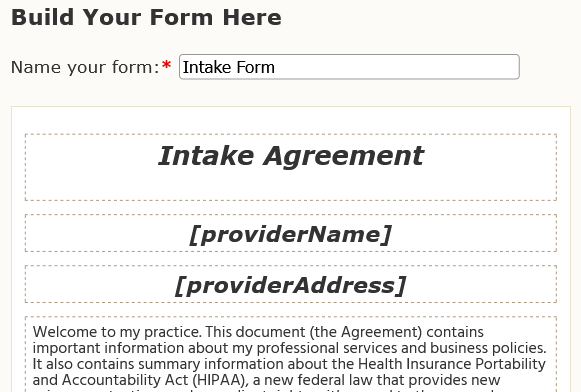

When you click "Create" on the window you're editing, the changed heading will appear on your form:

Although you may opt to never use the Clone Tool, the advantage of it is that it can save you some time, especially in larger documents. For example, if you're creating your entire Telehealth Informed Consent, you may want all headers for the various sections to be formatted alike. Maybe you want all 5 of the headers in your document to be H2s (next to the largest header size) and center aligned. If you create one the way you want it and clone it 4 times for each of the others, they will all be center-aligned H2s. You just have to double click each of them to change the text.

Now that we've covered the basics of how to build a Custom Form, we'll look at each tool in your Toolkit separately.

Set Default Styles

The Set Default Styles tool is the top tool on the left nav under "Overall Look & Feel":

You may never want to use this tool. PSYBooks has chosen default styles for Custom Forms that will work for most users. However, we also provide the Default Styles tool for those who want more control over how their Custom Forms look. If you're in the latter category, here's how it works:

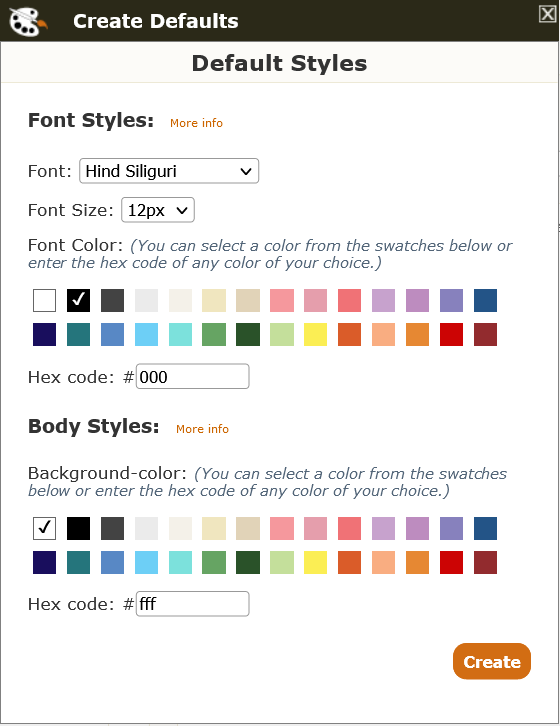

If you drag the Default Styles tool over to the Edit area, the tool that opens looks like the image below and allows you to change the font, font size, font color and/or background color for this entire form.

You may notice that the font names are not the standard Arial, Verdana, Helvetica, etc. that you're probably used to seeing in other programs. That's because PSYBooks has opted to use multilingual fonts, designed to provide the best experience for all users. These fonts have also been specifically designed to look good on the Web.

Default font size and color will affect all other features on your form that display text, i.e., all remaining tools except Upload Graphic. The Paragraph tool allows you to modify these, allowing you to format some paragraphs differently than others. However, any changes to font size and color you want to make to Heading, Radio Buttons, Checkboxes, Select, Q & A Short and Q & A Long will have to be made with the Default Styles tool.

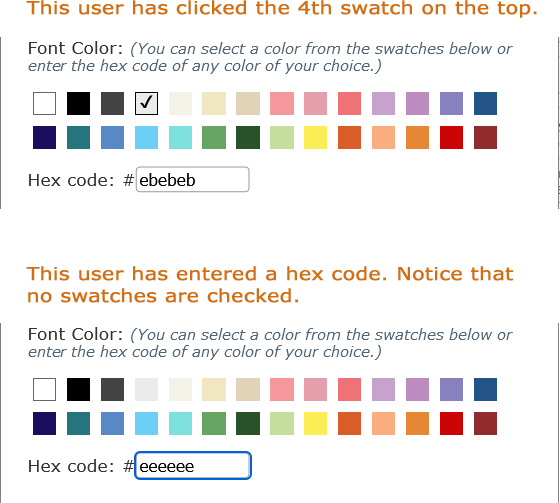

At first glance, it may appear that font color and background color are limited to the 28 color swatches that are shown. However, this is not the case. You can change the hex code to the exact color you want and not use the swatches at all. So, for example, although clicking on the 4th color on the top row displays a hex code of #ebebeb, you can manually change the hex code to #eeeeee and that's what will be used on your form:

As was mentioned above, you do not need to use the Set Default Styles tool at all. For users who do not use this tool, the PSYBooks default styles for Custom forms are Font: Roboto; Font Size: 12; Font Color: Black (#000); Background Color: White (#FFF).

-

Upload Graphic

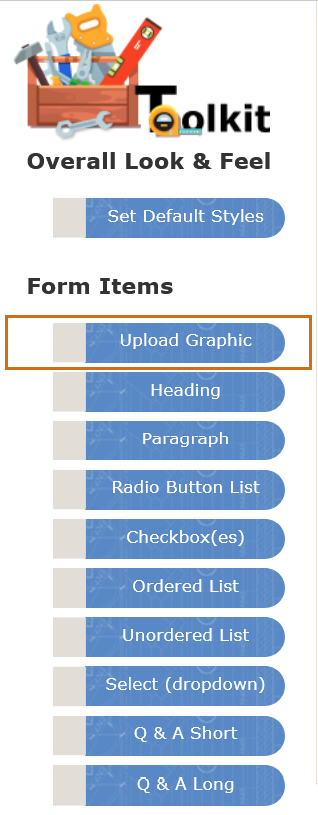

The Upload Graphic tool is the the first tool in the "Form Items" section of the left nav:

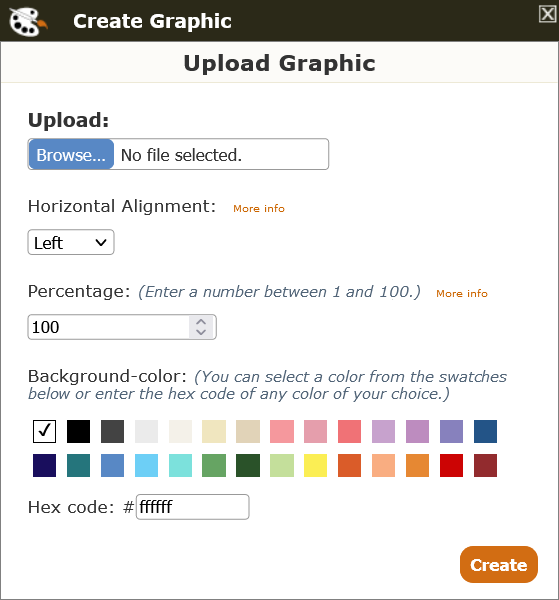

The Upload Graphic tool allows you to add your logo or any other graphics you'd like to add to your Custom Form. When you drag the Upload Graphic tool to the Edit panel, the tool that opens looks like this:

It has the standard upload tool at the top, and then the ability to change the horizontal alignment, percentage and background color. Percentages must be between 1 and 100.

-

Heading

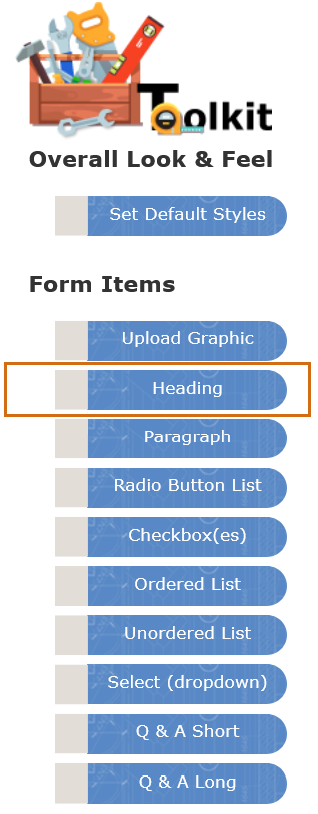

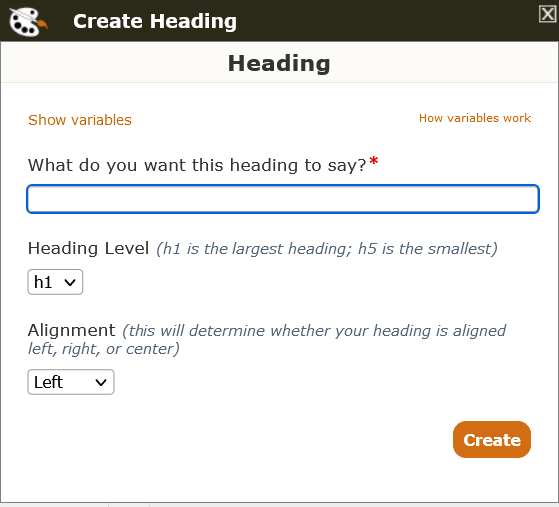

The Heading tool is the the second tool down in the "Form Items" section of the left nav:

A common place to use a Heading is at the beginning of a form. However, you can use the differing heading sizes (h1 - h5, with h1 being the largest) to create subheadings throughout your form. All will be bold. This can be very helpful for forms that are several pages long. You can also align your headings left, right or center.

-

Paragraph

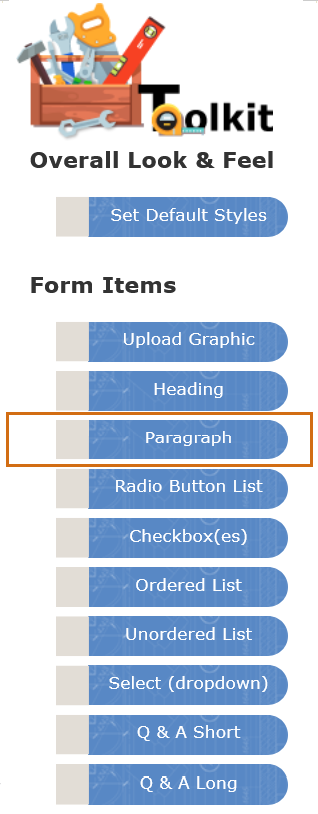

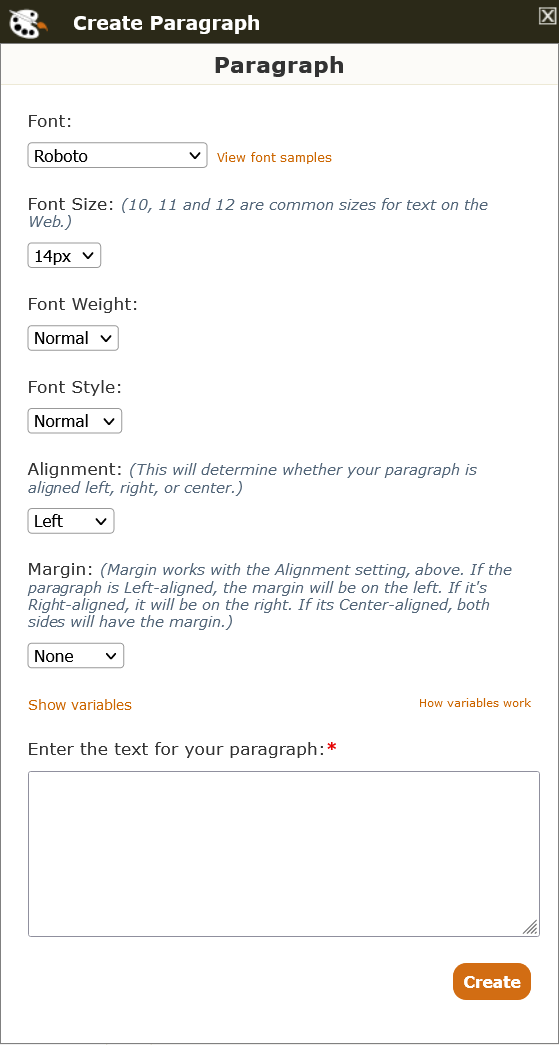

The Paragraph tool is the the third tool down in the "Form Items" section of the left nav:

When opened, the Paragraph tool looks like this:

The top two items, Font Family and Font Size, are determined either by PSYBooks' default styles or by the Set Default Styles tool, if you used that to modify the default styles. However, you may change either or both of those parameters here if you want this particular paragraph to be different. The next two, Font Weight and Font Style, allow you to choose Normal or Bold fonts and also to choose among Normal, Italic and Oblique. The last two settings work together. Alignment sets the overall alignment for this paragraph to left, center or right. The Margin setting puts a small, medium or large margin around your paragraph. If the paragraph is left-aligned, the margin will be on the left. If it's right-aligned, the margin will be on the right. If it's center-aligned, the margin will be on both sides.

The textarea at the bottom (where it says "Enter the text for your paragraph") is where you put the text you want in this paragraph. You can type it in or copy/paste it from another document. You will probably use the Paragraph tool more than any other when creating your Custom Forms. Although you can compose your paragraph as you create the form, if you have an existing digital copy of your form, it may be easiest to copy the paragraph from the existing form and paste it into the Paragraph tool. To do this, copy a paragraph from your existing form (using Ctrl/Cmd c or your preferred way of copying text) and pasting it (Ctrl/Cmd v) into the text area at the bottom of your Paragraph tool. Remember that you can expand textareas by grabbing the diagonal lines on the lower right corner and dragging it:

You will need to create a new paragraph in your Custom Form for each paragraph you want to add. If you make changes to the settings at the top of the Paragraph tool, you may want to clone a new paragraph from the previous one, and then edit the textarea of the clone so it has the text of the next paragraph in your form. That way, the styles you chose for the initial paragraph will be the same for all paragraphs you create and yet you don't have to change them each time.

A textarea can be used for any length paragraph, from a single sentence to very long paragraphs. Just know that this tool creates ONE paragraph. Although you can add line breaks as you type, they get stripped out when your paragraph is created and will be presented to your recipient as one single paragraph. On the other hand, you can add as many paragraphs as you like. You can also position paragraphs above or below other paragraphs, or even create a row of side-to-side paragraphs. Notice that you will not see the settings you chose for your paragraph until you actually create it. Once you've done that, you'll be able to view the paragraph, with the styles you gave it, both in the Edit Window of your Custom Form and also by using the Preview Tool. All elements on a Custom Form are easily editable, just by clicking the element in the "Custom Forms I've Created" table, which means you can go back and forth between creating and viewing as often as you wish.

Radio Buttons & Checkboxes

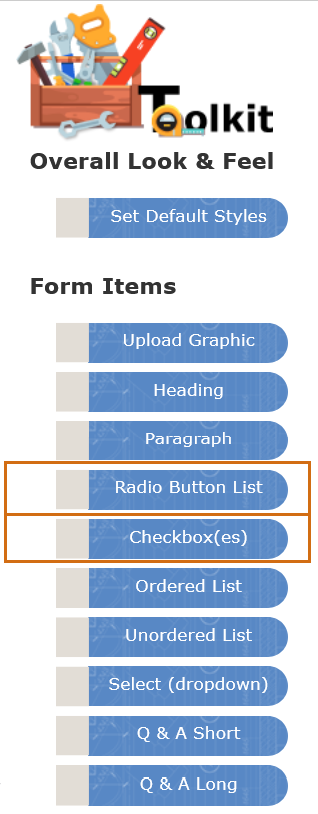

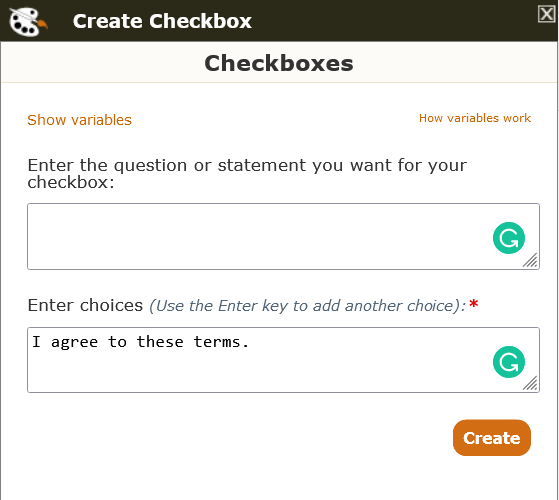

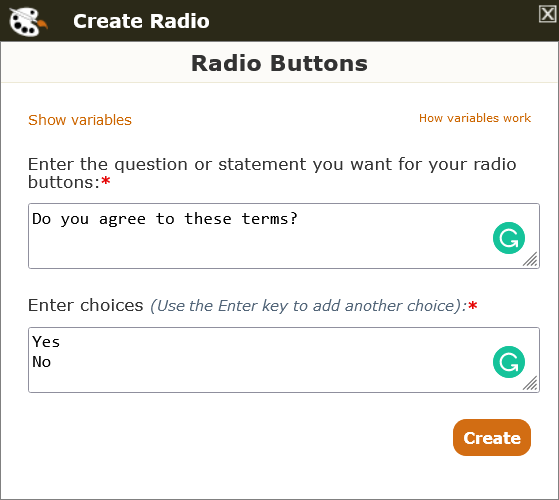

The Radio Button List and Checkboxes tools are the 4th and 5th ones down in the "Form Items" section of the left nav:

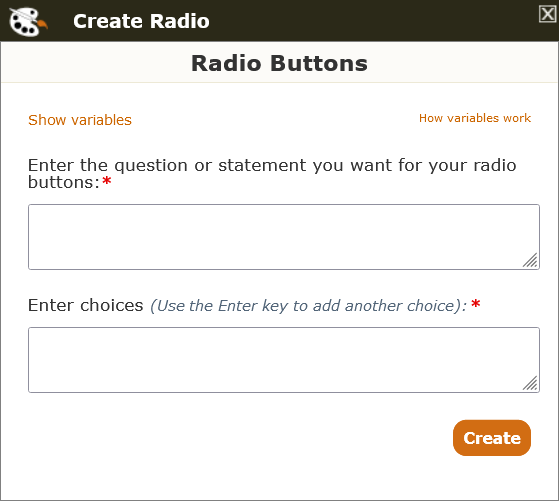

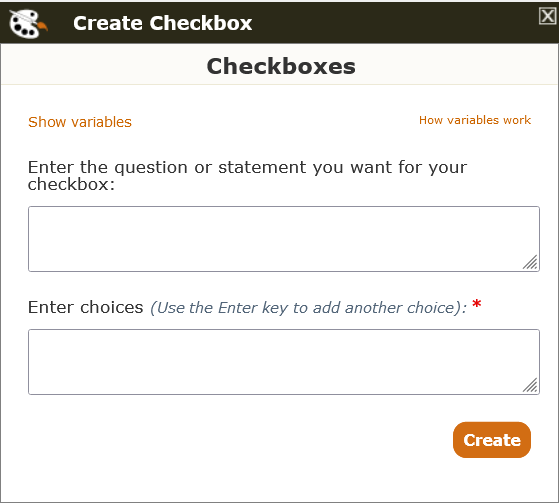

When you drag either the Radio Buttons or Checkboxes tools to the Edit Panel to open them, they look just alike. For both tools, you write your question in the top textarea and then put your choices for answers in the bottom portion.

The thing that distinguishes them is on the backend, i.e., how they work. If you create a Radio Button element, it will have circles for the user to make their choice. Checkboxes will have square boxes.

This was made with the Radio Buttons tool:

Which of these moods best describes your day?

This was made with the Checkboxes tool:

Which of these moods best describes your day?

More important than how it looks is the functionality associated with each. A Radio Button only allows the user to make one choice, whereas checkboxes allow them to select as many options as they need. The samples above could have been been part of a Custom Form. If you play with each of them, you'll see that you can only check one item in the list of radio buttons, but you can check as many of the checkboxes as you want. Keep this in mind as you use these two elements in your Custom Forms to prevent obtaining unexpected results.

An additional feature of the Checkbox tool is that you're not required to put anything in the top box, i.e., you don't need a question. That allows you to put something like this in your Custom Form:

That would produce the effect below on your form:

By contrast, the Radio Button List tool DOES reuire a question in the top box. You can achieve the same basic goal as above, by creating a Radio Button list like this:

When that entry appears in your form, it would look like this:

Do you agree to these terms?

-

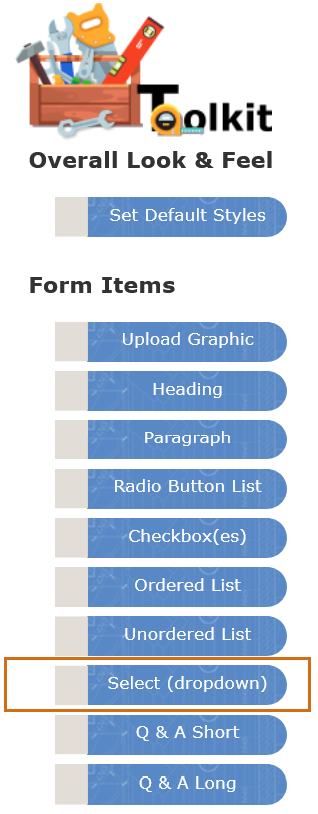

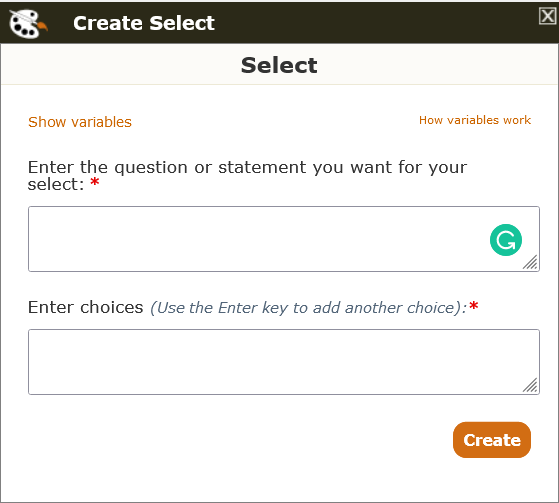

Select (Dropdown)

The Select tool is 3rd from the bottom in the "Form Items" section of the left nav:

A select box (sometimes called a dropdown box) funtions like a list of radio buttons, in that the user can only choose one option from the list. When you need that type of functionality, it's up to you whether you want to use radio buttons or a select box. The Select tool both looks and functions like the Radio Buttons and Checkboxes tools in that you write your question or statement in the top box and then add the choices in the bottom box, using the "Enter" key between each choice:

Often, people will use select boxes when they want to save room on the page. For example, if you need someone to choose their state from a list of states, a select box is much tidier than a list of radio buttons:

Plese choose your state:

Plese choose your state:

Notice that the first item on your select boxes is always "Select." That's done on purpose for clarity. For example, in the states example above, if "Select" weren't there, if someone returned a form to you with the top choice (AL) selected, you wouldn't be able to tell whether that's the choice the user actually made or whether they didn't answer the question.

-

Q & A Short and Q & A Long

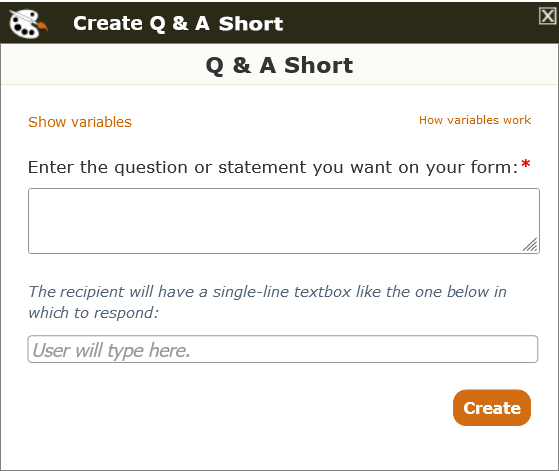

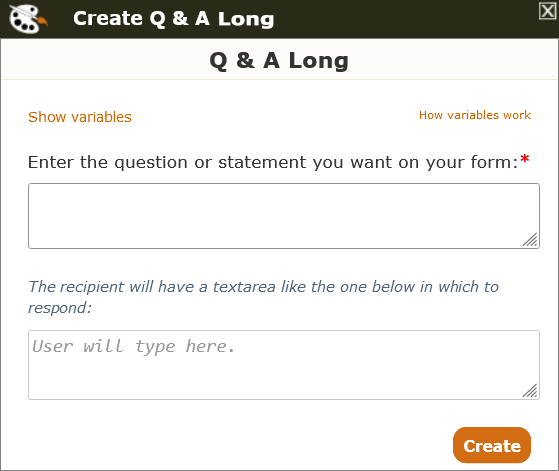

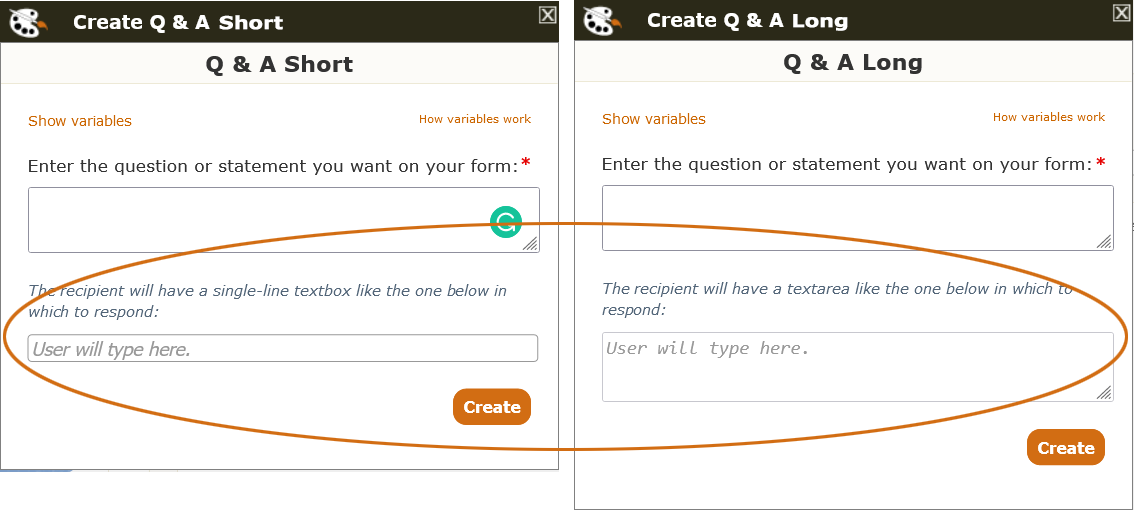

The Q & A tools are the last two in the "Form Items" section of the left nav:

The Q & A Short and Long tools are just alike from the therapist's perspective. There's nothing for the therapist to input except to write their question. The question can be short or long in either tool. The "Short" and "Long" on these tools refers to the length of the answer you want/expect from the recipient, not the length of the question. If you expect a short answer (e.g., "What city were you born in?") it would probably be better to use Q & A short. On the other hand, if you're asking more of an essay type question (e.g., "Describe your first year in elementary school."), you would want to use Q & A Long. The two tools look like this:

The difference between these two tools will be on the recipient's end. With Q & A Short, they will have a single textbox in which to write their answer. With Q & A Long, they'll have a textarea, which will allow them to write long answers. Each of the therapist's tools has a sample of what the recipient will see at the bottom of the form:

The words "User will type here" will not be on the recipient's form. The textbox and textarea at the bottom of each of the therapist's tools are just to give you a visual representation of the difference between the two tools.

Using Variables

The Variables feature on Custom Forms can be a big time-saver. There are three different categories of variables. The first two, Provider Variables and Recipient Variables, are taken directly from your database which means that their values are already available. You don't have to do anything to use them. The third type, Custom Variables, are variables you can create for your own use. In Custom Forms, variables are available in the Heading, Paragraph, and both the Short and Long Q & A tools as a link that says "Show Variables."

If you click the "Show Variables" link, it opens to show links for Provider Variables, Recipient Variables and Custom Variables. Clicking any of those links would open that section so you could see all variables available to you for your Custom Forms:

Once you decide which variable you want to use, just drag it to the textbox or textarea of the element you're creating. The example below is for a Custom Form that will begin with the greeting "Hi John," (or whatever the first name of the recipient is.) By using a variable, the therapist doesn't have to go back and customize each form with the person's name before sending it. It also allows a therapist to send the same Custom Form to several recipients at once, and yet have each one individualized with the recipient's first name:

We'll discuss each of the three types of variables below.

-

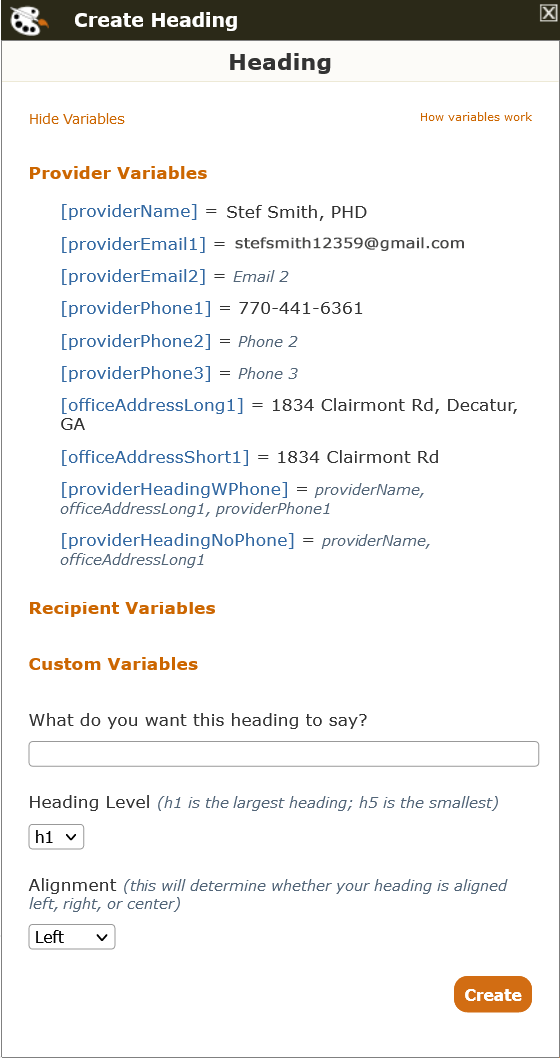

Provider Variables

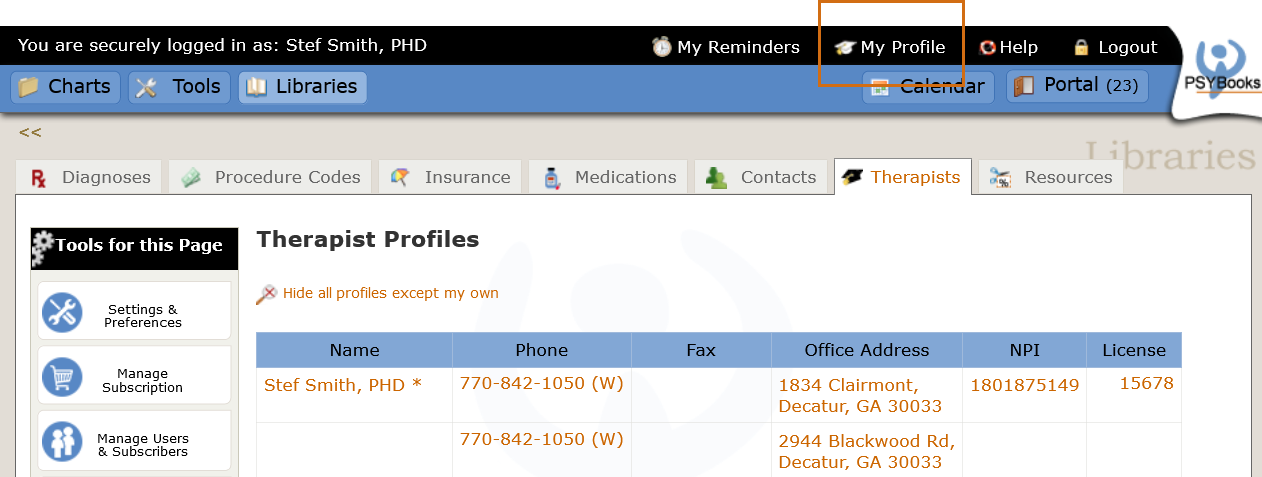

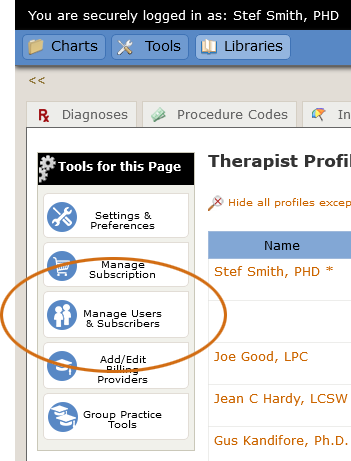

If you open the Provider Variables link, it would look something like this (this one is on a Heading tool, but variables are the same wherever you encounter them in Custom Forms). The variable names are on the left in blue with [] around them. The part after the "=" is the value of that variable for this particular subscriber. So in the screenshot, [providerName] is the name of the variable and Stef Smith, PHD is its value:

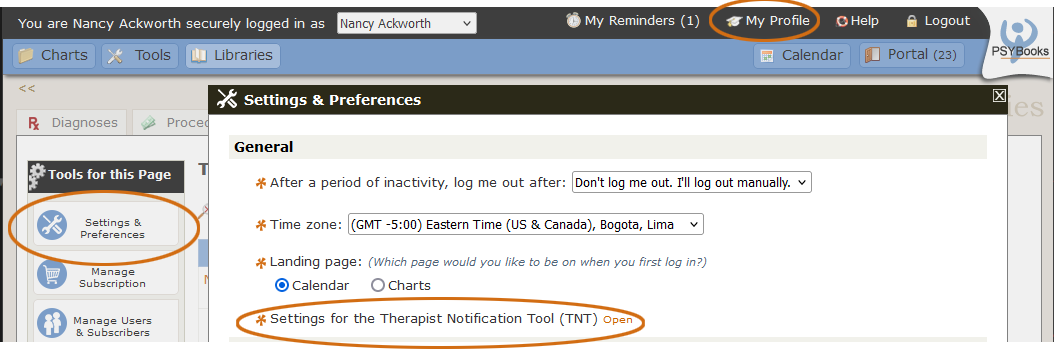

Provider variables are taken from the "My Profile" section of your app. If you open "My Profile," you'll see where the data for Provider Variables comes from (not all are visible in this screenshot, but if you were to click any of the orange links in the Therapist Profiles table, you'd open the Edit Profile form where you'd find the others):

The two screenshots above - for the variables list and My Profile were taken from the same account. If you look, you'll see how the variables match up. To change any of the variables in your Custom Forms, you'd need to change them in your Profile. For exampel, if Stef Smith decides she wants her credentials from PHD to Ph.D., she could change it in her Profile and then the value of [providerName] in her Custom Forms would automatically repopulate.

-

Recipient Variables

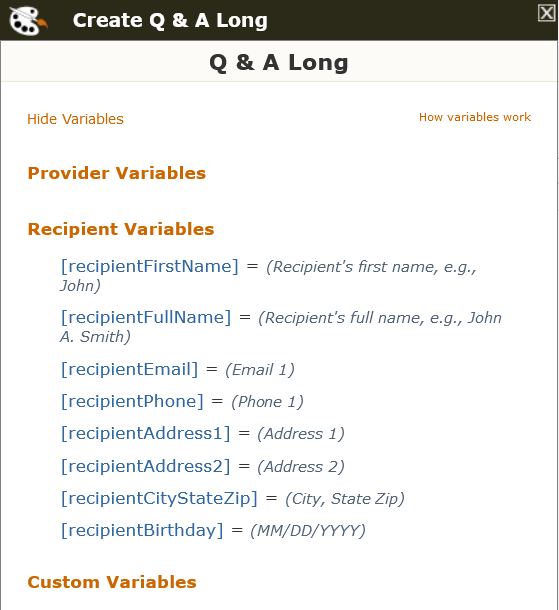

The Recipient Variable list looks like this:

You might notice that the Recipient Variables list, unlike the Provider Variables list, only lists the variables themselves, i.e., there are no values listed for any of the variables. That's because we don't yet know who the recipient is. Some examples are given in parentheses (in gray italics) to give you an idea of what the recipient would see. But those are only meant as aids to the subscriber. They are not what would be sent. In other words, when the recipient opens the form, if you added [recipientFirstName] at the top, they would see the value of that variable in their account (e.g., John), not the tip for the provider (Recipient's first name, e.g., John). If you are not sure of some of these, one way to test them is to create a dummy client in your own account and send your Custom Form to that person. When the recipient is a client, these variables are taken from the Demographics page of the client chart. For non-client recipients, variables are taken from whatever data is available in the program for that individual.

-

Custom Variables

Custom Variables are the most powerful of all because you construct them yourself. Although they can be anything, a common use would be for text you are likely to want to use in more than one Custom Form. For example, you might want to create a Custom Variable telling your recipients how they can get help on the forms, should they need it. You're asked to give the variable a name and a value. The name can be anything that's meaningful to you. No need to add the "[]" - PSYBooks does that. When adding the value, remember that textareas can be stretched down to whatever size you need.

The example below is for a variable which the therapist named "help," that has the value they want the recipient to see when they add that variable to a form:

You can add as many Custom Variables as you need. There is no limit. A good rule of thumb is that if you find yourself adding the same text in more than one heading, paragraph or Q&A, you will probably be able to save yourself some time by turning that text into a Custom Variable. Once they're created, you can use them like any other variable.

Edit Custom Forms

Once you create a Custom Form, it will be saved in the "Custom Forms I've Created" table at the bottom of the page:

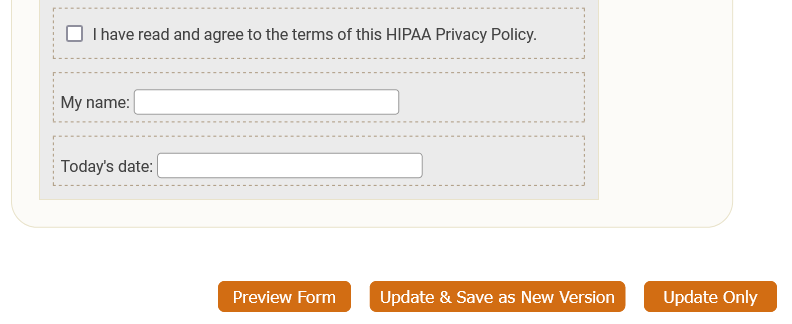

If you need to edit a Custom Form you've already built, clicking it's name in the "Custom Forms I've Created" table will open it back up in the form editor again - just like when you first made it. Once the form is open, double click the form element that you want to change to open it's editing window. In the example below, the user has decided they'd rather have the date left-aligned on the page, and they also want to add the word "HIPAA" to the "I agree" declaration:

If the user also wants to edit the Default Styles of the form, they can drag the "Set Default Styles" tool onto the edit pane:

You can make as many changes as you like. Notice that there are now 3 buttons at the bottom of the form: Preview Form, Update & Save as a New Version, and Update Only:

The Preview Form button allows you to see a copy of your form that will be similar to what your recipients will see. However, on the Web, much depends on the size and type of screen the recipient is using when they view your form, so although the text and form elements will always be the same, it's likely that the size of the window they see will not be. One use for the Preview Form button is that it will allow you to see how your Provider Variables and Custom Variables will look on the form. However, remember that since Recipient Variables cannot be understood until we know who the recipient is, they will still show as the variable name when you preview your form. If you want to actually see your Recipient Variables, you'll need to make a fake client in your account and send your form to them. Make sure the fake client has the information in their chart that the variable is asking for. For example, if you are using [recipientPhone], remember to add a phone number to the fake client you create.

The next two buttons are important to understand, although it's entirely up to you how you use them. When you are just making minor revisions to a form, you may prefer to use the "Update Only" button to save your changes. If you've made substantial changes to your form, you may want to save it as a new version. This will put a new version number following the form's name, like Intake Form, v2. However, once you create a new version, you will ONLY be able to send that particular version of the form. In other words, if you have an Intake Form, v2, you can no longer send Intake Form, v1.

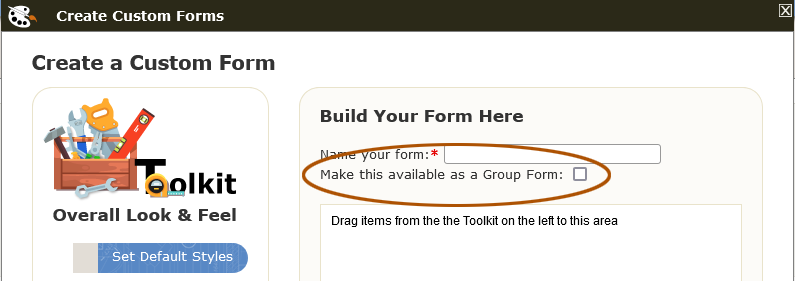

Shared Group Forms

Group practice owners may want to create forms for the entire practice and disseminate them to their employees. This allows everyone in the practice to use the same form(s) and also, saves time because one person (the practice owner or their admin) creates forms for all to use. A form can be designated as a shared from from either the Create Custom Form tool or the Edit Custom Form tool. The tool looks like this:

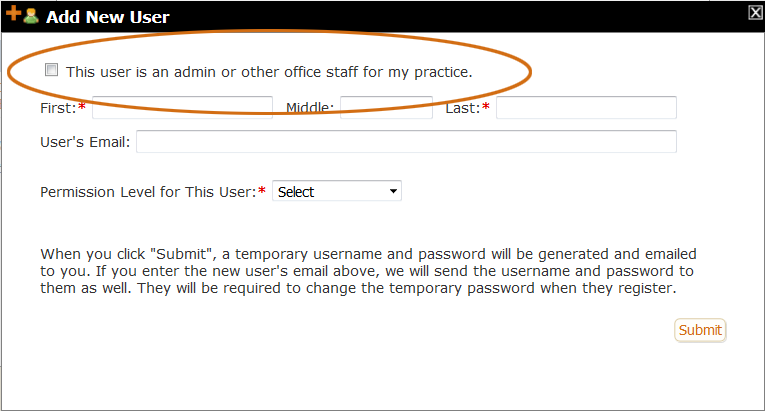

Notice that this tool is ONLY available on the Master Clinical (MC) account of a Group Practice. It is not available on GOI accounts, nor is it available on non-MC account holders of Group accounts.

Using it is as easy as it looks: checking the "Make this available as a Group Form" checkbox on an Add or Edit Custom Form window, makes that form available to all. The checkbox works as a toggle, i.e., it can be toggled on or off. The only one who can edit or delete it is the Master Clinical account holder, but everyone can use it in the same way as if they had created the form themselves.

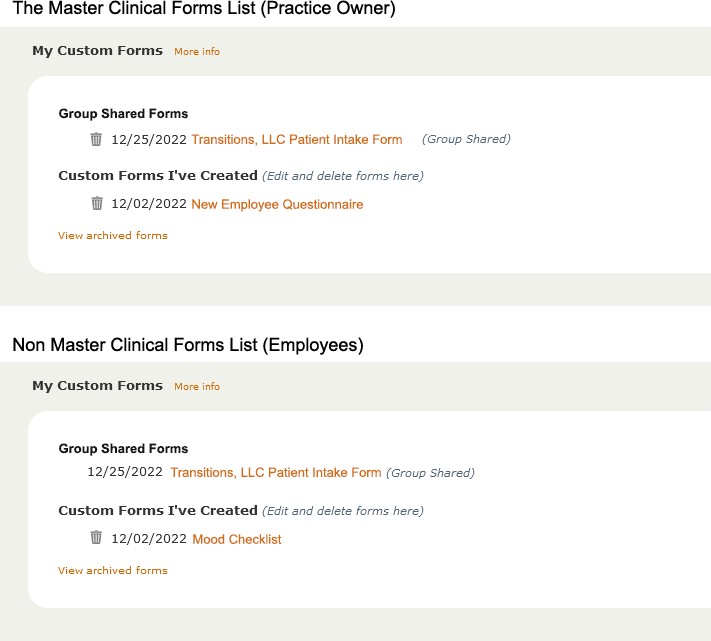

When a Group account has at least one shared form, the top part of the My Custom Forms area gets divided into two categories: Group Shared Forms and Custom Forms I've Created. The screenshot below is a Group Practice that has one Shared Form: Transitions, LLC Patient Intake Form. The top image is the practice owner's (Master Clinical) account. The bottom image is an employee's account:

Notice that in the MC's list, the shared form (Transitions, LLC Patient Intake Form) has a trash can whereas the employees' screenshot does not. This allows the practice owner to delete this shared form at any time. The MC has also created one personal, non-shared custom form which they've named "New Employee Questionnaire." Since this form is NOT shared, no one else in the practice can see it. In contrast, the employee's list at the bottom HAS the shared form "Transitions, LLC Patient Intake Form," but it cannot be deleted or edited. (They can click the link to view it, but they are not able to save any edits they might try to make.) Also, this particular employee has created their own custom form, "Mood Checklist," which is also not shared with anyone else in the practice. Notice that since this is a personal form, they can edit or delete it.

Built-in Templates

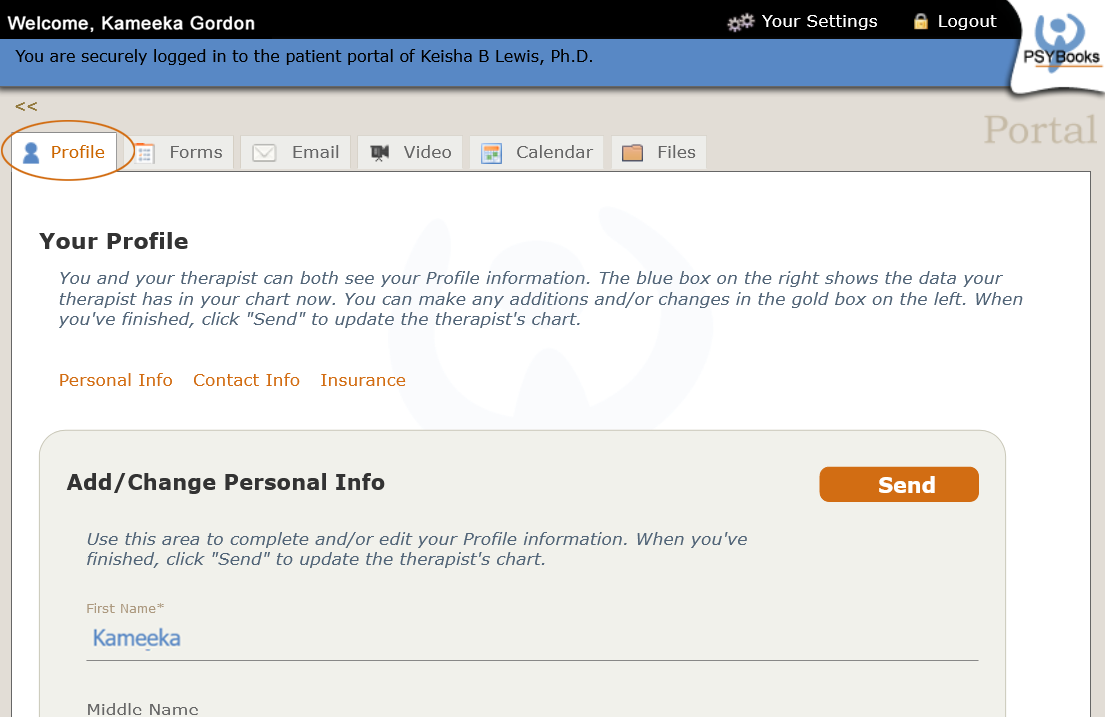

Currently, there is one very powerful built-in template, the Profile Form. The Profile form is only for clients, not other types of contacts or Users you may have. This is because it's designed to allow your clients to fill in and update the Demographics and Insurance tabs of their charts within PSYBooks.

The Profile Form

The Profile Form is a great way to ensure that you maintain the most current demographic, insurance and payment information on your clients, because it allows them to enter their own information and send it to you online. In other words, instead of your client telling you their new address, insurance info, etc. and then you entering it in their chart, when you send them the Profile Form, they can enter it themselves.

Because it's such a helpful tool, there's more than one way to send a Profile Form. The one we're discussing here is on the Files, Forms & Templates page. It's all the same tool - but you may find that you prefer one way to send it over the others. Some of the other ways to send it are extremely handy if you're adding new clients one at a time and/or if the recipient is not yet a Portal User. However, the Files, Forms & Templates Profile Form is the perfect tool to use if you want to send the Profile Form to multiple Portal Users at once, if you want to combine it with some of the Custom Forms you've created and/or if you want to write a note to the recipient(s) when you send the form. To send to multiple clients at once and maintain HIPAA compliance, put your own name in the To: field and BCC all others.

You can send the Profile Form from Files, Forms & Templates looks with the Send Forms tool at the top of the page:

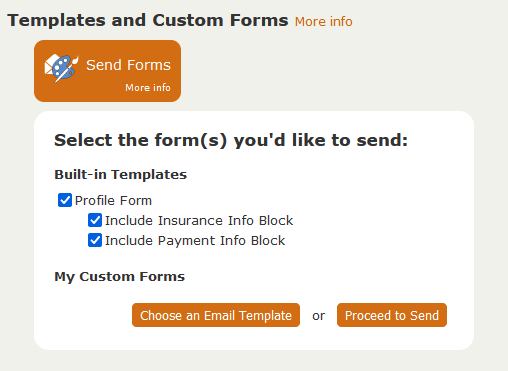

The majority of the Send Forms tool will be discussed as a separate item belowe. However, we do need to understand the options we have with the Profile form. If you click the Send Forms tool, it opens a window that has the Profile form listed at the top under a section called Built-in Templates. There are two options beneath the Profile Form checkbox - one to gather insurance information and the other to gather payment information:

If you check the box by Profile Form, you're shown the two optional Profile blocks you can send to your client, one to gather insurance information and the other to gather payment information:

Both are checked by default, but you can uncheck either or both each time you send the Profile form. This allows you the flexibility to collect insurance and/or payment information from some clients but not others. It might also be useful to omit the insurance and/or payment sections if, for example, you know a client has a new address you'd like them to enter but you also know that neither their insurance nor their payment info has changed.

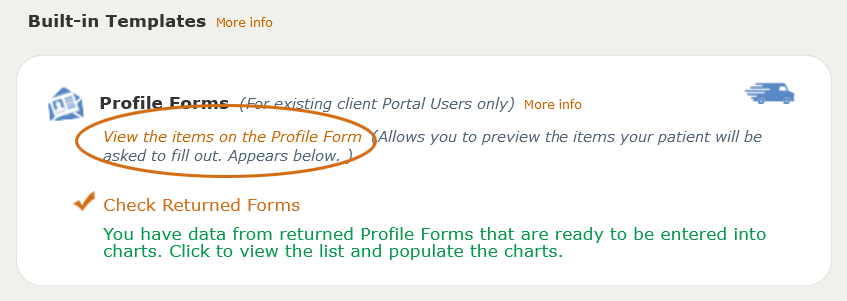

To see which items your patient will be sent on this form, you can click the "View the items on this form":

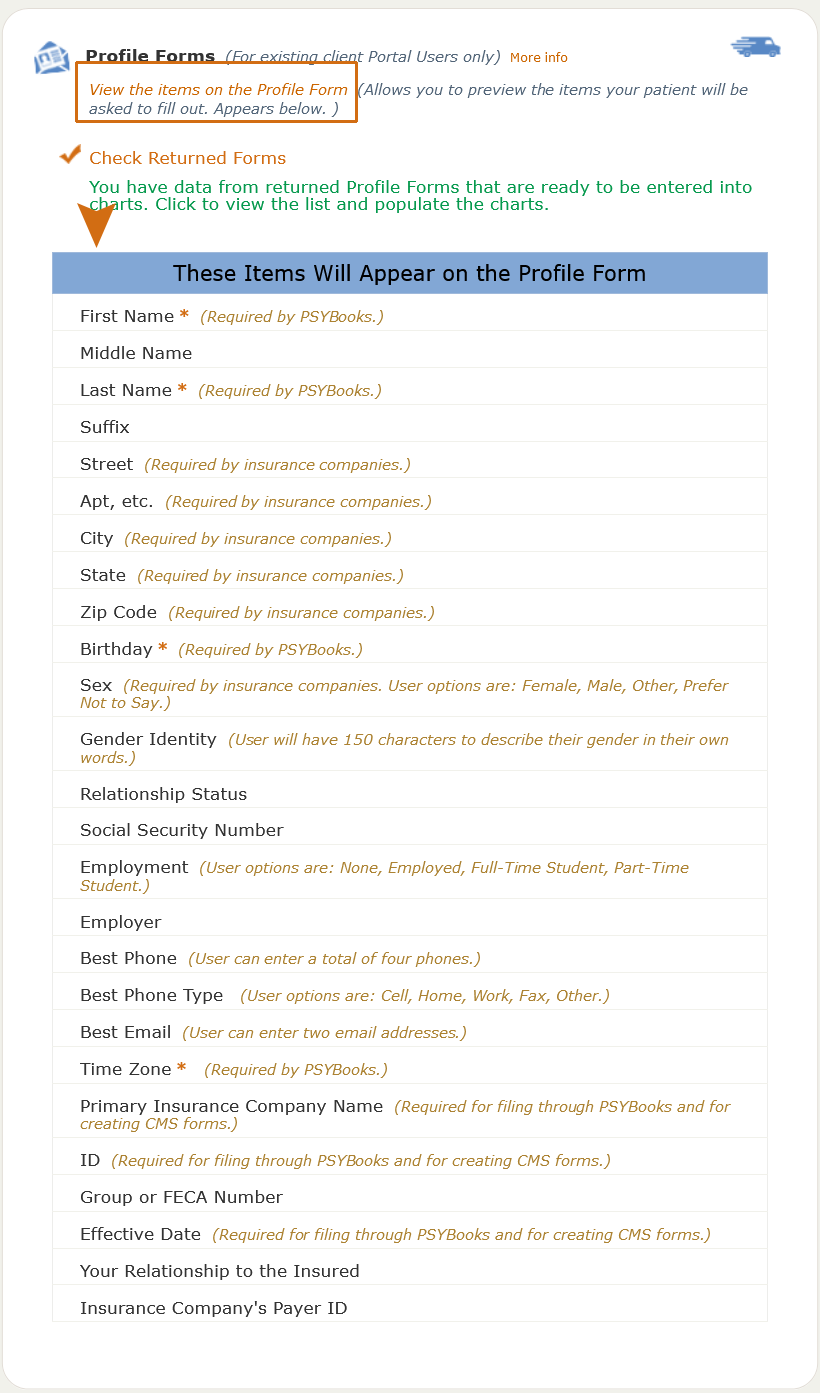

Clicking that link opens a table that looks like the one below. Although the form your patient will receive won't look like this, these are the fields they'll be asked to fill out. This is the complete form, i.e., as if the user has left both the Insurance Info and Payment Info checkboxes checked. With a couple of exceptions, the items are the same ones on the Demographics and Insurance tabs of a chart in the EHR:

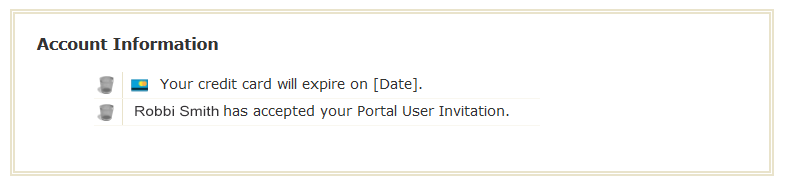

You may notice that, with the exception of the Payment Block, the only required fields on this form are the same ones required by the Demographics tab in your EHR, i.e., First Name, Last Name, Birthday and Timezone. However, since the form gets sent via email, you can write any additional instructions you want as you send the Profile Form. For example, some therapists might want to request their patients add more than one phone or email address if they have them. The client's experience of what happens when they get a Profile Request is discussed in detail elsewhere. For now, let's jump ahead to what happens on the therapist side when the client returns a Profile Form

Checking: What Happens When the Profile Form is Returned to You

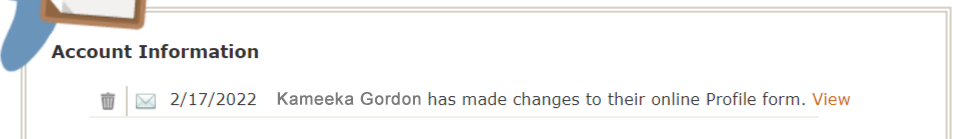

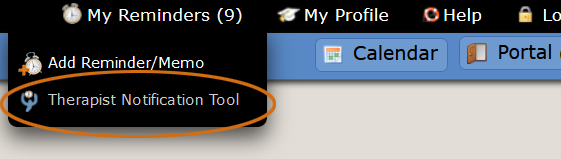

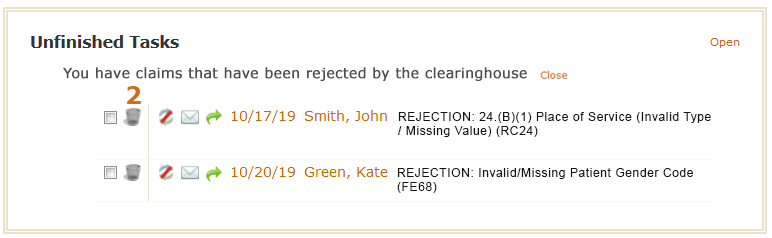

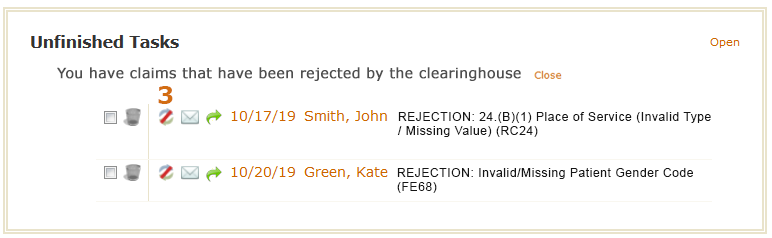

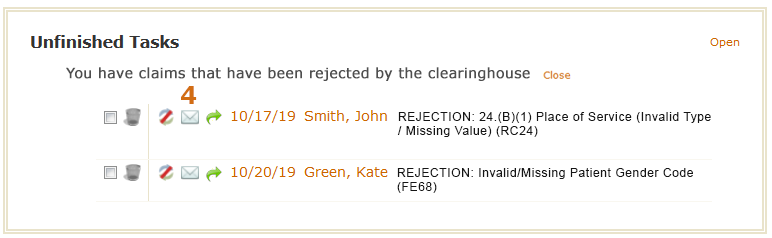

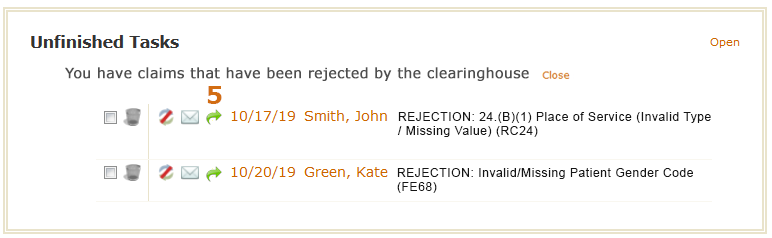

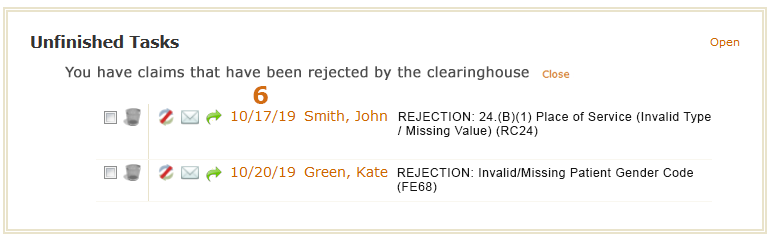

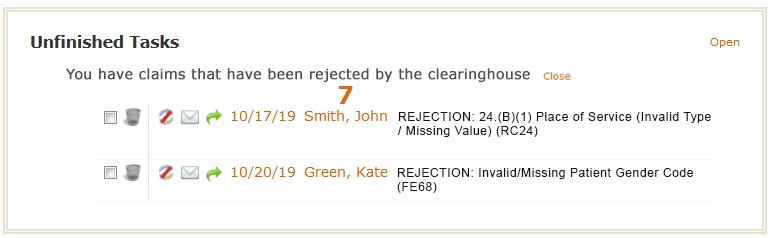

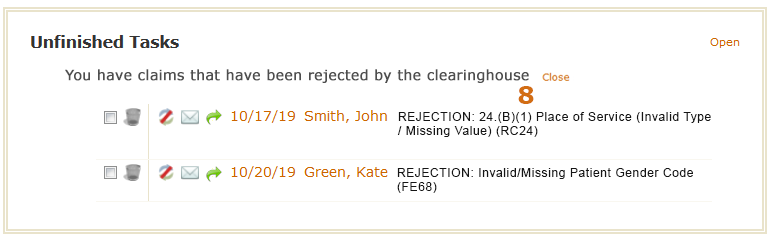

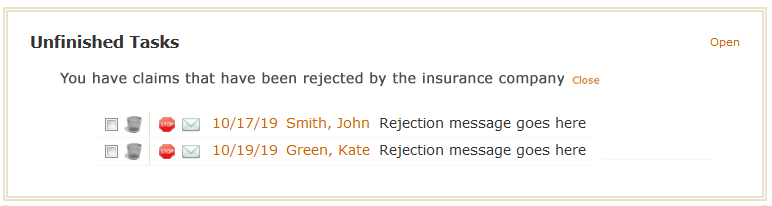

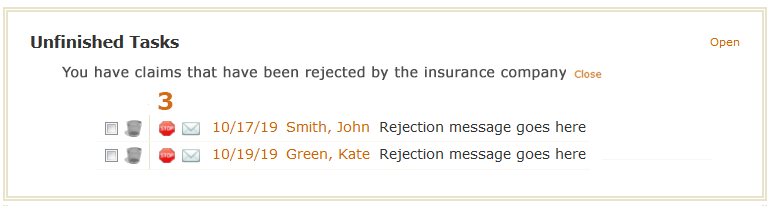

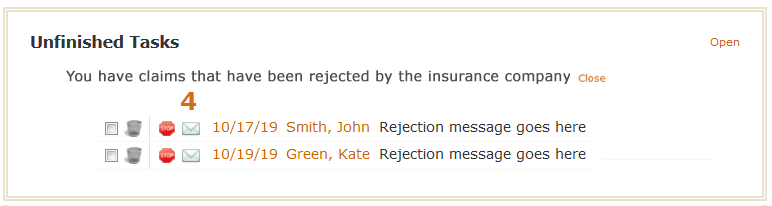

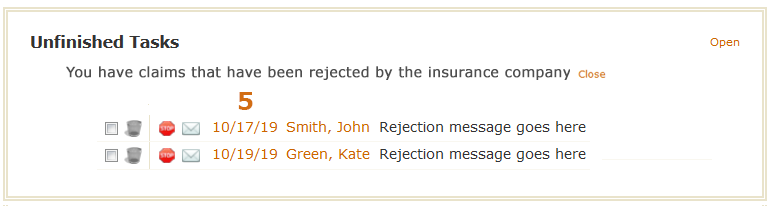

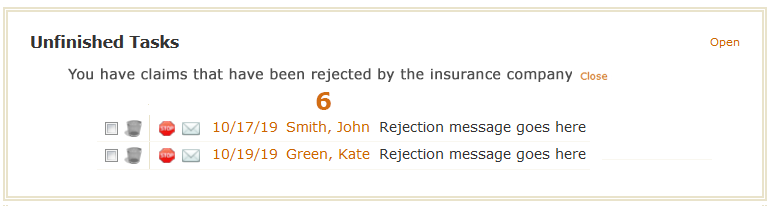

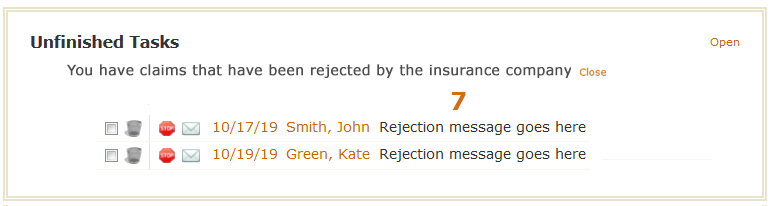

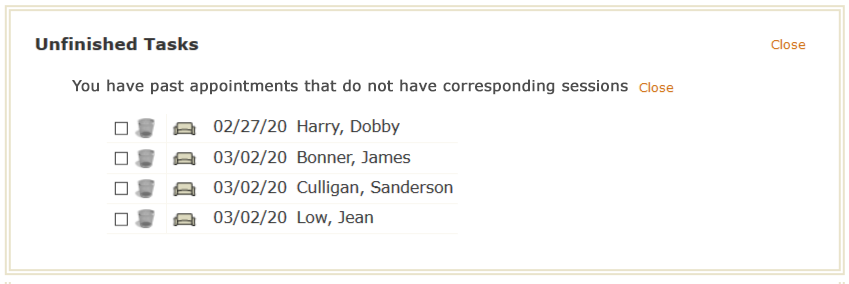

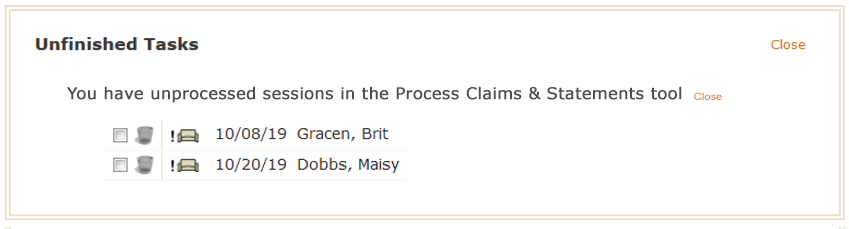

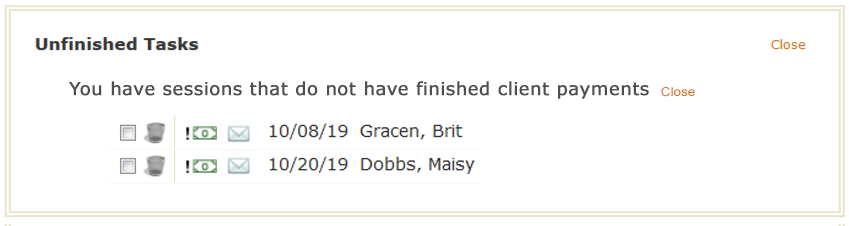

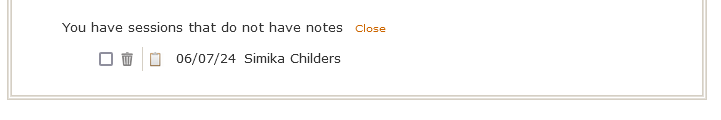

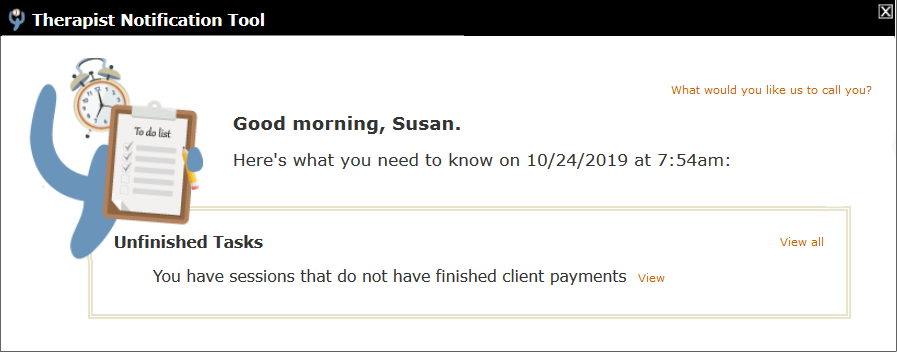

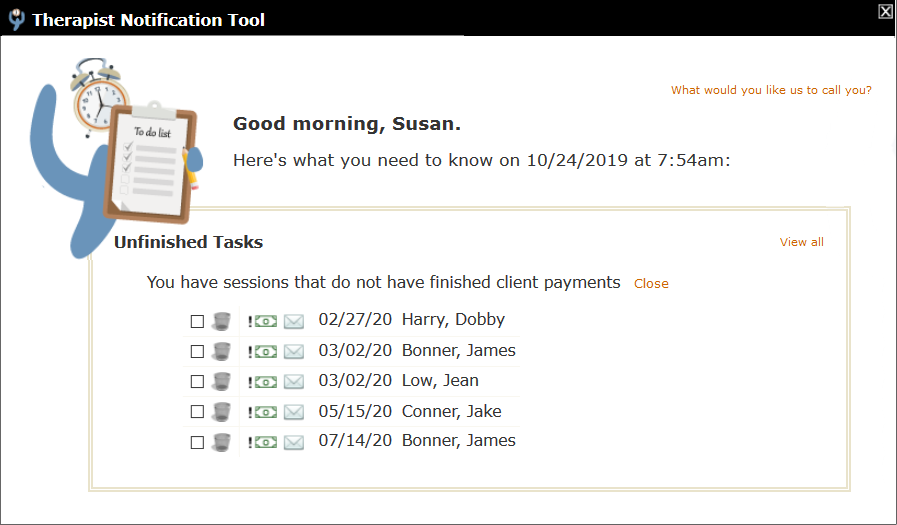

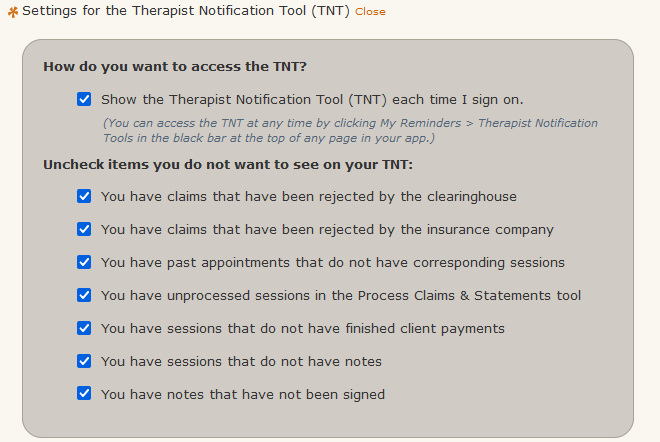

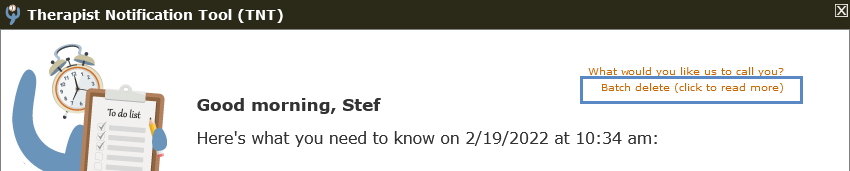

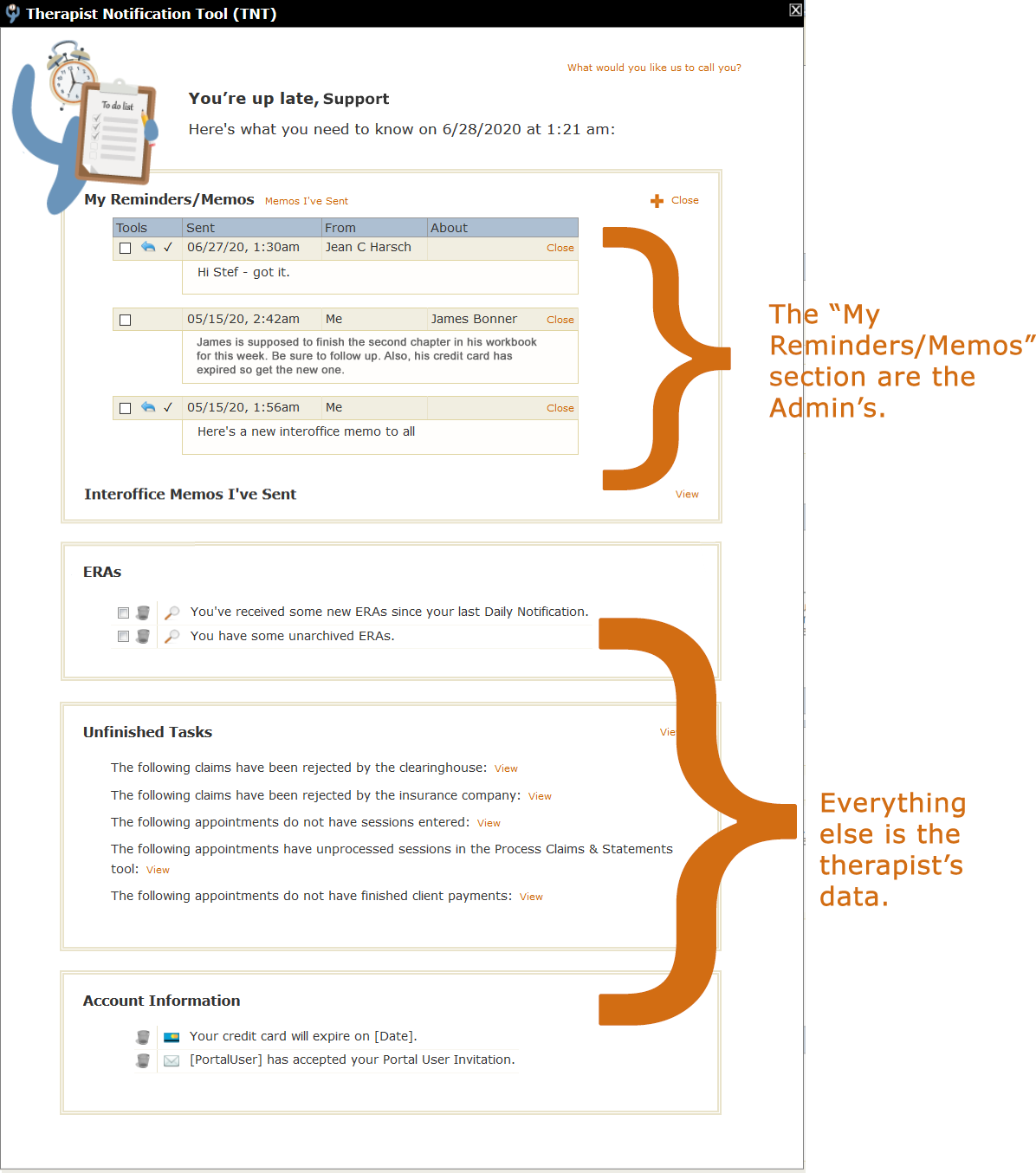

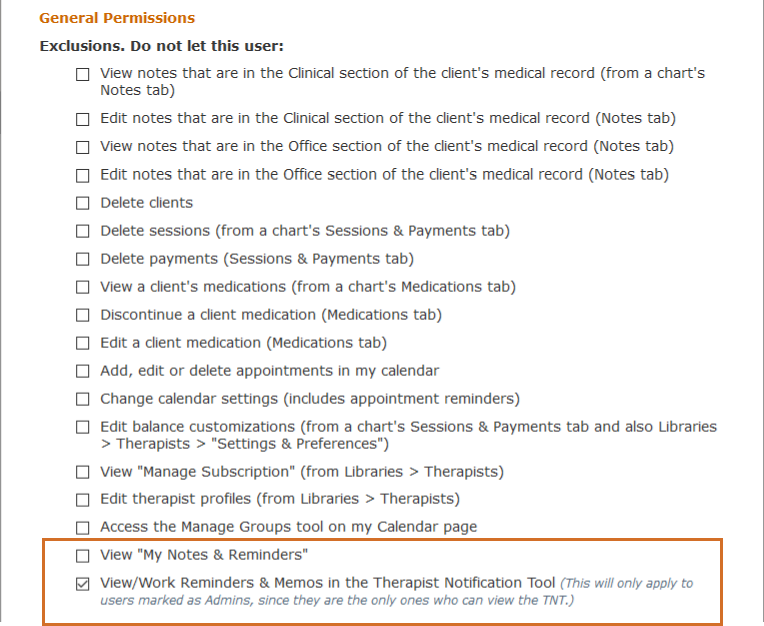

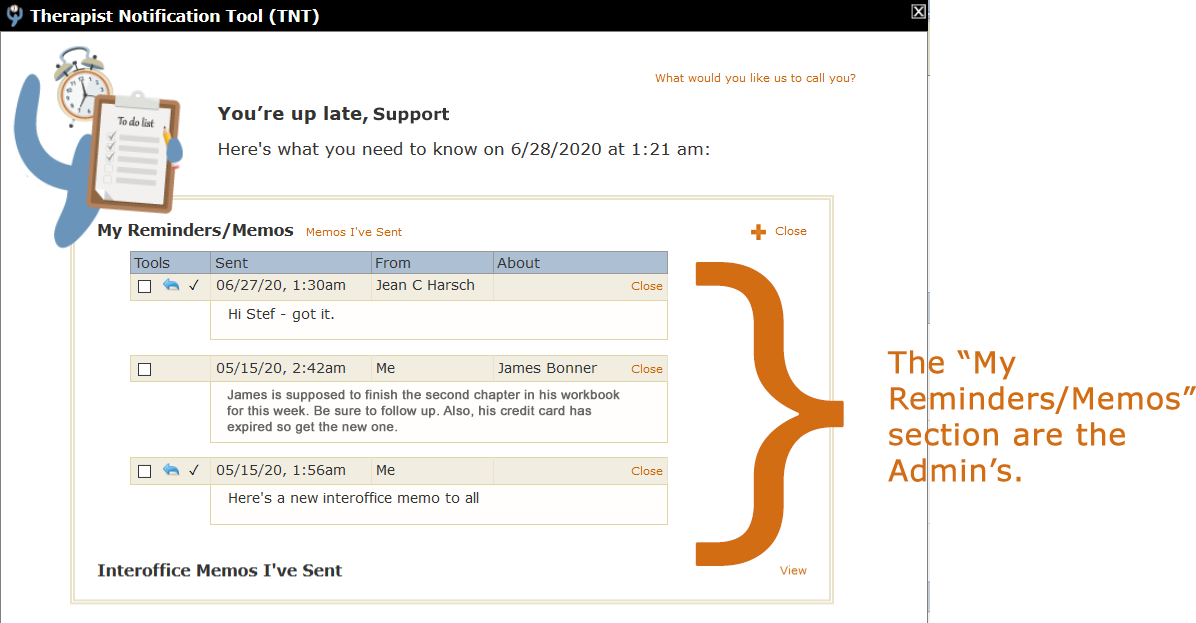

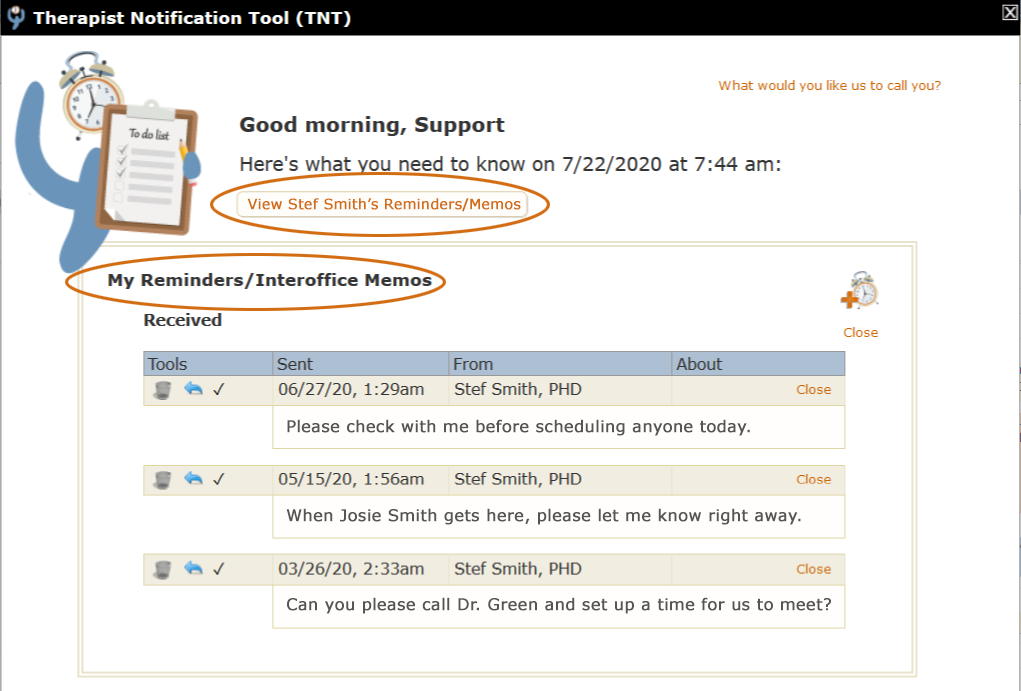

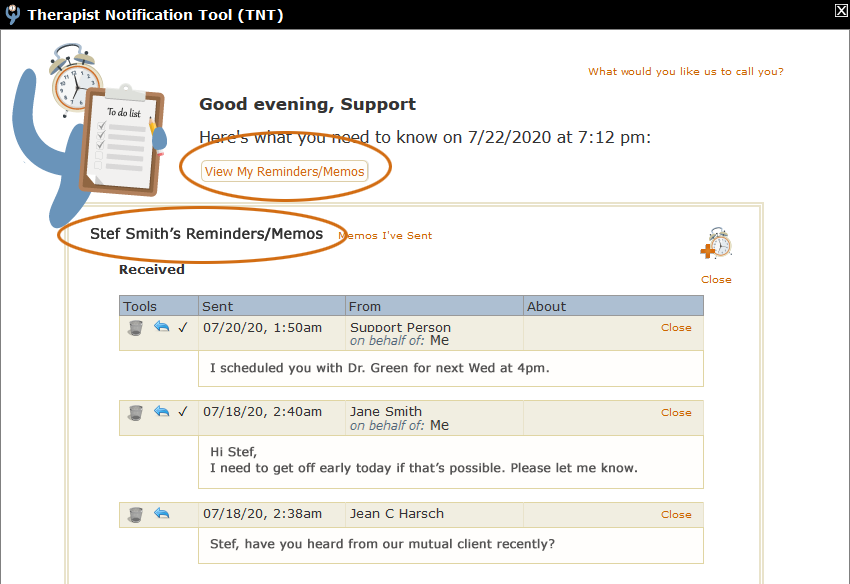

When a patient submits their Profile Form, the data is sent back to the therapist. The therapist is notified by email that they have a new Profile Form to check and a notification is also put on their TNT (Therapist Notification Tool):

It's important to note that the therapist (or their admin staff) serves as the gatekeeper for all data that's entered into their EHR. That means that despite the fact that the patient has submitted their data, nothing changes in their chart until the therapist "checks" the data. There are two ways the therapist can do this:

- The "home base" for the checking tools is at Tools > Files, Forms & Templates, so you can navigate there at any time and work through any new Profile Forms that have come in.

- However, especially if you just have one or two Profile Forms to check, it may be easiest to just click the "View" link on the TNT. That will open a window where you can check and submit the data right there. The advantage of this method is that you don't have to navigate away from where you've been working. You just click the link to access your TNT (Therapist Notification Tool) from anywhere in the program - and follow the instructions for viewing returned Profile Forms:

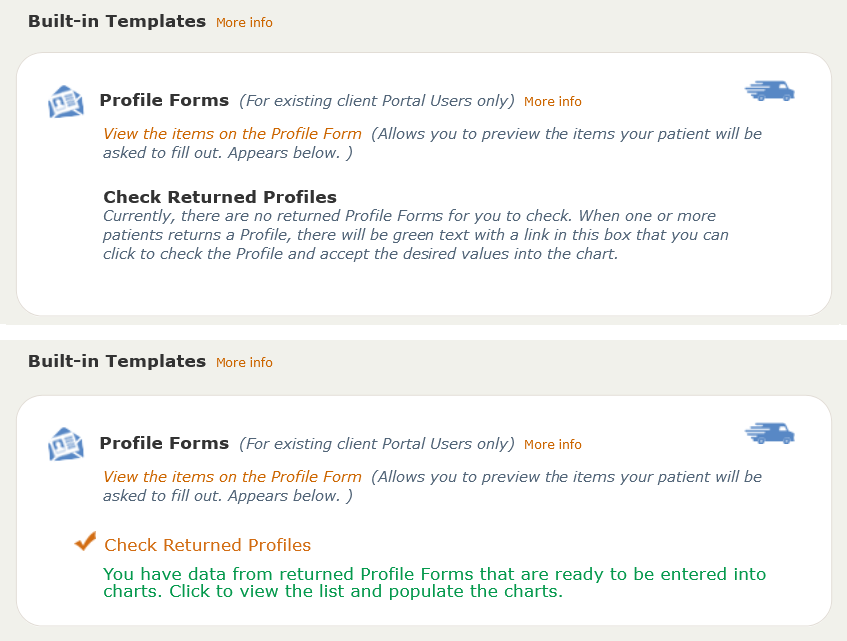

The top screenshot below shows Profile Forms secton on the Files, Forms & Templates page in its default state (i.e., when there are no new Profile Forms to check). The bottom screenshot shows what you can expect to see when new Profile Forms have come in and are ready to be checked. Notice the orange checkmark and green text under the Check Returned Profiles heading:

As you can see, in the top screenshot, the Check area is closed. By comparison, the bottom one is open, giving you access to the Check Returned Forms tool.

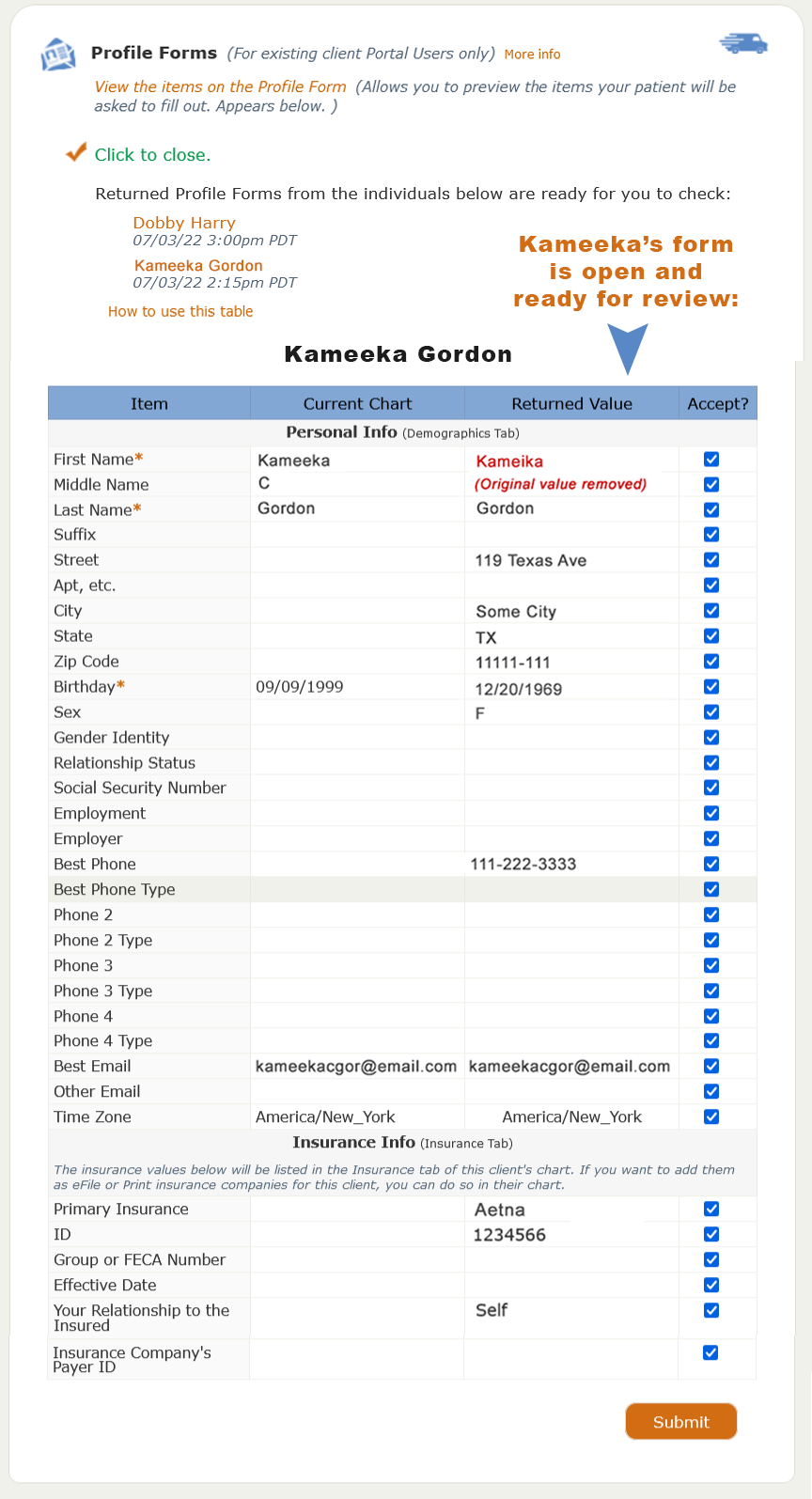

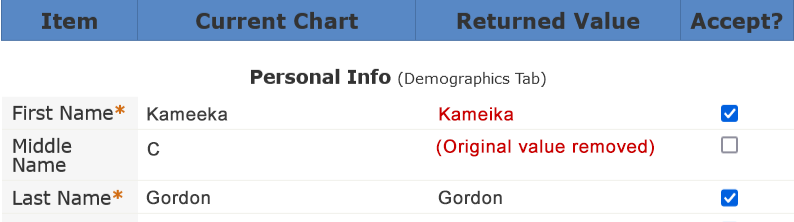

Clicking the green text under Check Returned Forms opens a window that shows a list of all patients who have returned Profile forms since the therapist last checked. If there's more than one, data from the earliest Profile will be shown in a table below the list. However, the therapist can click any name they want to view that patient's data. In the screenshot below, the therapist clicked Kameeka Gordon's name to view her data:

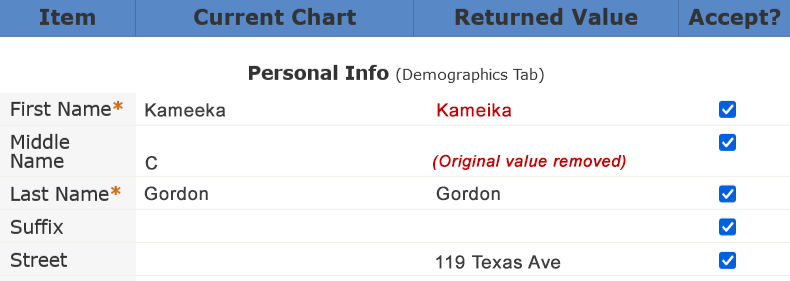

We'll look at a few of the entries at the top of the table as being representative of the types of changes a user might make:

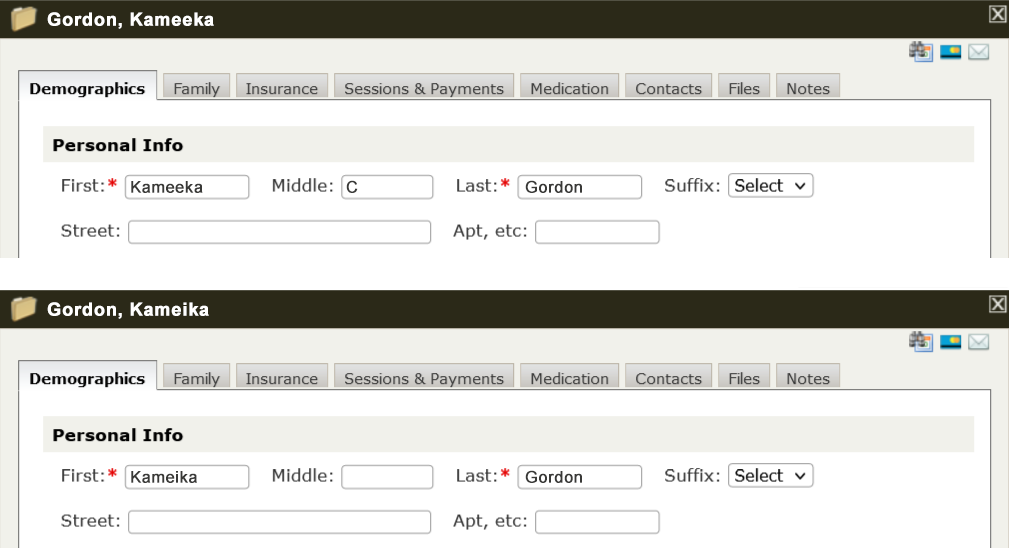

The table has 4 columns: Item, Current Chart, Returned Value and Accept? The values listed in the Current Chart column are what's on the Demographics page of this client's chart right now. In other words, her name is listed as Kameeka C Gordon and there's no Suffix or Street listed. The Returned Value column shows the corrections and additions the patient made. Red text items are things the user changed - places where the new value does not match the current value. For example, it looks like the patient's first name was misspelled. It's Kameika - not Kameeka. Also, the current chart has a middle initial of "C." Kameika removed the C. Kameika also added a street address. If you accept these new values into the chart, the current values will be overwritten by the new ones. The image below shows what the top part of this chart would look like before accepting the new values and the bottom one shows the new values:

However, you do not have to accept all changes a user sends you. The Accept? column has checkboxes for each item. By default, all boxes are checked. However, if there are items you do not want added to the chart, just uncheck the box beside that item before you submit:

If the user submitted the above, the spelling of Kameika's first name would be updated, but the middle initial "C" would remain in the chart.

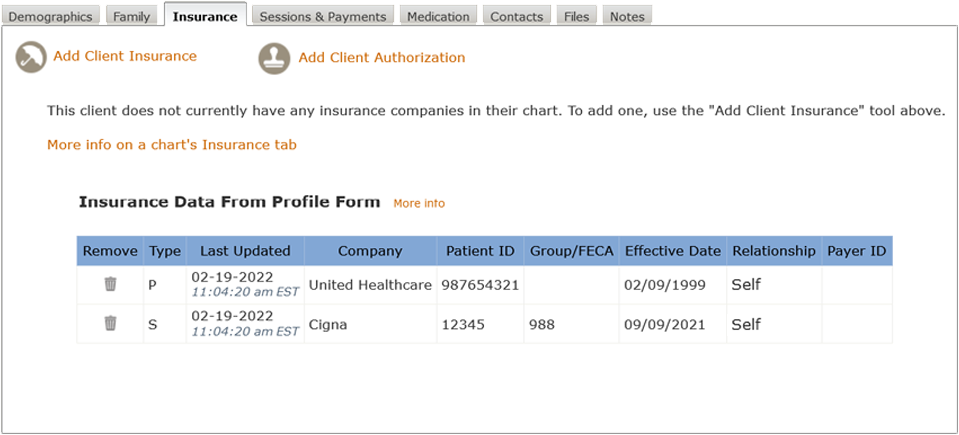

The Insurance Section

PSYBooks subscribers use the Insurance Tab differently. Some efile, others create paper forms, and others are strictly private pay and don't want insurance information in the chart at all. Also, even for therapists who are set up to efile, they may or may not have any given client's insurance company listed in their PSYBooks Insurance Library. For this reason, when you accept insurance information from a patient's Profile Form, we populate the insurance tab of their chart with a separate Profile table with the data ONLY, i.e., the company has not yet been added as an active insurance company in their chart. The screenshot below shows that the therapist accepted the patient's insurance data from their Profile Form, but you can also see the note at the top telling you that they do not yet have any insurance companies in their chart:

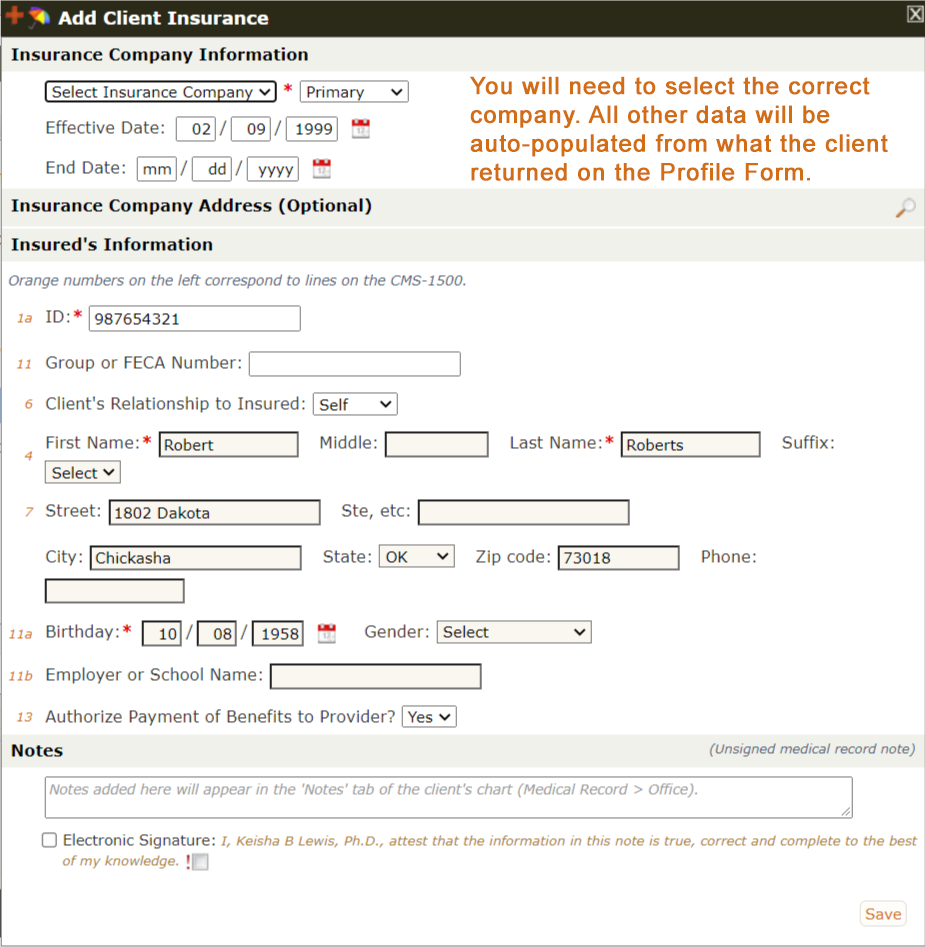

If you don't file insurance or need to create superbills or CMS forms to give the client, you can just leave this table exactly as it is, i.e., don't bother attaching the insurance company to the chart. However, if you do need to attach the insurance, when you click the Add Client Insurance tool, it will be populated with the data the client returned in their Profile Form. The screenshot below shows the same screen as above with the Add Client Insurance tool open. Notice that the form is pre-populated with all data the client returned in their Profile form - both the demographic data needed to file insurance and also the specific insurance information. However, although the client returned the name of the insurance company - and possibly even the payer ID, we leave selecting the correct company up to you:

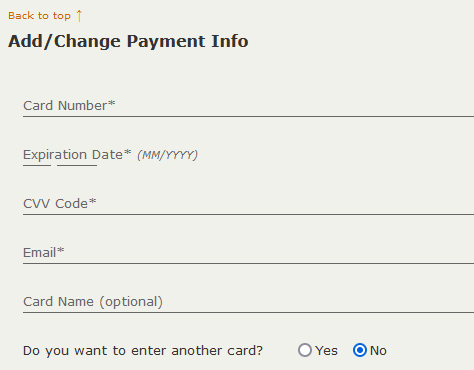

The Payment Section

When you include the Payment Section with your Profile form, your client sees this at the bottom of the form they're asked to fill out:

When the client submits the Profile form, the information goes directly into the "Saved card" list for you to use in collecting their payments. The new saved card(s) will be available for you to use as soon as the client returns the Profile form and you accept it. Notice that this method of collecting credit card data will only be helpful if you are set up to use Stripe within PSYBooks. If you need to collect client credit/debit card information to use with a different payment processor, you can request it via your secure email and/or ask your client to upload images of the credit card into the Files section of their Portal.

The Send Forms Tool

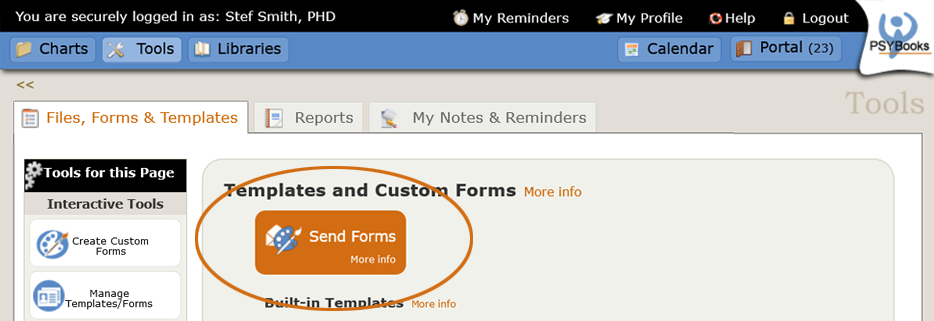

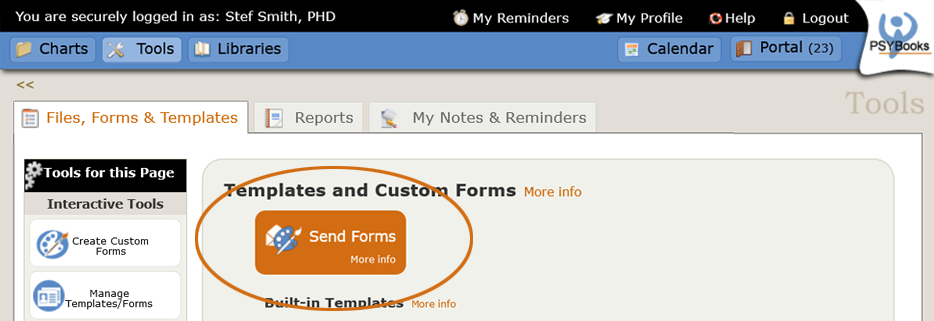

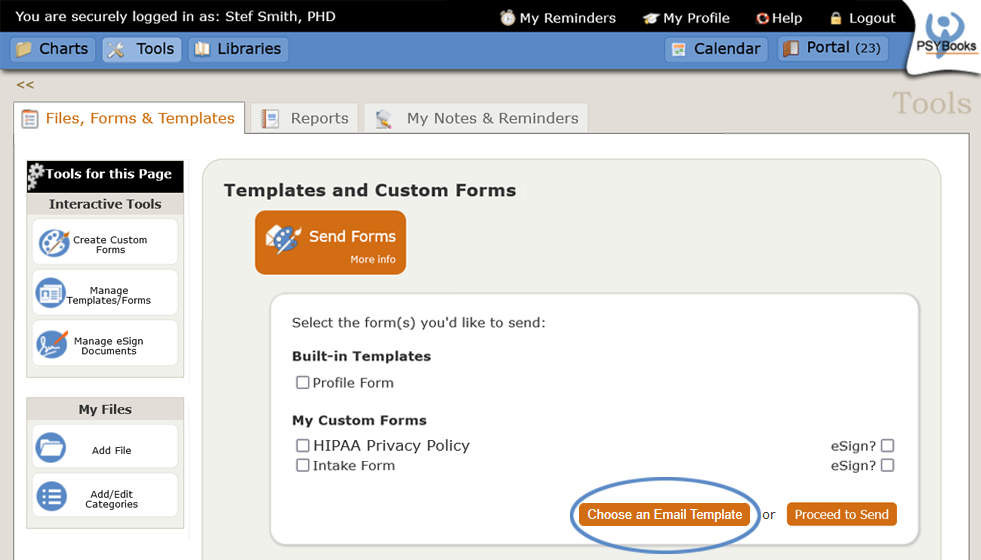

There's a single tool for sending forms that's used for both Built-in Templates and also any Custom Forms you've created. The Send Forms tool is the large orange button at the very top of the "Templates & Custom Forms" section of the Tools > Files, Forms & Templates page:

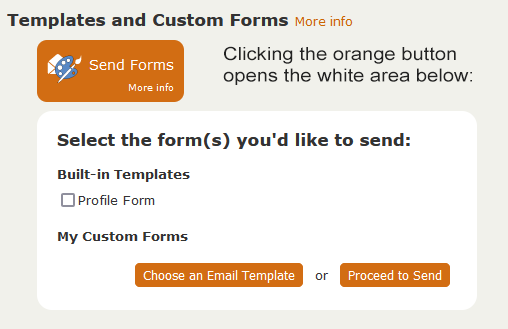

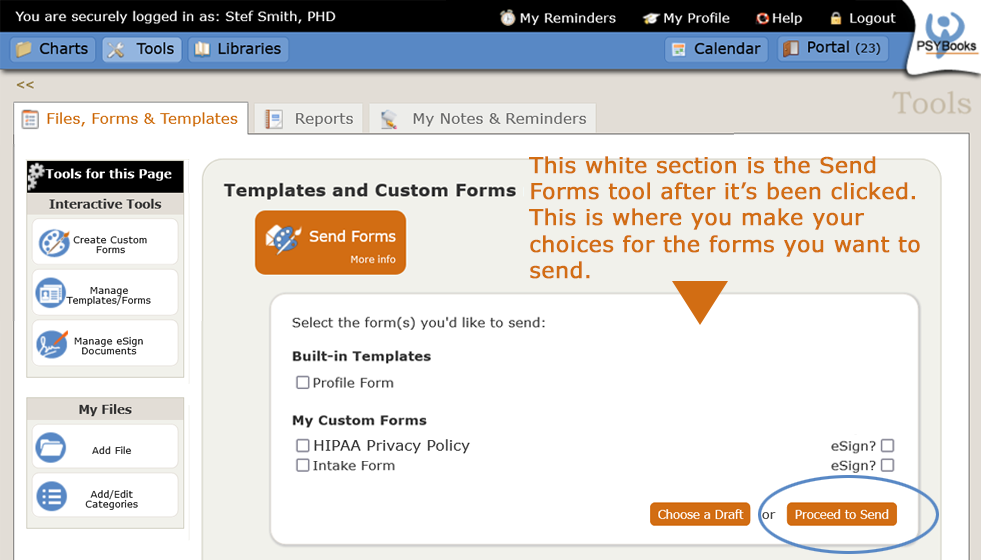

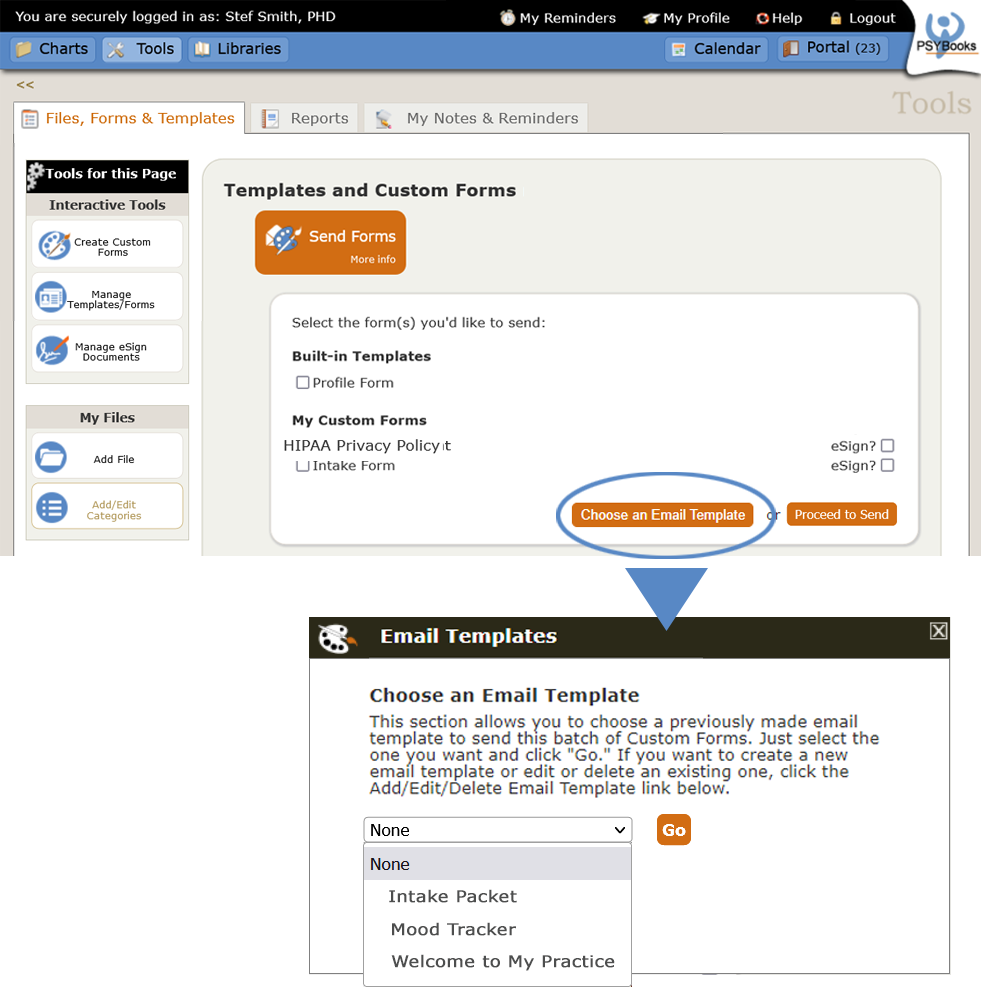

When you click Send Forms, a white area opens beneath the orange tool that allows you to select any of the Built-in Templates and/or any Custom Forms you've created. It will look something like this:

This individual has created two Custom Forms - a HIPAA Privacy Policy and an Intake Form. They can send either or both of those, with or without the Profile Form. They can also request eSignatures on any Custom Form they send. When the user has made their choices, clicking "Proceed to Send" opens a special type of Compose Email form. (We'll cover the "Choose a Draft" button later. That's a "nice but not necessary" tool that not all users will want to use.)

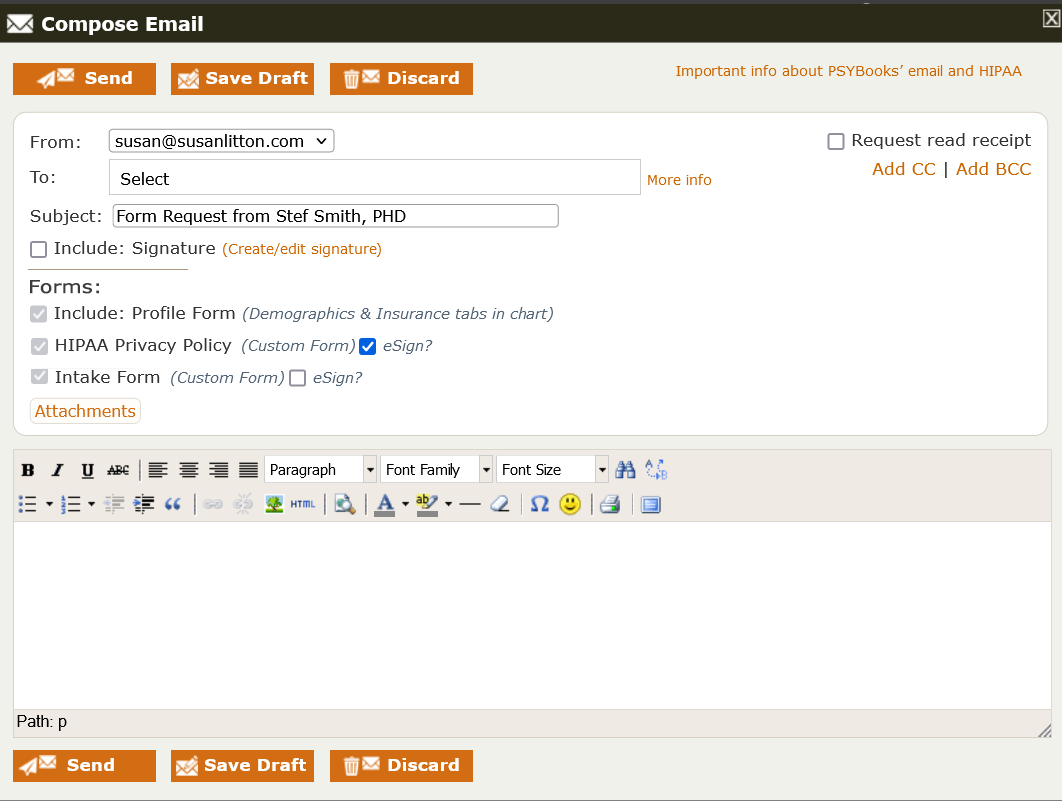

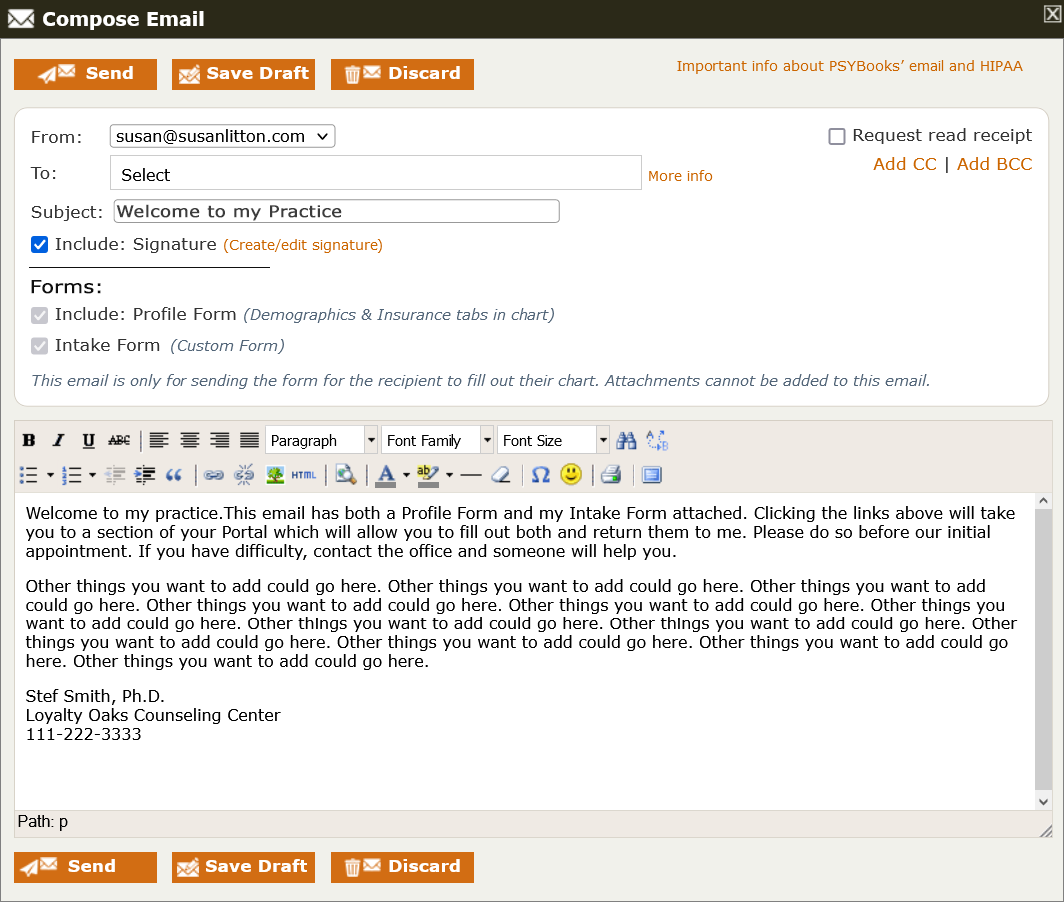

The email that is sent with the Send Forms tool is programmed to do special things once it gets to the client's Portal. However, on the therapist side, it looks like a normal email that you would see in the Portal. A Send Forms email might looks something like this before it's sent:

This user has decided to send all three of the forms they had available, i.e., the Profile Form and both of the Custom Forms they've created. They are listed in the email under "Forms." The therapist's choices for requesting eSignatures have already been captured but can be changed here if desired. In addition, you can CC and BCC, request Read Receipts, include a signature and, if you wish, write in the body of the email. All you need to do at this point is select the individual(s) to whom you want to send the forms and then click Send. If you have additional attachments, you may attach them to this email, requesting eSignatures if you wish. If you want to send the same packet of forms to more than one client, you can put your own name in the To field, and list each of the clients as a BCC recipient. This will allow you to simplify your workflow in a way that is HIPAA compliant, since no client's email will be seen by any of the others.

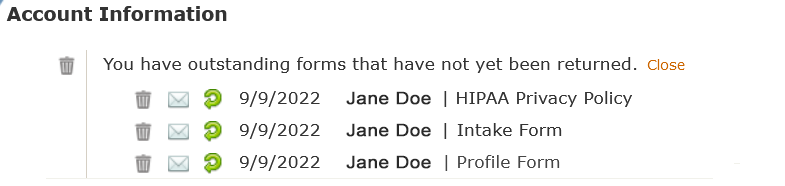

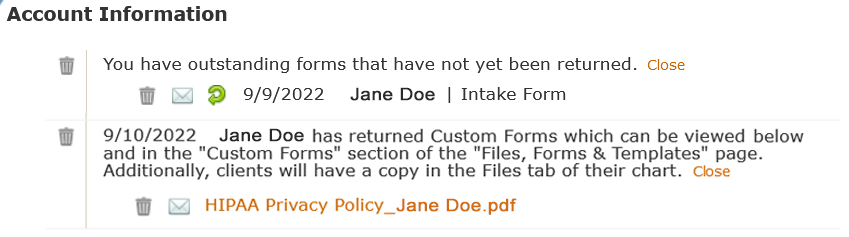

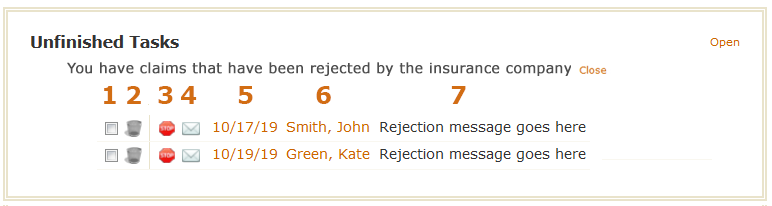

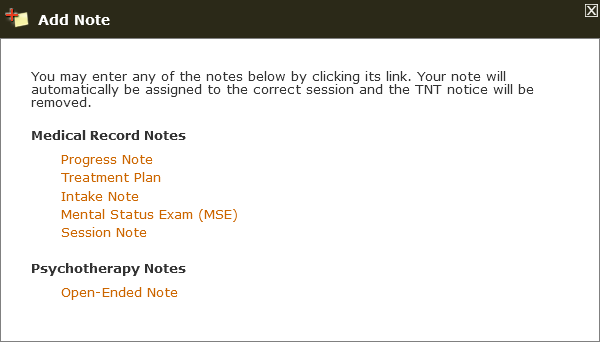

As soon as you send the forms, a notice appears on your TNT (Therapist Notification Tool) alerting you to the fact that you have outstanding forms which have not yet been returned:

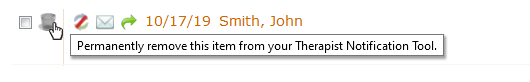

The therapist above has three outstanding forms - the Profile Form, plus the HIPAA Privacy Policy and also the Intake Form. They were all sent to a client named Jane Doe. Jane has not yet returned any of their forms. The three tools on the left allow the therapist to trash the notification, email the client, or remind the client to fill out the form (the green backwards arrow). Notice that the trash can is ONLY to remove the notification so it won't appear on the TNT. It does NOT "un-send" the form or tell the client they don't need to fill it out. (If you need to cancel the request, that can be done from the Manage Templates & Forms tool.)

As soon as a form is returned, the therapist is noticed via email and also on the TNT. In the screenshot below, we can see that Jane has returned their HIPAA Privacy Policy, but the Intake Form is still outstanding:

Copies of the returned forms can always be found in the My Files section of the Files, Forms & Templates page. There's a separate category in the Files from Portal Users section called "Custom Forms" where copies of all returned Custom Forms are held. In addition, when the Custom Form is from a patient, a copy will also be put in the Files tab of their chart.

Email Templates

(i.e., Save an Email So You Can Reuse It)

Another feature the Send Forms tool has is the ability to save and reuse email templates. This allows you to write an email you plan to use often and save it as a template, so you don't have to rewrite it each time you need it. A common usage might be to develop an email you routinely send to new patients. You can save the draft of that email and reuse it each time you have forms you want to send to a new patient. Note that you are NOT saving a Custom Form with this feature. Instead, you are saving the email you want to use to SEND one or more of your Custom Forms.

Add an Email Template

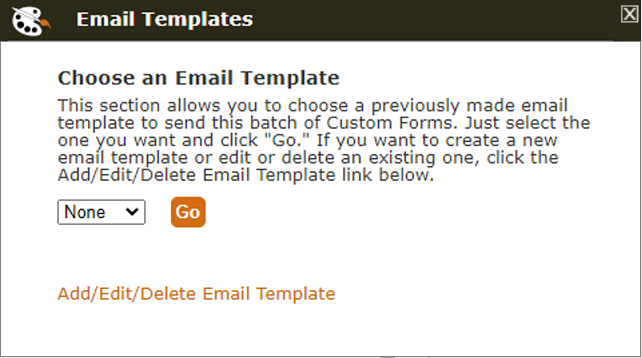

There's more than one way to add a Custom Forms email template. Perhaps the most straightforward is to click "Send Forms." That will open the Send Forms tool, as we saw above. There are two buttons at the bottom: Choose an Email Template and Proceed to Send:

Clicking the Choose an Email Template button opens another window that looks like this:

As you can see, the window above has two tools:

- A select box where you can choose among templates you've already saved if you're ready to send a form

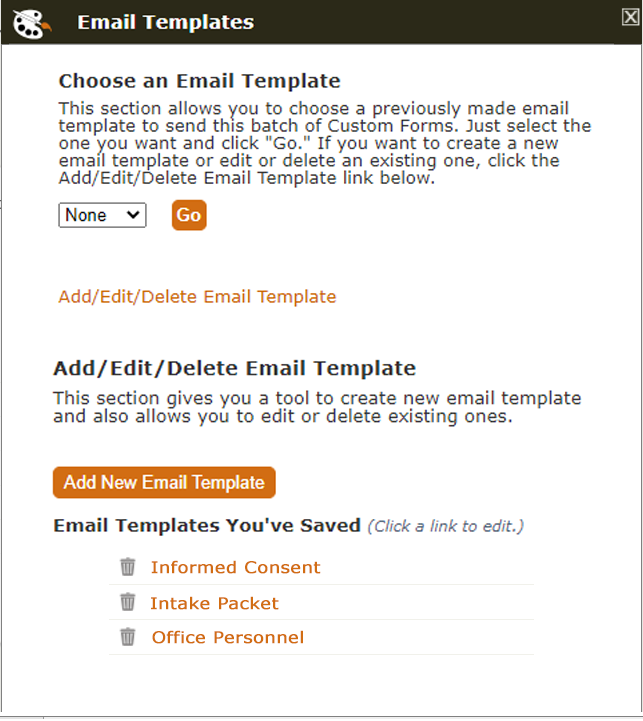

- A link at the bottom that says "Add/Edit/Delete Email Templates"

If you're wanting to add a new template, click the Add/Edit/Delete Template link. That will open the bottom section of the form which looks like this:

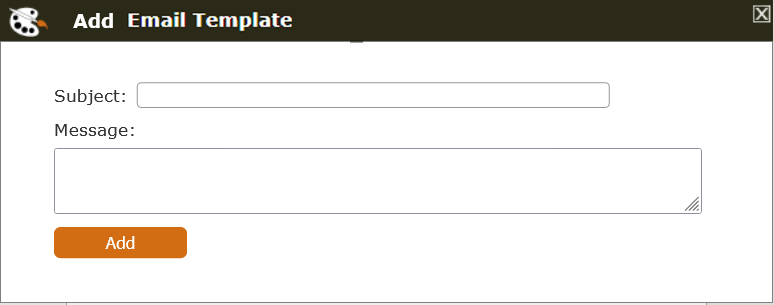

Clicking the Add New Email Template button, opens this small window:

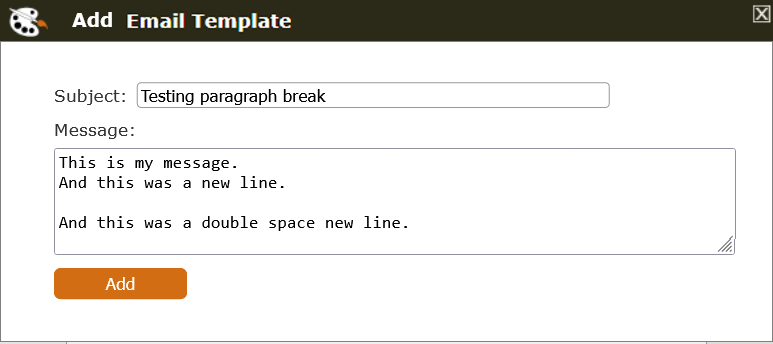

From this window, you can enter the Subject you want your email to have, plus the message you want in the body. Although you cannot add formatting here, the system will register line breaks. Let's assume you type this in the Message section of the Add New Draft window:

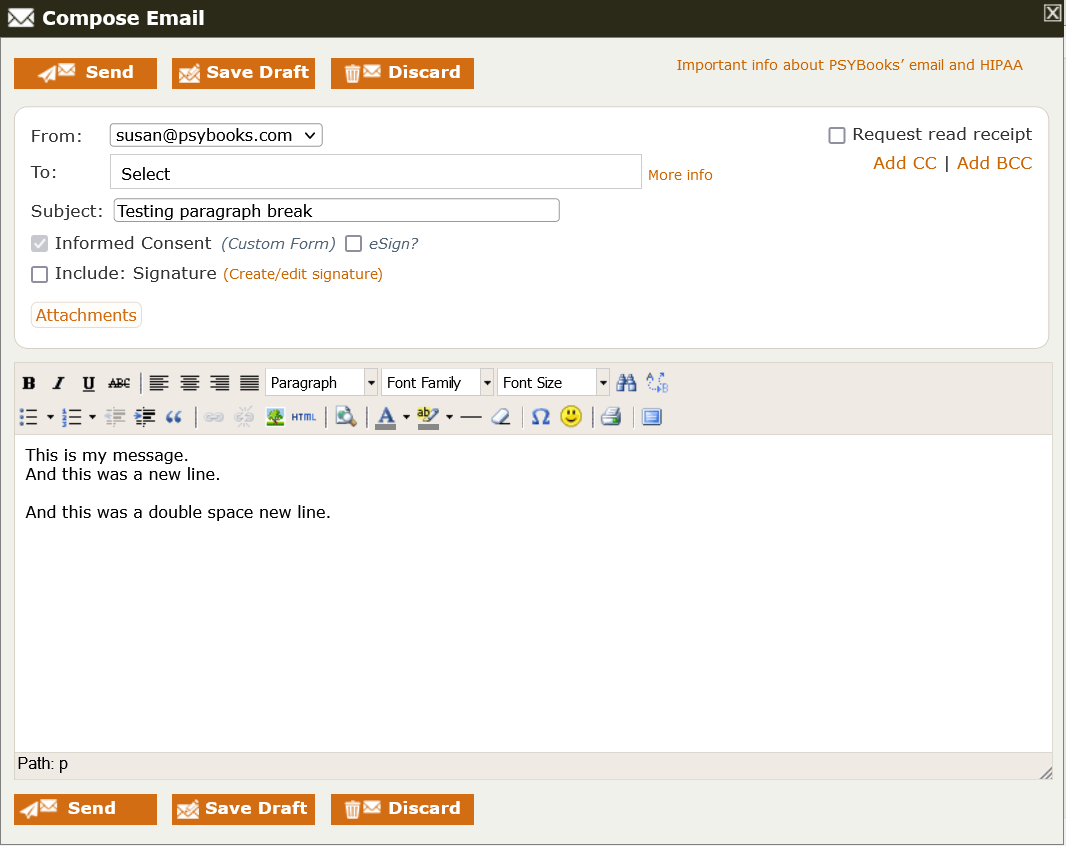

It will look like this when you actually use that draft to send forms:

At this juncture, you can use the formatting tools to style your email if you like, but it won't change the draft itself. In other words, you'll have to add the formatting each time you use the template. You can also make adjustments to the text here for specific cases. Again, those adjustments will be added to this particular email, but they will not affect the template itself.

Edit/Delete Templates

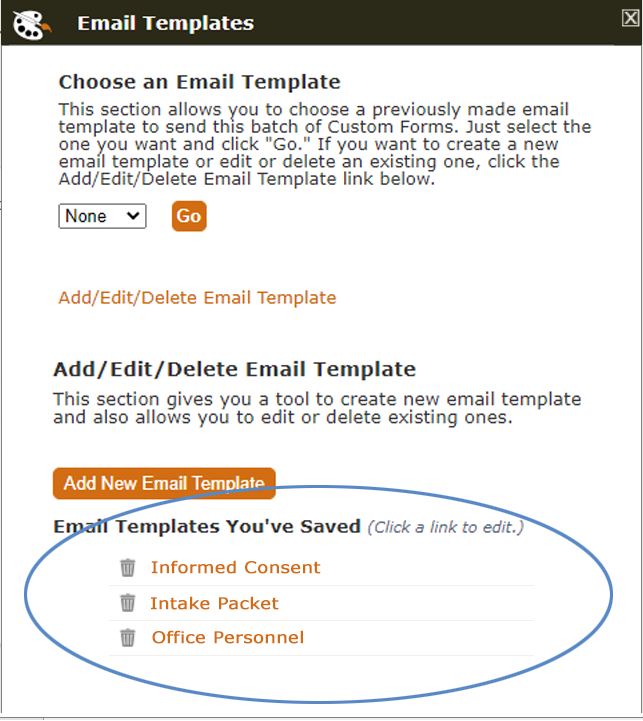

If you read the Add an Email Template section above, you probably noticed the section for both editing and deleting templates, which is right under the Add New Email Template button:

Clicking a link brings up a form that allows you to edit that draft; clicking the trash can will delete it.

Use a Template to Send Forms

To use a template that you've previously saved, click the Send Forms tool and then click the Choose a Draft button at the bottom. When that window opens, use the select box at the top to choose the template you want to use:

Let's assume the user chooses the "Welcome to my Practice" draft. When they click "Go" an email will open that has that draft inserted in both the subject and the body of the email:

Notice that the email above has forms attached (Profile Form and Intake Form) but does not yet have a recipient listed in the To box. This is because you can insert a draft at any point in the Send Forms process, i.e., before you add the recipients and also before or after you add the forms you want to include.

You do not have to use the Email Templates feature. It's optional. However, if you have one or more standard emails you routinely send, saving them as templates can be a real time-saver.

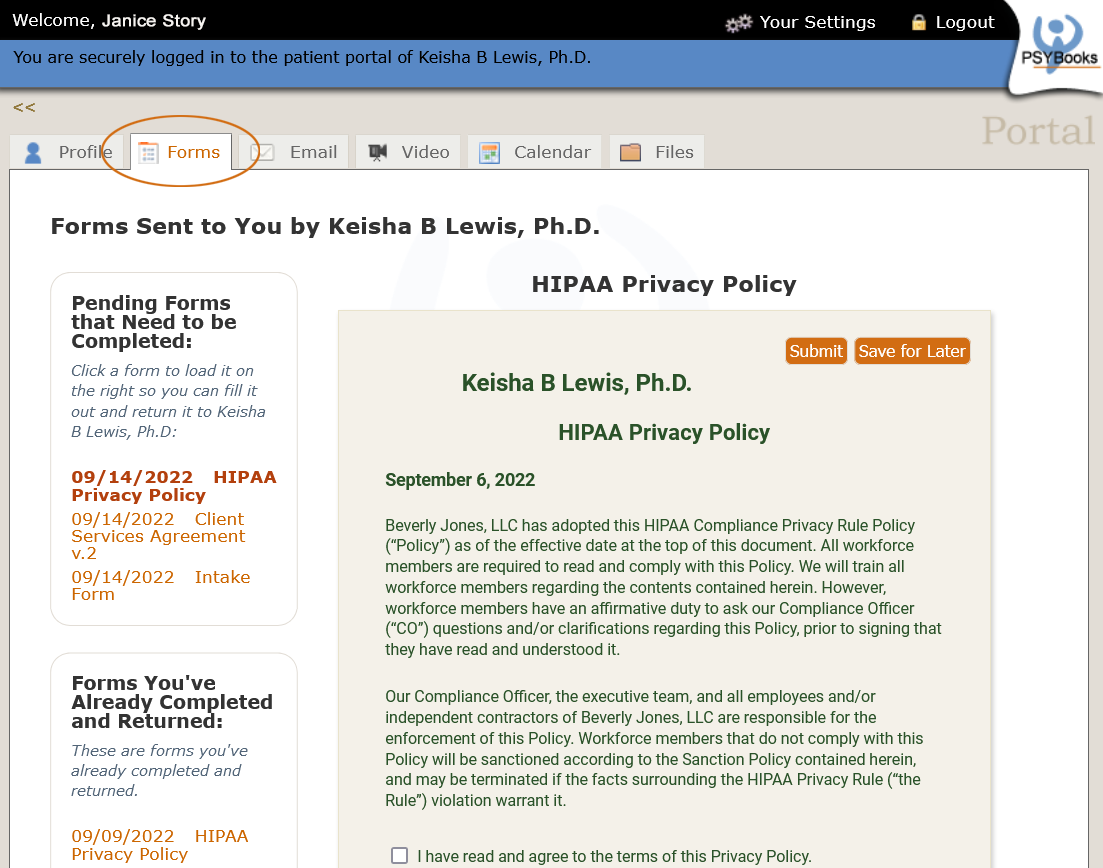

Client Experience

The Client Experience

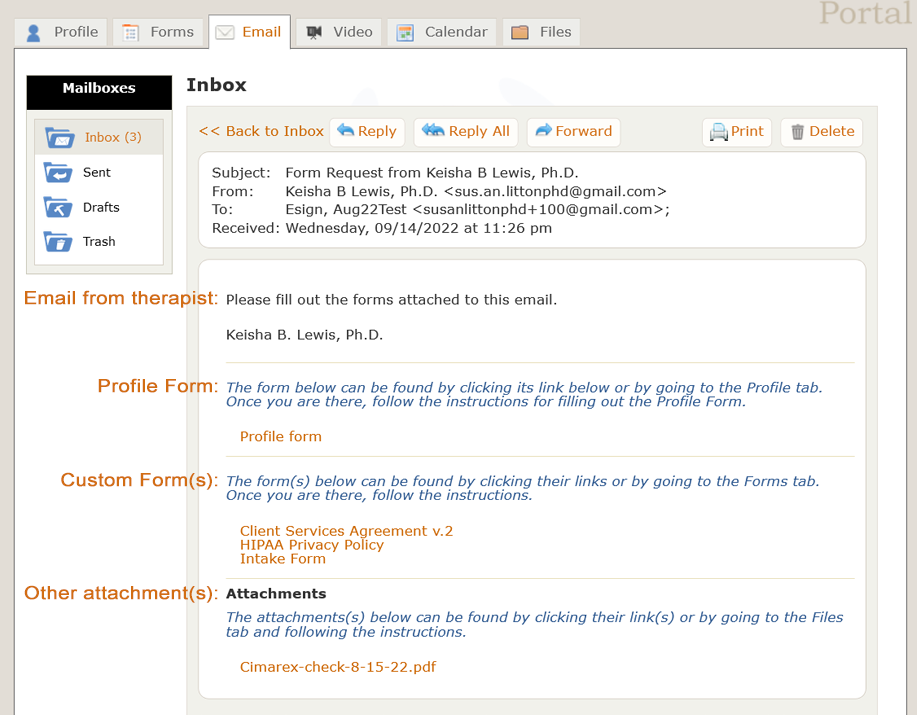

When you send a Send Forms email, the recipient is notified via their regular email that they have received an email in PSYBooks. There's a button in the email they can click that will take them to their login page. When they log in, they'll be taken to the Email tab of their portal so they can view the portal email without having to search for it. Once they open the email, how it looks depends on what you sent them. The example below is from a therapist who wrote a brief note at the top, then attached a Profile Form, three Custom Forms, and one attachment:

If you've sent only a Profile Form, it will open the Profile tab:

If you've sent only Custom Forms, it will open the Forms tab:

If you've sent both, the email they receive will have links to both the Profile and the Forms tabs and can complete them in any order. Finally, if the therapist sent some regular attachments with the Send Forms email, they will be on the Files tab of the patient's portal. If eSignatures have been requested on any of the forms or attachments, the recipient will be guided through that process.

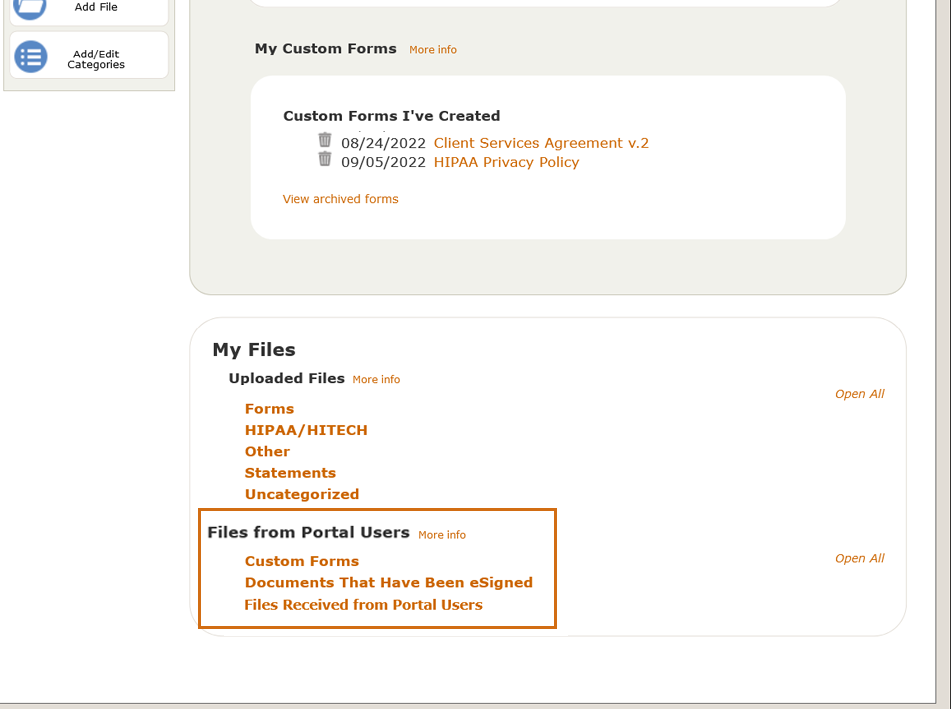

My Files

What this isMy Files is the bottom part of the Tools > Files, Forms & Templates page. It's a secure holding/working environment for digital files pertaining to your practice.What it looks likeThe My Files section is at the bottom of this page. It looks like this:  |

Where this isMy Files is the bottom section on the Tools > Files, Forms & Templates page. |

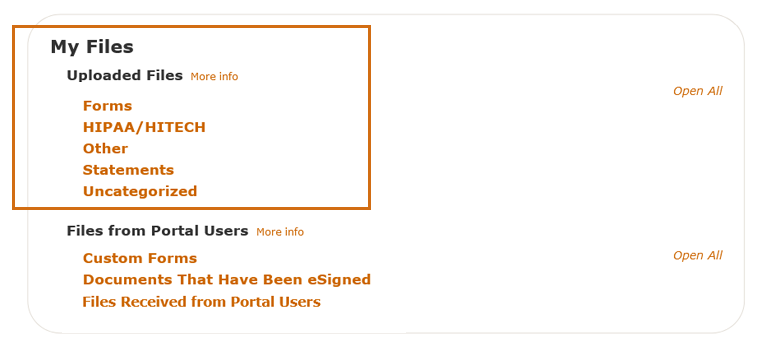

Whereas the top part of this page, Templates and Custom Forms, holds tools that "do things" in the program, the bottom part of the page, i.e., My Files, is a secure storage area for digital files that are part of your practice. As with the top section, My Files is divided into two sections: Uploaded Files and Files Received From Portal Users. Each section will be discussed below.

My Files > Uploaded Files

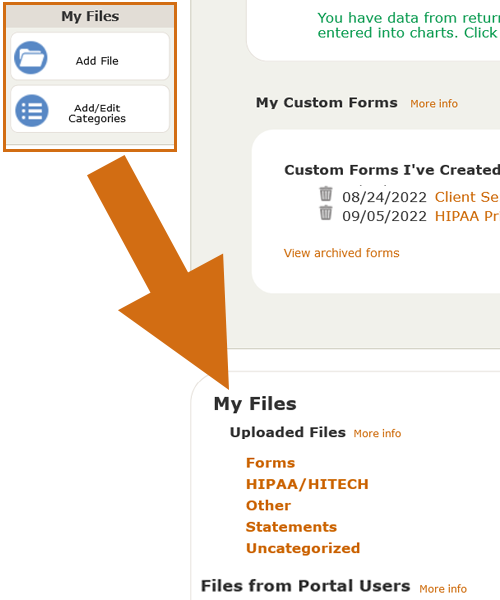

As we discussed earlier, the Files, Forms & Templates page divides into two broad categories: Templates & Custom Forms at the top, and My Files at the bottom. My Files subdivides into Uploaded Files and Files from Portal Users. This section covers the first section in My Files, i.e., Uploaded Files:

The Uploaded Files section is analogous to the Files tab each of your patients has in their PSYBooks Chart. In both cases, the only files stored there are those belonging to that individual. For example, a client chart in PSYBooks only holds files belonging to that one client. Similarly, files stored in Uploaded Files only belong to YOU. No one else has access to them unless you have Admins of other PSYBooks subscribers in your practice to whom you've specifically granted permission.

The orange titles in the screenshot above (Forms, HIPAA/HITECH, Other, Statements and Uncategorized) are Categories. PSYBooks provides you with some Categories and you can also make your own. In the screenshot, the Categories are closed, so you can't actually see the files each Category holds. Your Categories will likely be different from these - they're individualized to how you use the program. Clicking on a Category name opens it to reveal the files inside:

Files get added to this section in one of three ways:

- By directly uploading them with the "Add File" tool on the left;

- By requesting they be added here from other places in the app by using the 'Upload to My Files' tool:

- By PSYBooks, when certain conditions are met, e.g., when you run a statement report for a patient.

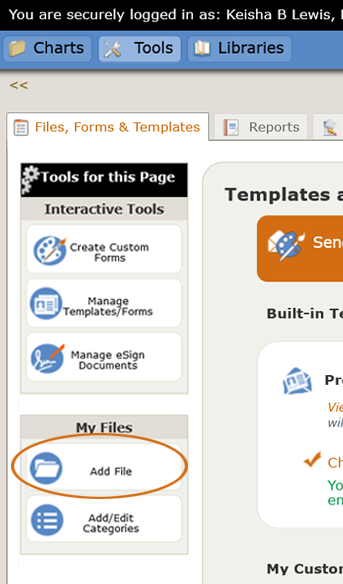

The left nav of Files, Forms & Templates is divided into two parts. The bottom part - which consists of the Add File and the Add/Edit Categories tools - feeds into the bottom part of the page, i.e., My Files:

My Files > Files from Portal Users

Whereas files in My Files are primarily files you've uploaded, files in the bottom section, as the name implies, have been uploaded by Portal Users. Files from Portal Users is the bottom half of the My Files section:

This whole category is for files you get from Portal Users. In other words, you cannot directly upload files into this section. Instead, Files from Portal Users holds files you may want to save for documentation purposes. For example, anytime a Portal User completes a Custom Form and returns it to you, a copy of that file will automatically be put into the "Custom Forms" category. Similarly, when a Portal User eSigns a document that is not a Custom Form and returns it to you, a copy of that file will automatically be put into the "Documents That Have Been eSigned" category. If the Portal User is a client, an additional copy of these types of files will also be placed in the Files tab of their chart. However, other Portal Users from whom you may want to request eSigned documents or Custom Forms don't have "charts" so their files are only stored here.

The Other Files from Portal Users sub-category is for times when a Portal User directly uploads a file to you - those files are stored here.

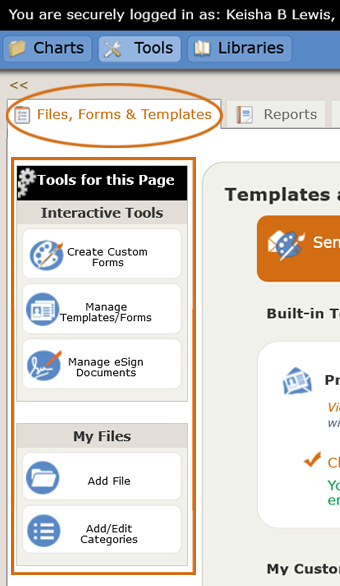

Tools for This Page(Files, Forms & Templates)

What this isThis is the left nav of the Tools > Files, Forms & Templates page.What it looks likeTools for This Page on Files, Forms & Templates looks like this:  |

Where this isThis is the left nav of the Tools > Files, Forms & Templates page. |

The left nav on the Files, Forms & Templates page is divided into two sections. The tools at the top are called "Interactive Tools" whereas the bottom tools are in a section called "My Files." The My Files tools correspond to the section on the right with the same name (My Files). In other words, the My Files tools ONLY affect things in the My Files section. The Interactive Tools are more varied and, although there's not a 1:1 correspondence, they tend to affect or reflect things in the Templates and Custom Forms section on the right.

Each tool will be discussed below.

Create Custom Forms

The Create Custom Forms tool was covered in detail in the Your Custom Forms section above so will not be covered here.

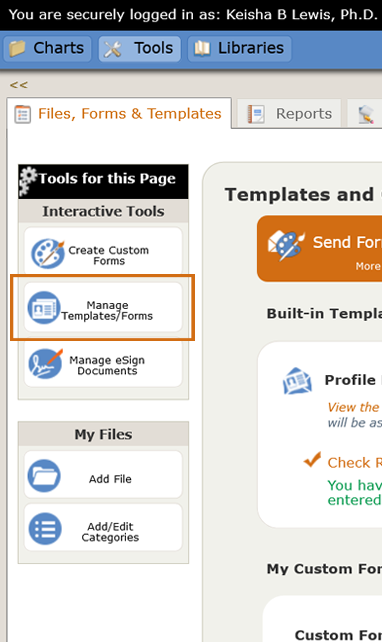

Manage Templates/Custom Forms

What this isManage Templates/Custom Forms Tool keeps track of the Profile Forms you've sent to your patients and also any Custom Forms you've sent to patients or other Portal Users. Additionally, there are tools allowing you to work with and track the progress of these documents.What it looks likeThe Manage Templates/Custom Forms Tool looks like this:  |

Where this isManage Templates/Custom Forms is available on the left nav of Tools > Files, Forms & Templates in the "Interactive Tools" section at the top. |

The Manage Templates & Forms tool allows you to both track and manage Profile Forms (templates) and also any Custom Forms that you've sent. There are a variety of filters at the top of the page that allow you to view as broad or narrow a result as you need:

- Select how many items appear on the page. The default is 10, but you can change it to see more.

- Choose the specific page you want to view if you have more than one.

- Sort by Newest to Oldest (the default) or Oldest to Newest.

- Choose all, or a specific Portal User's documents to view.

The table itself has several tools on each row that you can use with that file:

With these tools, you can:

- Securely email the person who sent you this file.

- Reset the password to their Portal User account if they've forgotten it.

- Remind the Portal User to sign and return the documents.

Next, we'll look at a couple of actual rows in the table:

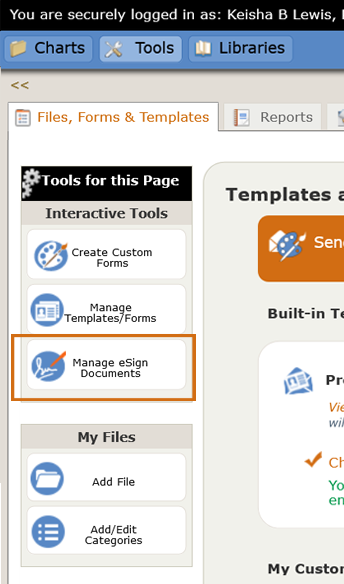

Manage eSign Documents

What this isThe Manage eSign Documents Tool keeps track of all stand-alone documents you've sent that have requested an eSignature. Notice that this tool does NOT include Custom Forms that have requested eSignatures.What it looks likeThe Manage eSign Documents tool looks like this:  |

Where this isManage eSign Documents is available on the left nav of Tools > Files, Forms & Templates in the "Interactive Tools" section at the top. |

Esignatures can be requested on standalone files that are sent as attachments to regular emails and also on Custom Forms. The Manage eSign Documents tool is only for tracking standalone documents requesting eSignatures. Managing Custom Forms, including those with eSignatures, can be done with the Manage Templates/Forms tool, above this one on the left nav.

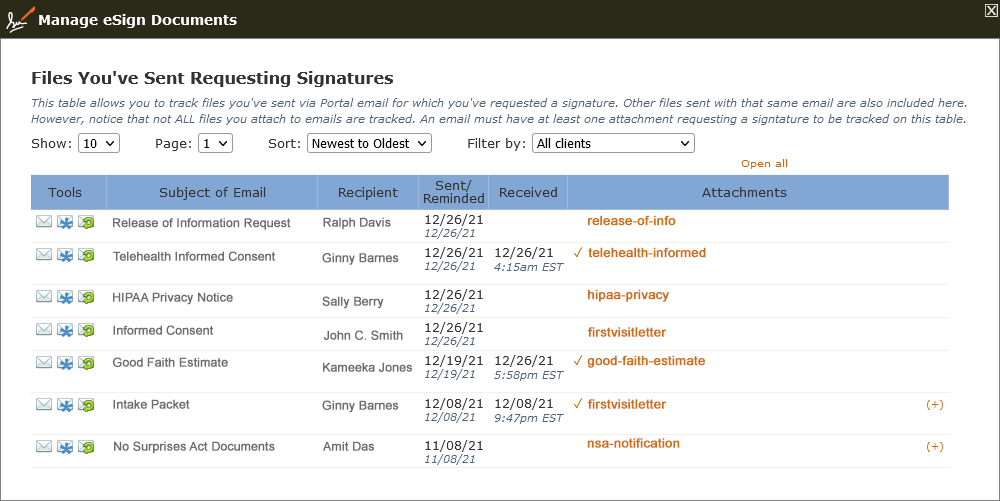

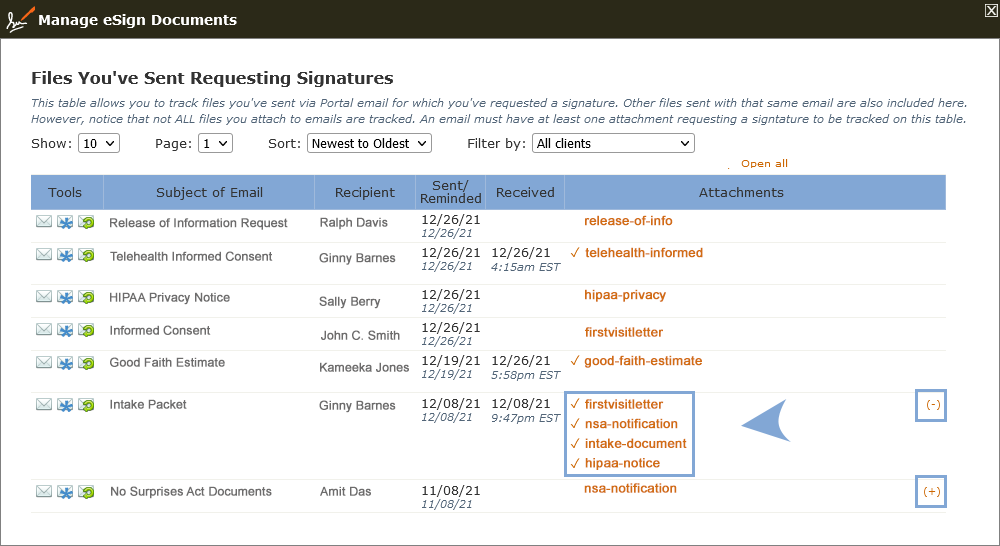

When you click the Manage eSign Documents tool shown in the screenshot above, the window that opens looks like this:

The top part of Manage eSign Documents has a set of filters that will allow you to find what you need if you don't see it right away:

With the filters, you can:

- Select how many items appear on the page. The default is 10, but you can change it to see more.

- Choose the specific page you want to view if you have more than one.

- Sort by Newest to Oldest (the default) or Oldest to Newest.

- Choose all, or a specific Portal User's documents to view.

The table itself has several tools on each row that you can use with that file:

With these tools, you can:

- Securely email the recipient of this file.

- Reset the password to their Portal User account if they've forgotten it.

- Remind the Portal User to sign and return the documents.

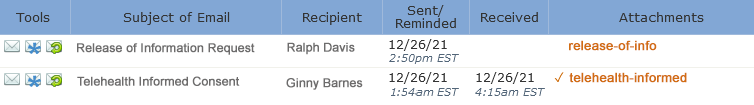

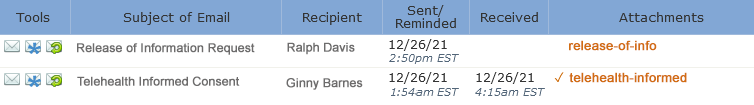

Next, we'll look at a couple of actual rows in the table:

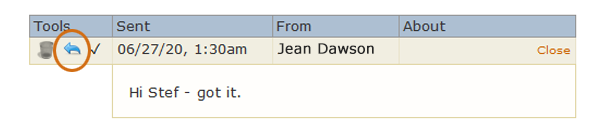

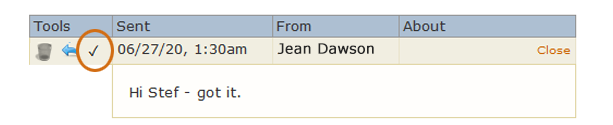

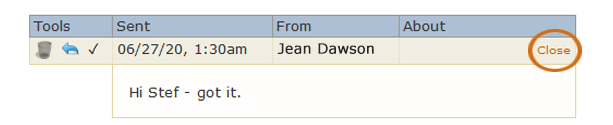

The first column holds the Tools that we discussed above. The next column is the Subject line the therapist used when they sent the email, and the third column is the name of the person to whom it was sent. The Send/Receive column shows the time/date stamp for when you sent the request. Similarly, the Received column shows when you received the signed response back in your Portal.

The Received column has two possible tools - the orange link of the filename and, when present, the orange checkmark beside it, which is also a link. Clicking the filename link opens a copy of the file you sent in the PDF Preview tool. Once the file has been signed and returned, the checkmark appears. Clicking the checkmark allows you to see the signed document.

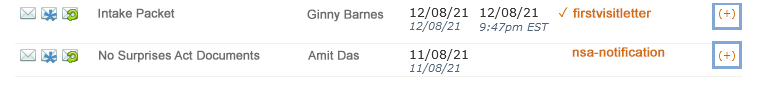

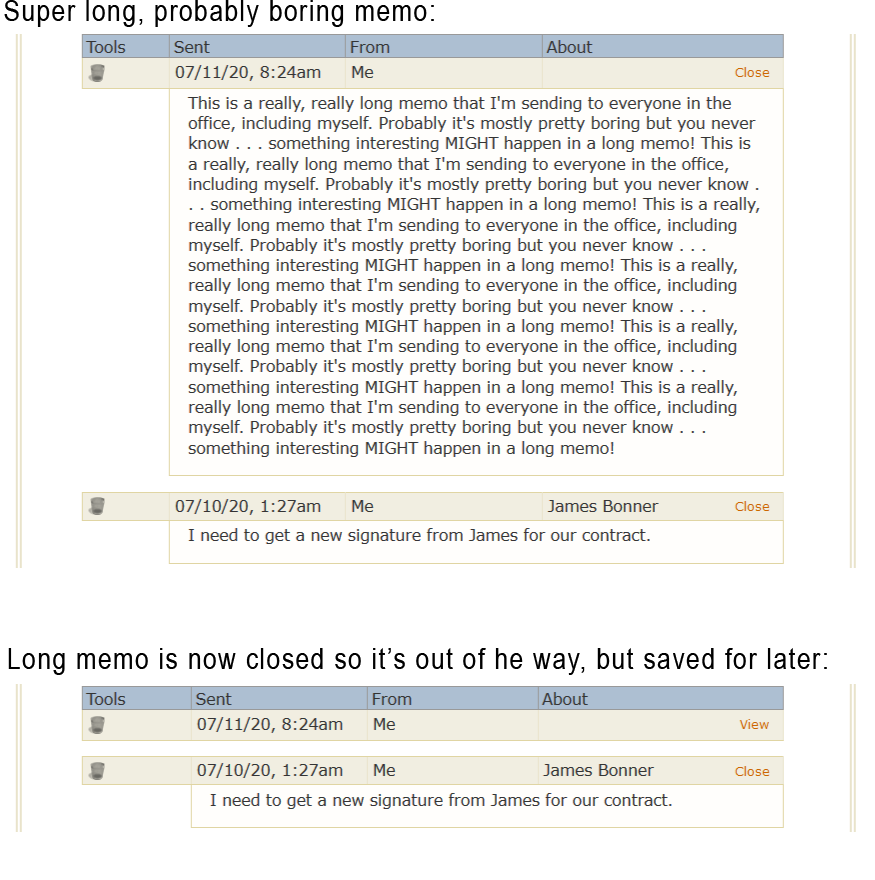

When you attach several files to a single email, those files are grouped together in a packet. Rows that include more than one eSigned document are indicated by an "Open" tool (+) on the far right side:

Clicking a (+) link opens the packet so you can see all files that were attached to that particular email:

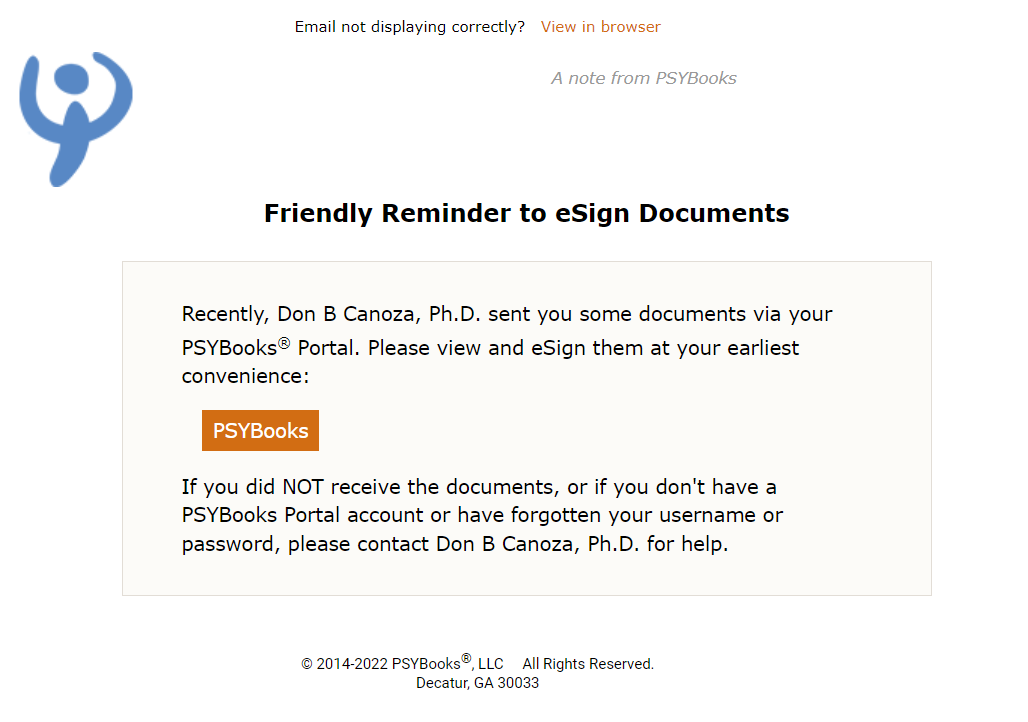

As we discussed above, the third tool on the left allows you to remind the Portal User to eSign and return the documents. Clicking this tool: sends this email, customized to display your name:

sends this email, customized to display your name:

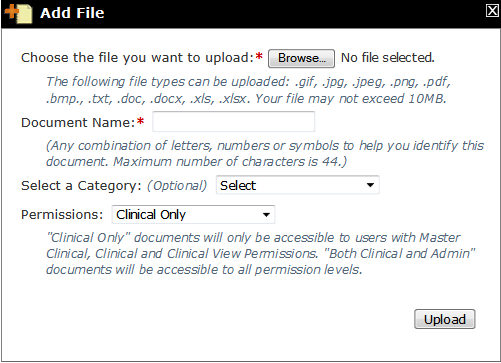

Add File

What this isThe Add File tool on the Files, Forms & Templates tab allows you to enter a Name, Category and Permission level of a file you're uploading to the therapist's file storage area.What it looks likeThe Add File tool looks like this:  |

Where this isThe Add File tool is in the My Files section of the left nav of the Files, Forms & Templates tab in the Tools section. |

Clicking the Add File tool in the Files, Forms & Templates section opens a form exactly like the one in the Files tab of a client chart:

The first line lets you browse your computer for the file you want. Once you find your file, PSYBooks automatically populates the Document Name field with the name of your existing file. However, you can change the name to anything you want. The next line allows you to select a category for your file. This is an optional tool to help you keep your files organized. The last line allows you to set a permission level for the file (i.e., specify which types of users are allowed to view the file).

As noted above, Add File adds files to the bottom section of the page, i.e., the "My Files" section.

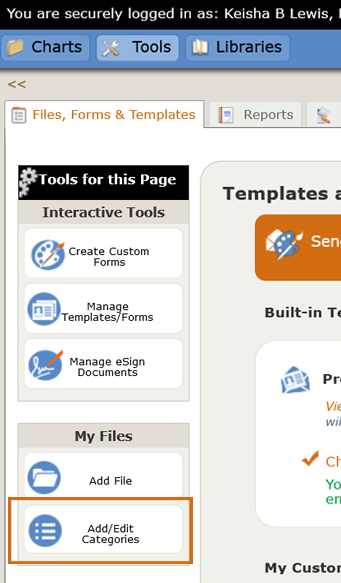

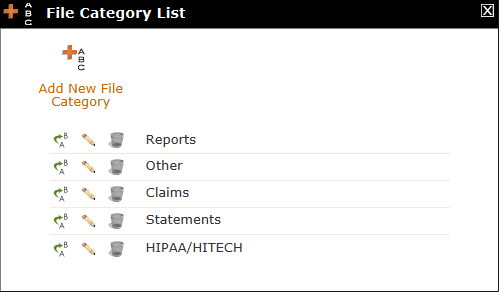

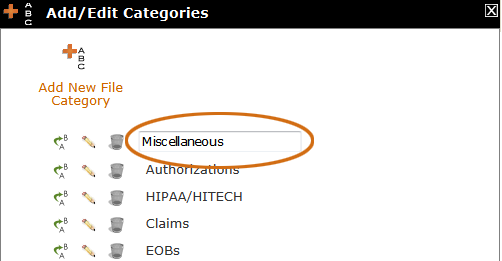

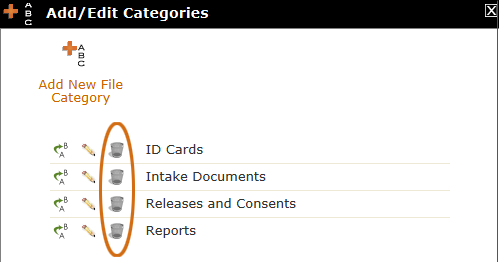

Add/Edit Categories

What this isThe Add/Edit Categories tool in the Files, Forms & Templates section allows you to add, edit, delete and reorder the categories you use to organize your own files. The categories in the therapist file section are totally different from the file categories in clients' charts so changes you make here will not affect any client chart.What it looks likeThe Add/Edit Categories tool in Files, Forms & Templates looks like this:  |

Where this isThe Add/Edit Categories tool is on the left nav of the Files, Forms & Templates tab in the Tools section. |

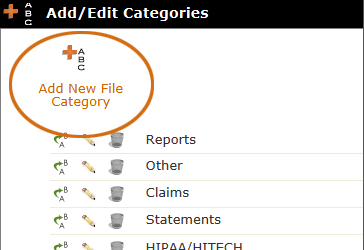

Any categories you add to Files, Forms & Templates will appear in the My Files > My Uploaded Files section, as discussed above. When you first click the Add/Edit Categories tool in the My Files section, the default form that opens looks like this:

Notice that there are many fewer default categories in the therapist file storage area than are present in the client file storage area. However, you can change the categories in any way you want. As with client file categories, there are four separate tools for working with the categories: The Add New File Category tool at the top plus three small table tools: Reorder, Edit and Delete. Each will be discussed below:

Add New File Category tool

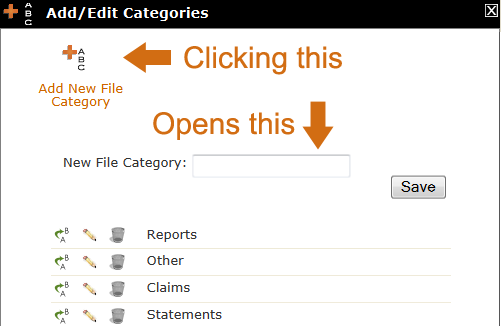

The Add New File Category tool looks like this:

Clicking the tool opens a textbox right on the form where you can add your new category:

You can add your new category, click Save, and it will be added to the list below the tool.

Reorder File Categories tool

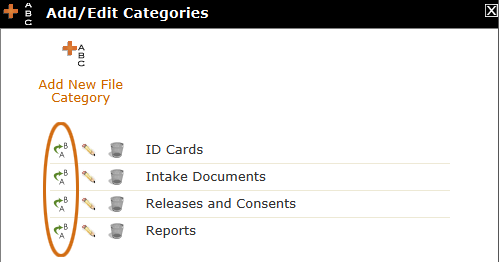

The Reorder File Categories tool is a small table tool beside the name of the category. It looks like this:

You can click and drag any category to another place in the list with this tool.

Edit File Category tool

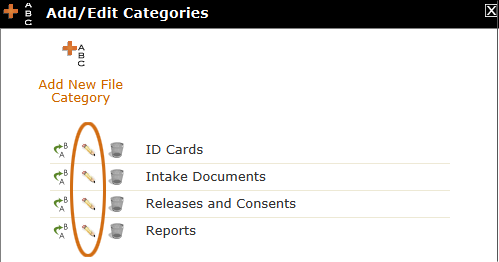

The Edit File Category tool looks like this:

Clicking an Edit File Category tool puts the category name in that row in a textbox where it can be edited:

Delete File Category tool

The Delete File Category tool looks like this:

You can use this tool to delete file categories. You will be warned if a category contains files so you can decide whether you want to delete the files and the category or just the category. As with the Add File tool, any changes or additions you make with Add/Edit Categories only affects Categories in the "Your Uploaded Files" section.

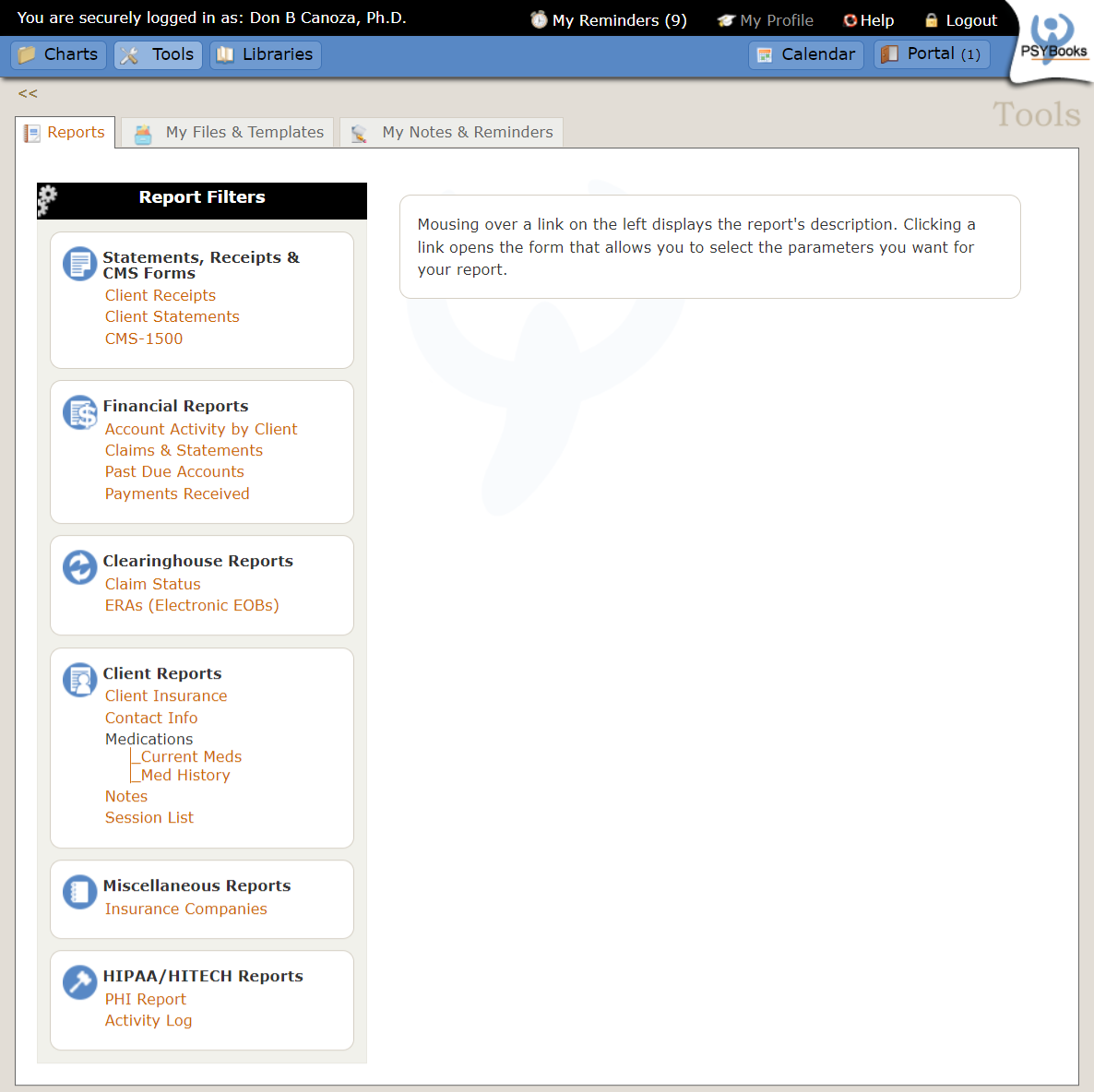

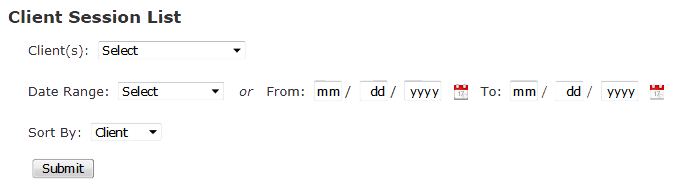

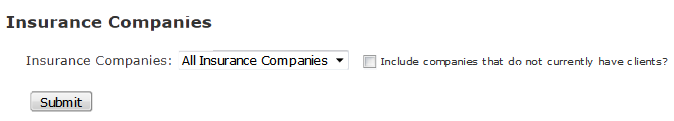

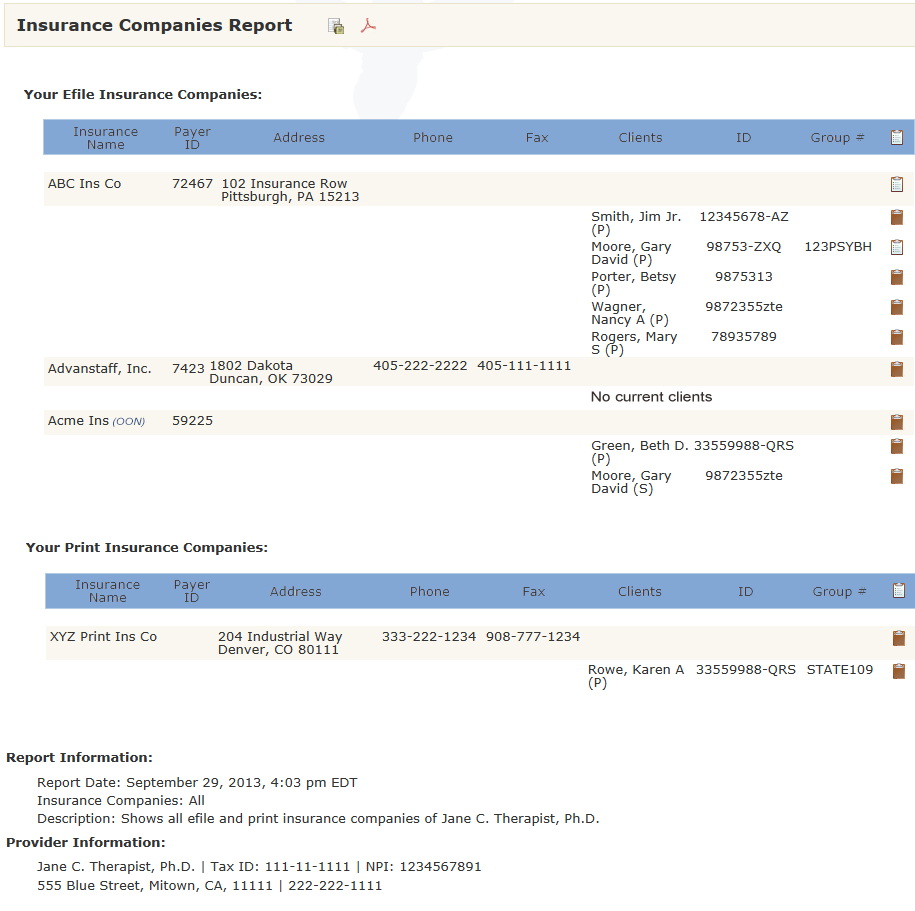

Reports

What this isThis is a tab in the Tools section of the app which allows you to create reports from your practice data. All reports have filters so you can narrow what the report contains. In most cases, reports also provide tools for working with the report data. Reports you generate can be saved to a PDF format so you can print or save them to your computer. You can also save your reports to the My Files section so you can easily pull up that same data at any time.What it looks likeTools > Reports  |

Where this isReports is the first tab in the Tools section of the app. |

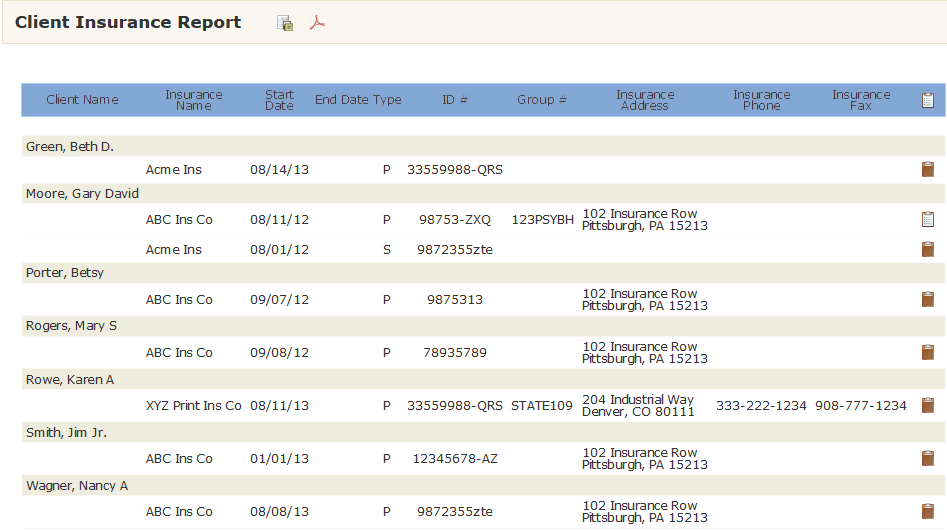

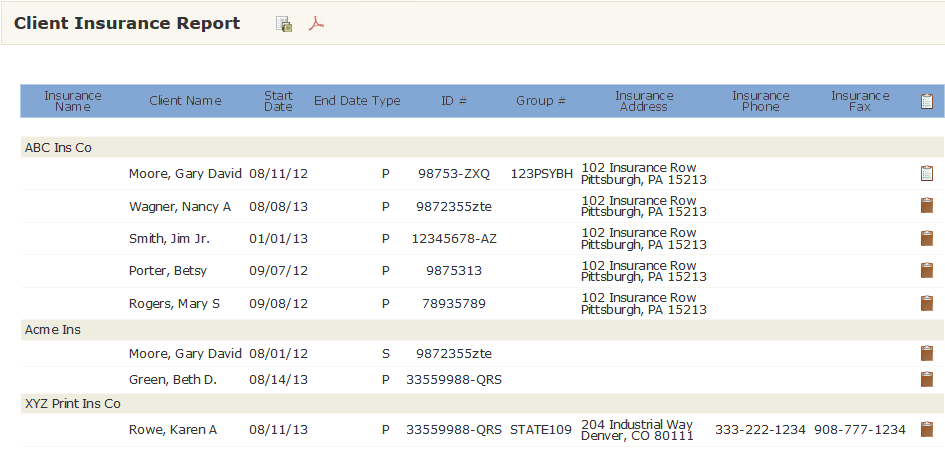

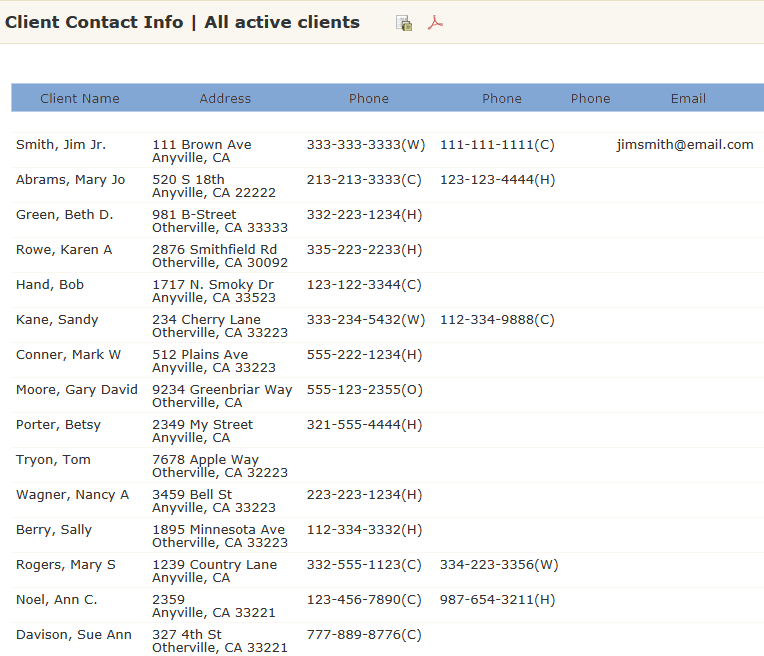

The Reports section has links to various report filters on the left nav:

The reports are grouped by category: Statements, Receipts & CMS Forms, Financial Reports, Clearinghouse Reports, Client Reports, Miscellaneous Reports and HIPAA/HITECH Reports. Mousing over a link in one of the categories will give you more information about that specific report. Clicking a link will bring up a form that allows you to narrow the parameters of what you want to see in your report.

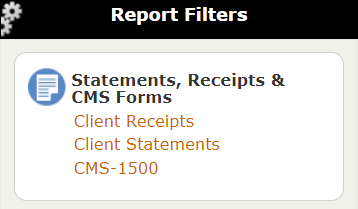

Statements, Receipts & CMS Forms

What this isThe Statements, Receipts & CMS Forms group of report filters allows you to generate some of the forms you may need in your practice. You can create statements, receipts and CMS-1500 forms to print and give to clients. There are also links to blank CMS forms you can fill out manually and save or print. (This feature only works with certain versions of Adobe Reader.)What it looks likeThe Statements, Receipts & CMS Forms section of the Reports filters looks like this:  |

Where this isStatements, Receipts & CMS Forms is in Tools > Reports. |

Statements, Receipts & CMS Forms holds three reports: Client Receipts, Client Statements and CMS-1500. Each will be discussed separately below:

Client Receipts

Client Receipt filters allow you to generate receipts to give your clients for amounts they've paid. You can select one client or many, for a single date or a range of dates. You can also customize the items you have on your receipts by including or excluding these items:

- Diagnosis

- Client's Account#

- Provider's NPI

- Provider's Tax ID

- Provider's License#

Receipts will be generated in PDF format. Once they've been generated, they can be printed, saved to your computer and/or saved to the My Files section of PSYBooks.

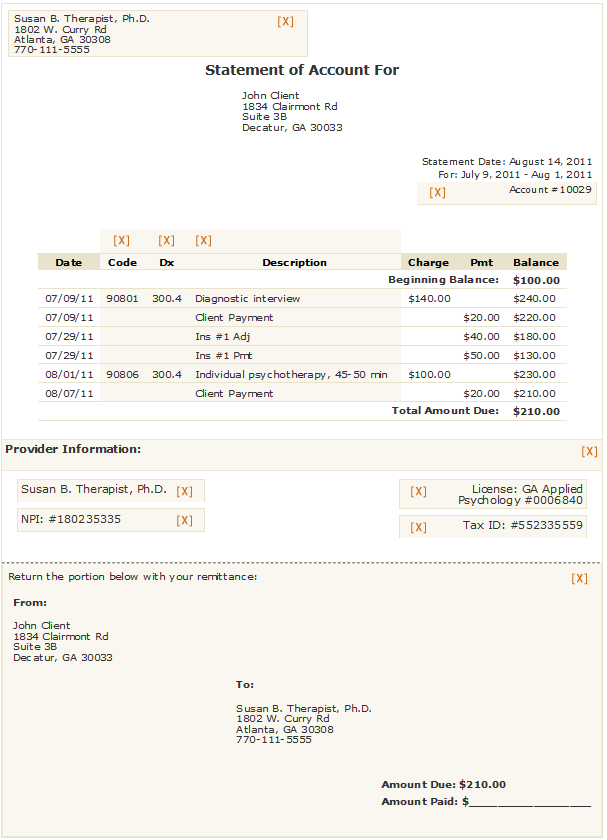

Client Statements

Client Statement filters allow you to generate statements with itemized bills of the amounts each of your clients owes. You can select one client or many, for a single date or a range of dates. You can also create your own statement templates with the Manage Template tool and then select which template you want to use with each client.

The Manage Template Tool

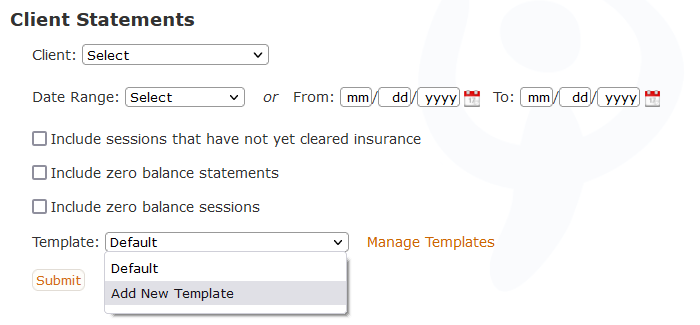

When you first get your PSYBooks subscription, the Client Statement filter template area will look something like this:

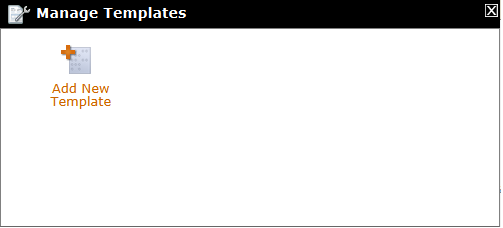

Notice that the Template select box box only has two options: you can use the Default template or you can add a new template. If you click the Manage Template link beside the select box, it's also pretty blank - the only thing in the window being a tool for adding a new template:

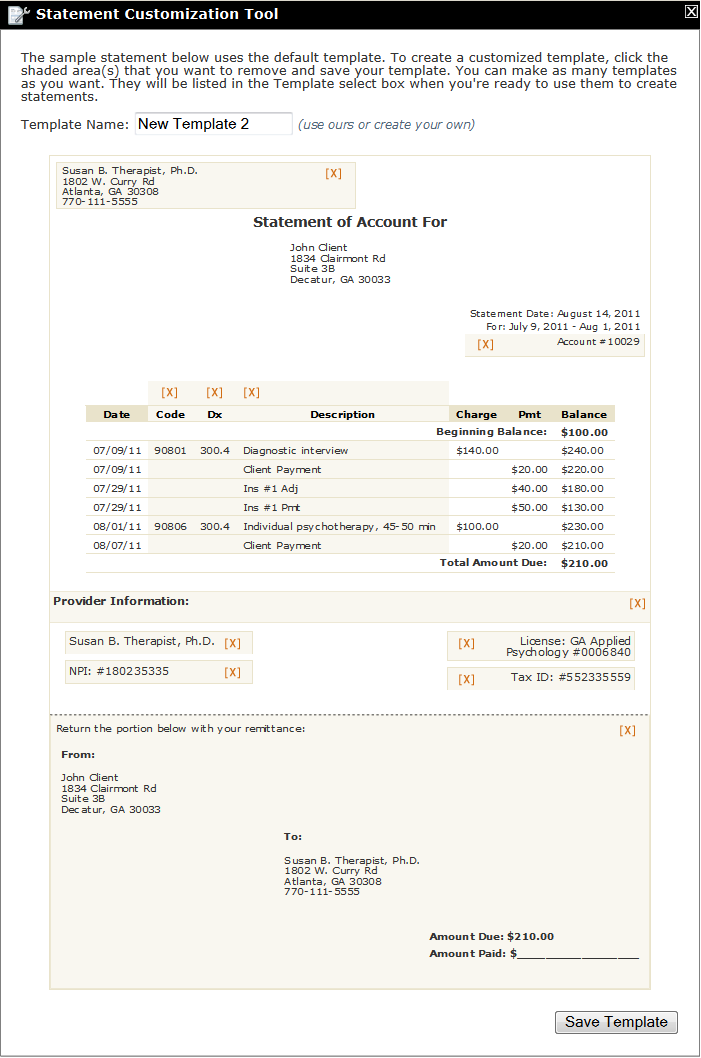

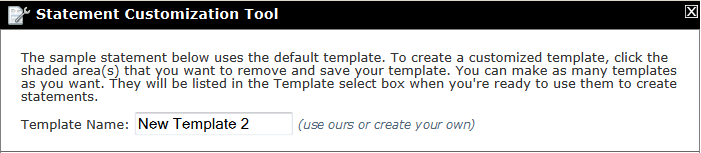

If you're happy with the Default statement, you never have to worry with adding new templates. However, if you would like to customize your statement a bit - or even if you just want to play - you can create a new template by clicking either the Add New Template option from the Template select box, or the Add New Template tool from the Manage Templates window. They both do exactly the same thing. Clicking either of the Add New Template links will open a window that looks like this:

There are only three things to do on this form - the first of which is optional:

- Give your new template a name (optional - although our names are pretty bland and boring)

- Make whatever changes you want in the template

- Click 'Save Template'

We'll look at each separately.

Name Template. To name your template, just write whatever you want in the Template Name textbox:

If you don't want to bother with this step, PSYBooks will generate new template names for you by adding an incremented number at the end (New Template 2, New Template 3, etc.) However, you might want to name your templates something that will be more meaningful to you such as 'No Remittance' for templates that don't include the remittance portion at the bottom, or 'Employer Template' for templates you might want to use for clients who need something to submit to their employer for reimbursement, etc.

Make Changes. The statement template you see below the Template Name area is the Default template. In other words, if you don't create any custom templates, this is the statement that will be generated whenever you run the Client Statement report. If there are some parts of the Default template that you want to remove, just click the light gold shaded area (removable areas also have an '[X]'). Sections you remove will turn a darker gold and may be toggled back on if you change your mind. This section of the Add New Template form looks like this:

As you can see, there are very few items on the Default template that CAN'T be removed so you have quite a lot of flexibility in the type of statements you create. After you've made the changes you want, click Save Template and you're finished. From then on, your new template will appear in the Template select box in the Client Statements report filter and also on each client's Sessions & Payments tab. You can choose a different template each time you generate a statement. There are no restrictions.

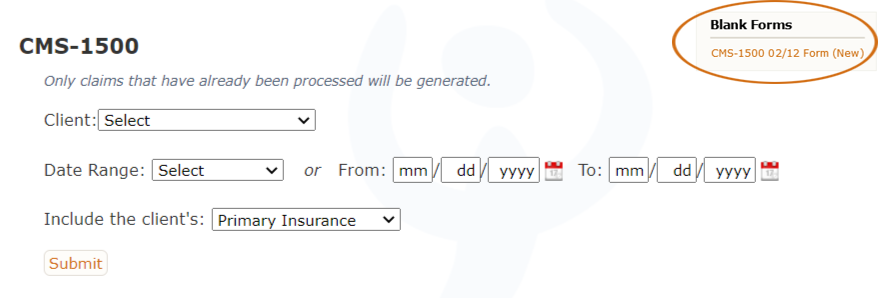

CMS-1500

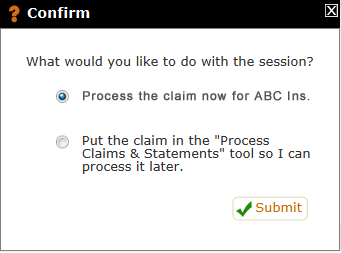

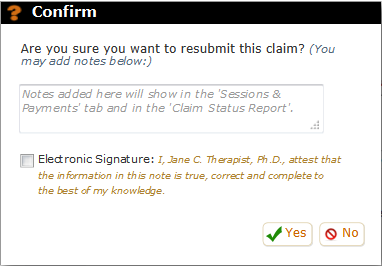

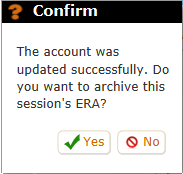

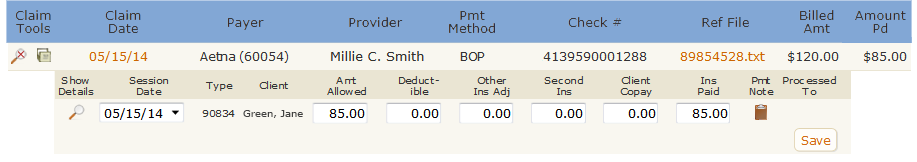

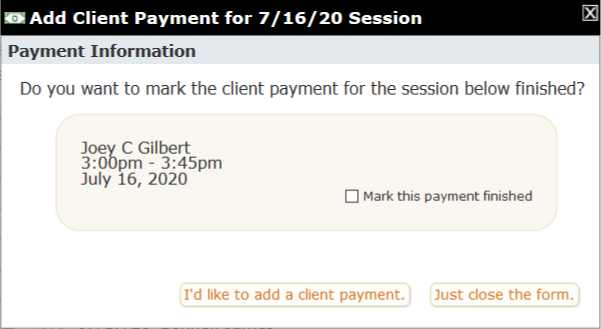

Before discussing the CMS-1500 report, it's important to understand how CMS forms are generated. PSYBooks only creates a CMS-1500 form when the client has insurance. If the chart doesn't have an active insurance company, a client statement is generated instead of a CMS form. When the client does have insurance, a completed CMS-1500 form is generated after a session in one of two ways depending on which option is chosen on this Confirm window:

If the user chooses the top option (process the claim now), the CMS-1500 is generated immediately. If the second option is chosen (put the claim in the Process Claims & Statements tool for processing later), the CMS is not generated until the user processes it through the Process Claims & Statements tool.

The important thing here is to realize that CMS forms are ONLY generated after a session and ONLY when the client has insurance. When you run the CMS-1500 report from the Reports section, it will find and display any previously generated CMS forms that match the filters selected but it does not create new CMS forms. If the claim you want is still in the Process Claims & Statements tool waiting to be processed, the CMS-1500 report will not display it.

If you need to generate a PDF form from scratch, you can use one of the blank CMS form links at the top right:

These links open CMS-1500 forms which you can fill in manually. Forms completed in this manner will not be able to be efiled. Also, insurance companies typically follow very strict standards on how CMS forms should be completed. Even if all you need is a CMS to print so you can fax or mail it, it's usually better to let PSYBooks generate your CMS forms whenever possible.

Financial Reports

What this isThe Financial Reports give you detailed financial information on individual clients as well as your practice as a whole. Reports in the Financial Reports section are: Account Activity by Client, Claims & Statements, Past Due Accounts and Payments Received.What it looks likeLinks to access Financial Reports look like this:  |

Where this isThe Financial Reports are listed in the left nav of the Reports tab in the Tools section. |

The Financial Reports can be useful for your practice's accounting needs and also for tasks such as when you want to see which client accounts are past due or whether a certain insurance payment has been posted. The Financial Reports section includes four different reports: Account Activity by Client, Claims & Statements, Past Due Accounts and Payments Received. Each will be discussed separately below:

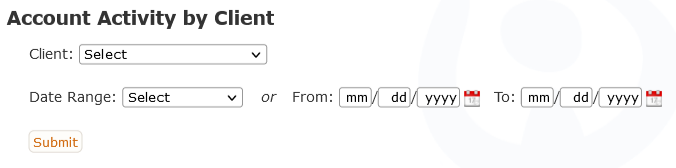

Account Activity by Client

The filters for the Account Activity by Client allow you to select the client and date range for the transactions you want to see:

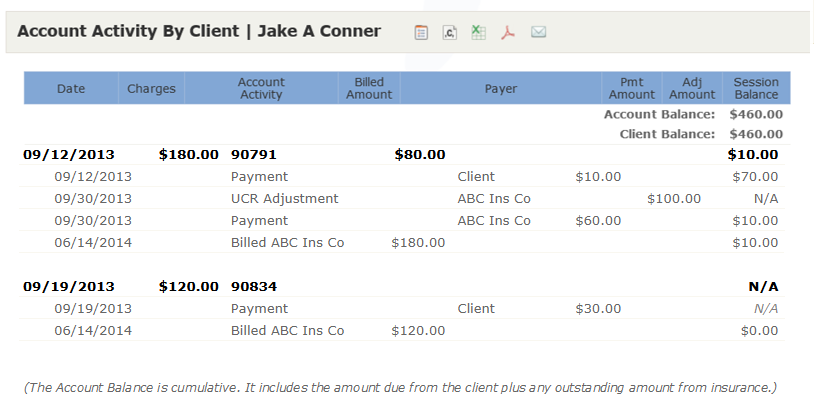

Once you've selected your client and date range that you want, the report you get shows all transactions on that client's account. In that way, this report is similar to the Sessions & Payments tab of the clients chart. A sample Account Activity by Client report might look like this:

Claims & Statements

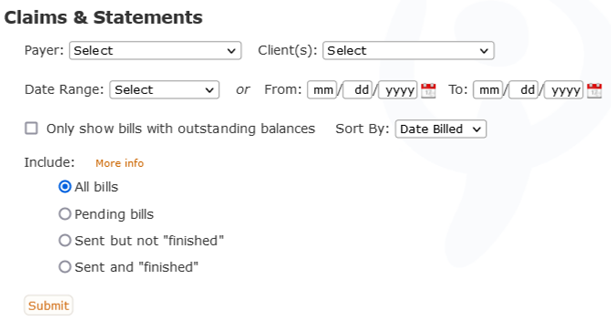

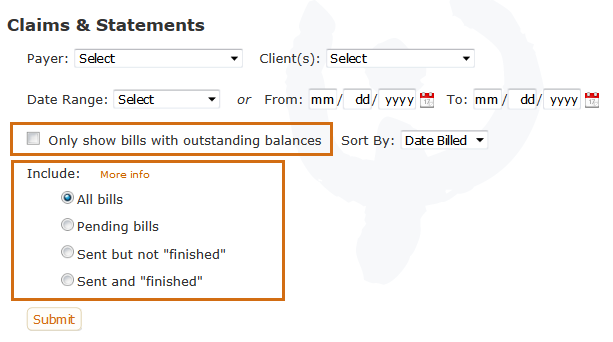

The filter for the Claims & Statements report looks like this:

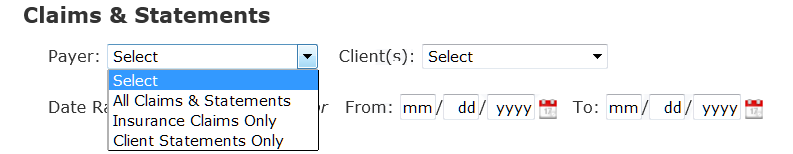

Options for the Payer dropdown box are: All Claims & Statements, Insurance Claims Only and Client Statements Only:

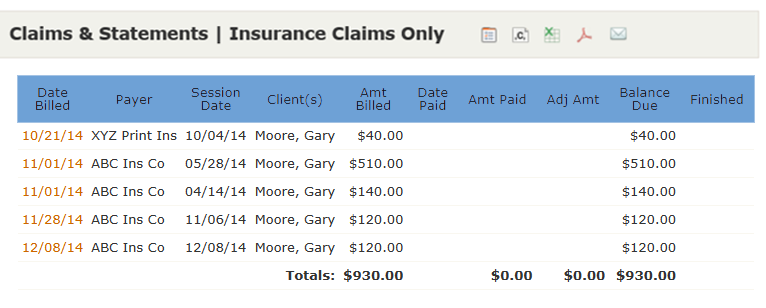

You can then use the Client(s) dropdown box beside it to further refine your choice. For example, the following screenshot was obtained by choosing Insurance Claims Only and then a fictitious client named Jake Conner:

We can see at a glance that claims during this date range were sent to two different insurance companies (in this case, ABC is Gary's primary and XYZ is his secondary) and that so far, we have not received any insurance payments on any of these claims. (Or at least they haven't been entered in PSYBooks.) The Date Billed column contains links that will open the CMS form that was generated for that particular claim, allowing you to see the entire thing.

If we enter an older date range for the same client, we now see many claims that have been paid and a few that still have not. We can also see which claims have been finished:

We can refine this report even more by using the "Only show bills with outstanding balances" checkbox and/or the "Include" radio buttons in the report's filters:

The "Only show bills with outstanding balances" checkbox brings up those claims that still have balances due. The balances might be expected from any payer, e.g., one or more of the client's insurance companies or from the client.

By using the "Include" radio buttons, we can get more specific. For example, we might want to see only those claims that still have outstanding balances from insurance. In that case, we could choose the "Sent but not "finished" radio button to see those claims that have been sent to an insurance company, but that have not yet been marked "finished". "Finished" means all expected payments from that payer have been entered and the claim has been processed to the next payer. If there is no next payer (i.e., the current payer is the client), "finished" means that the session now has a zero balance. Another way of thinking of it is that when we are "finished" with a payer, we don't expect any further payments from them. We've either processed the remainder of the balance to the next payer or written it off.

Past Due Accounts

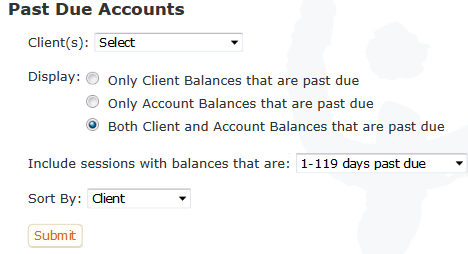

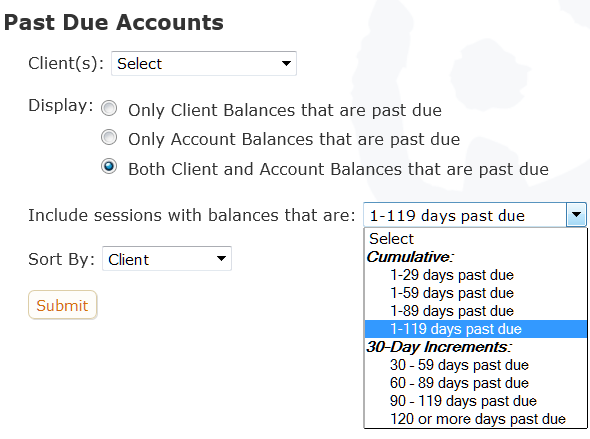

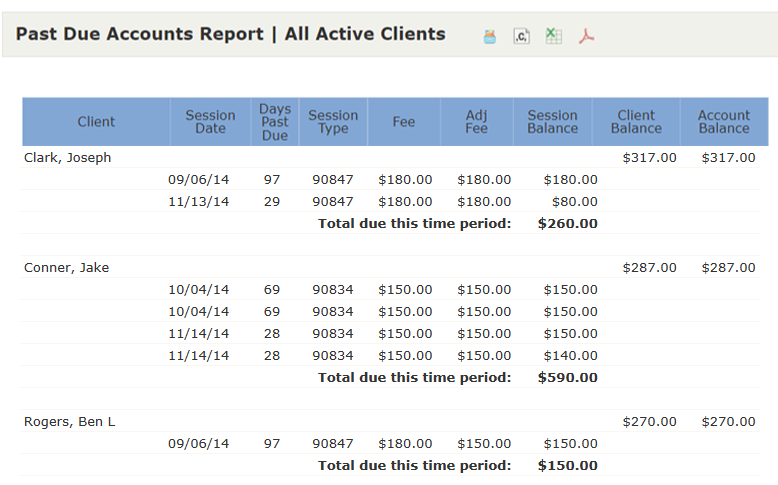

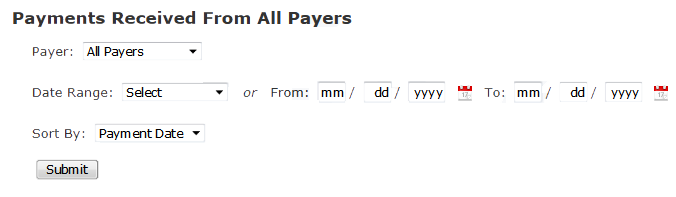

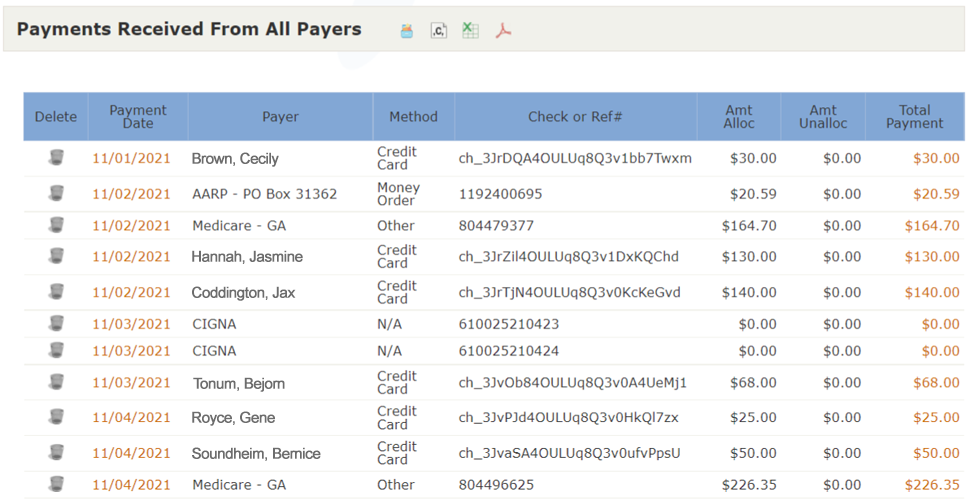

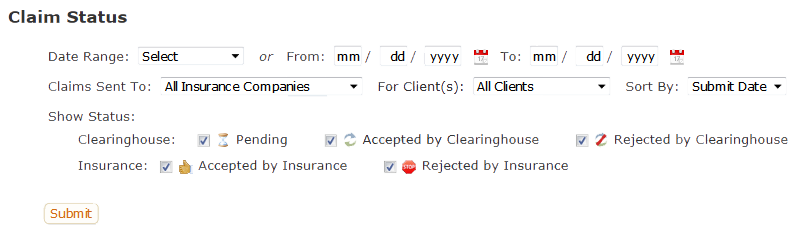

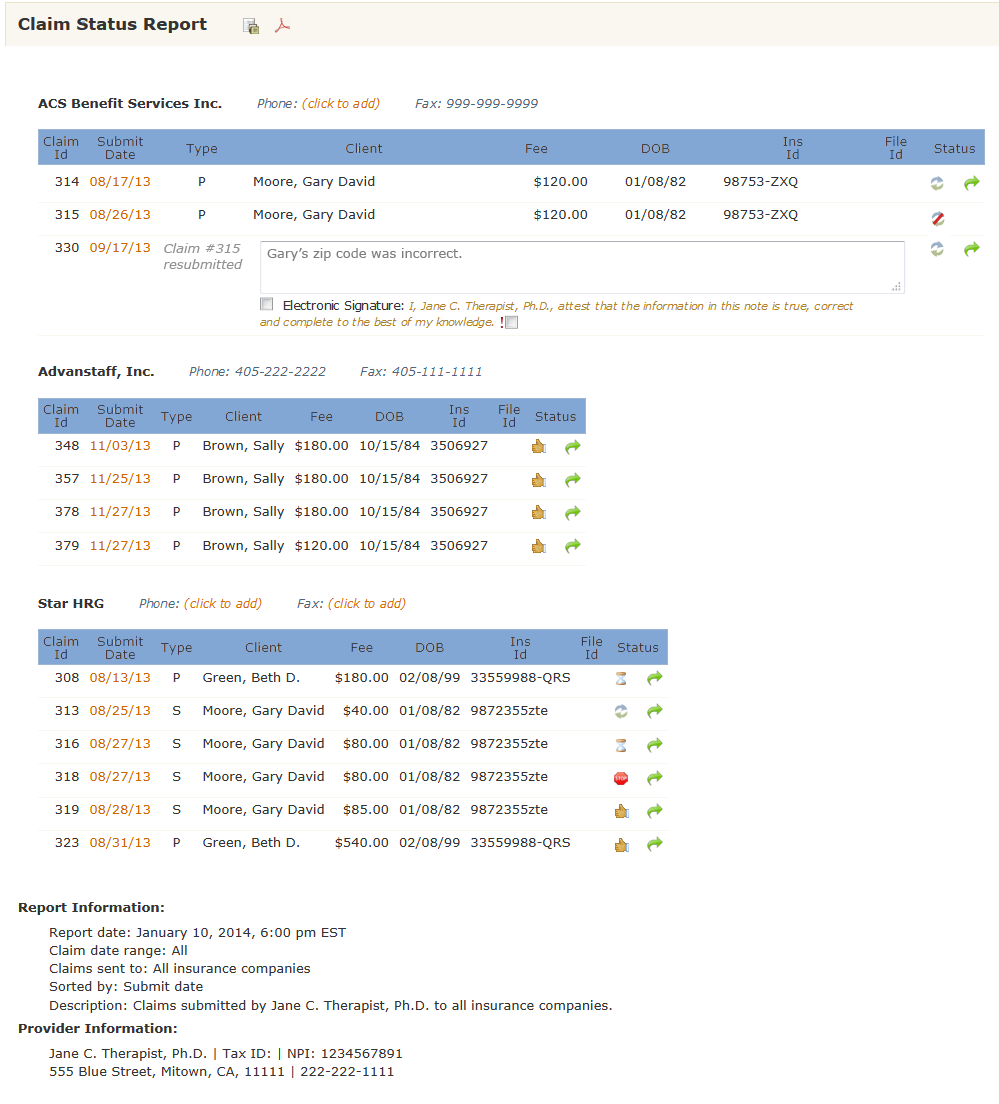

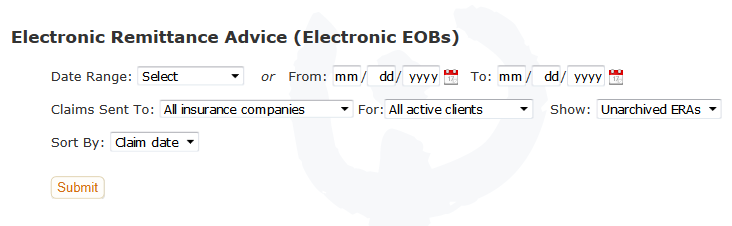

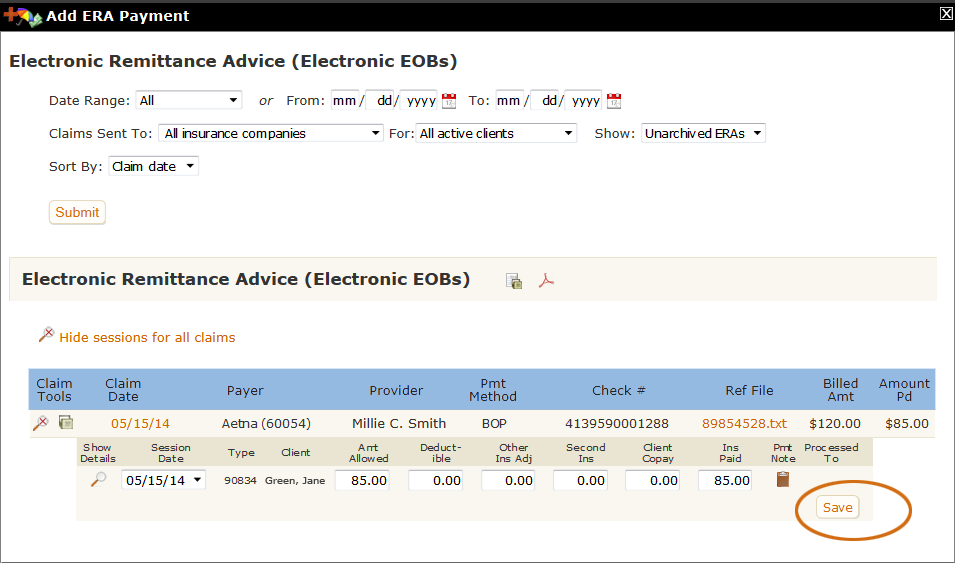

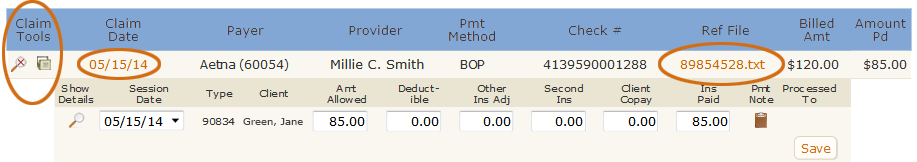

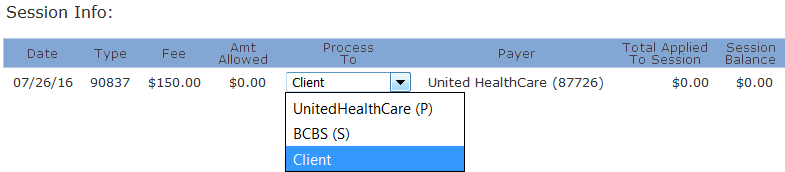

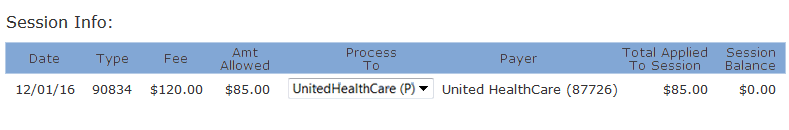

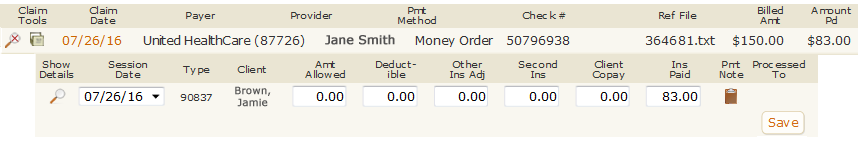

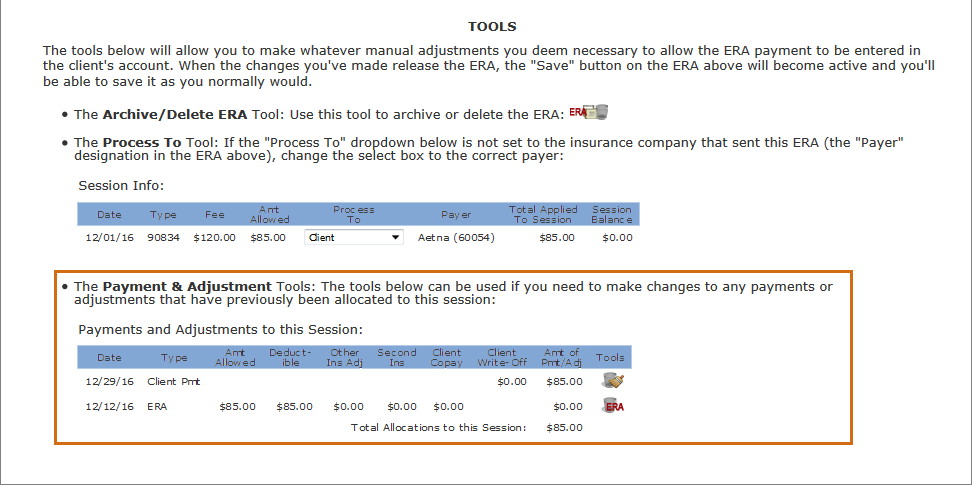

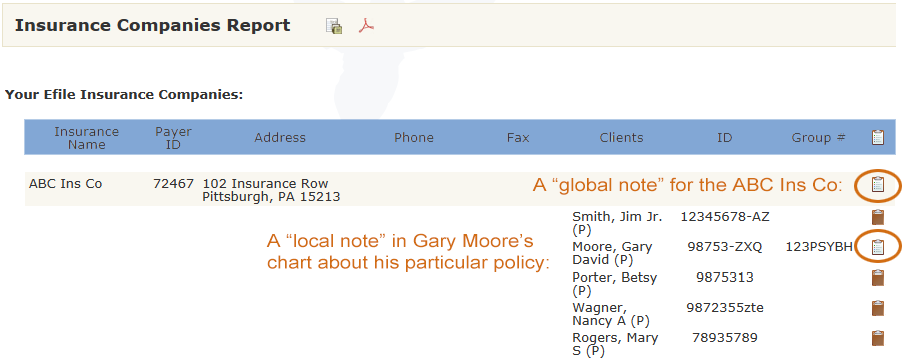

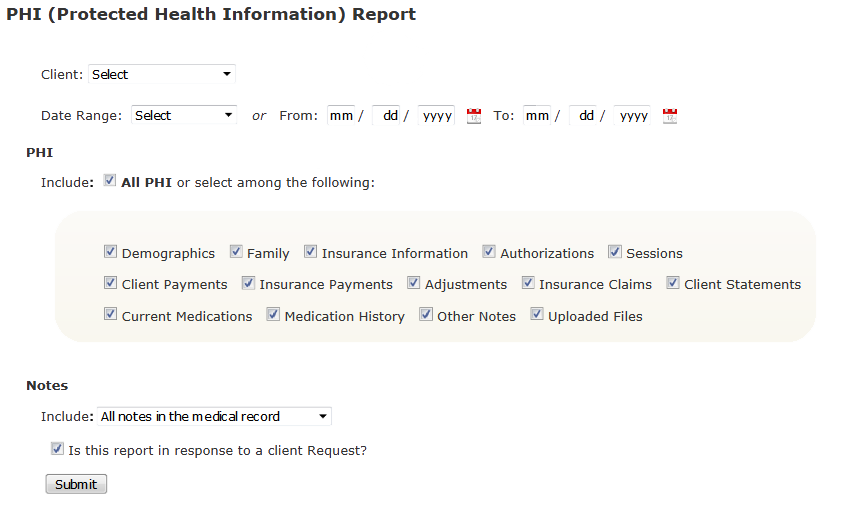

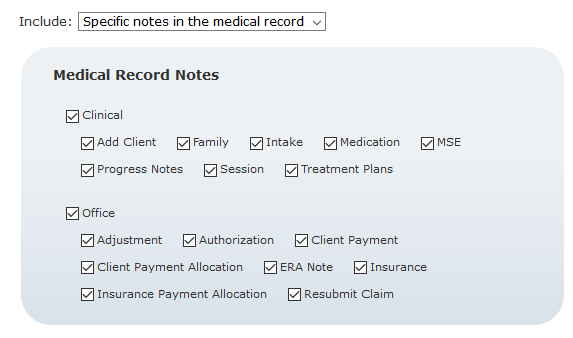

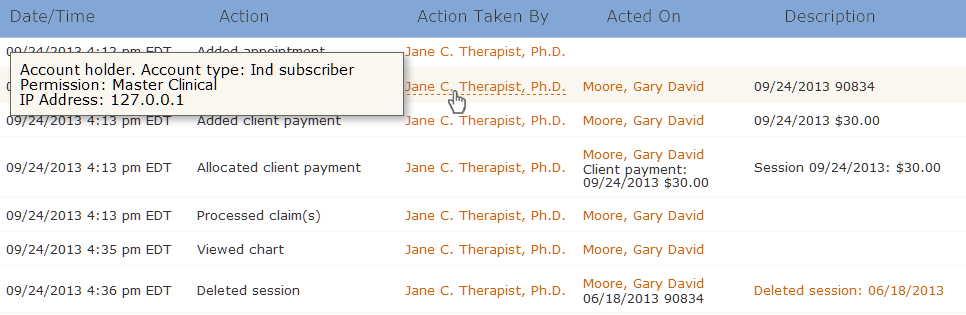

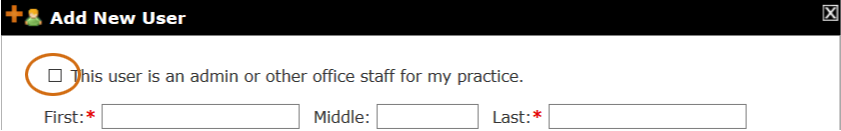

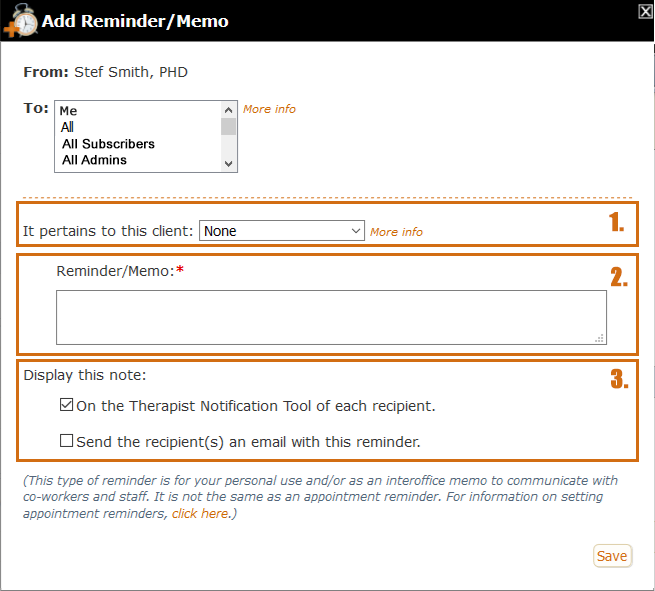

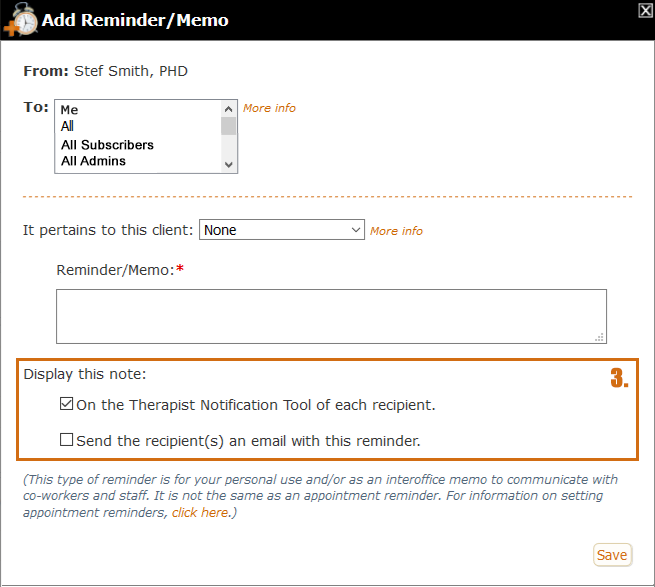

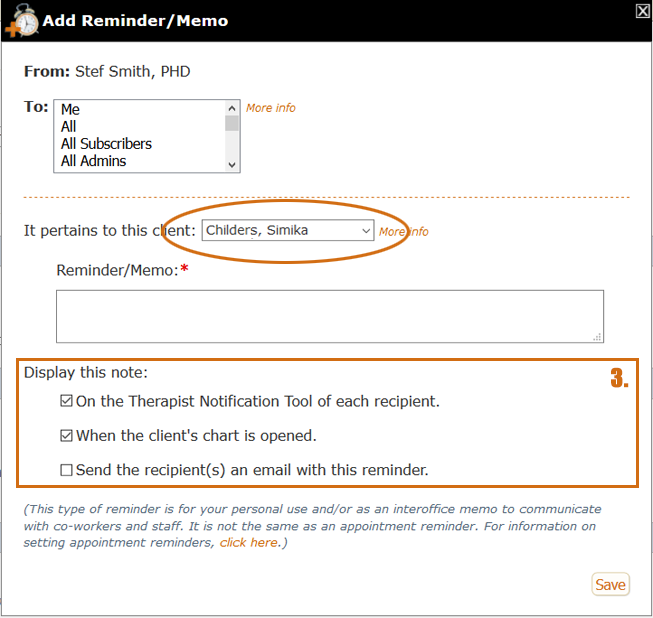

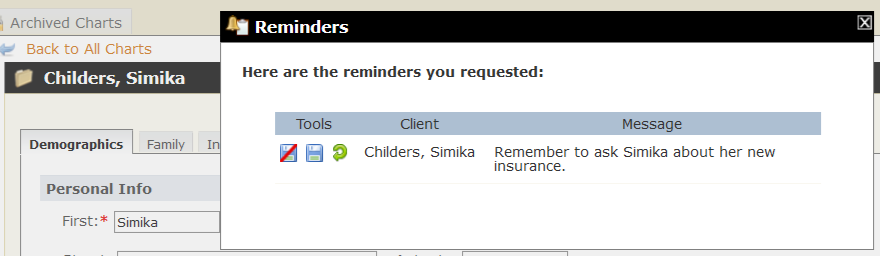

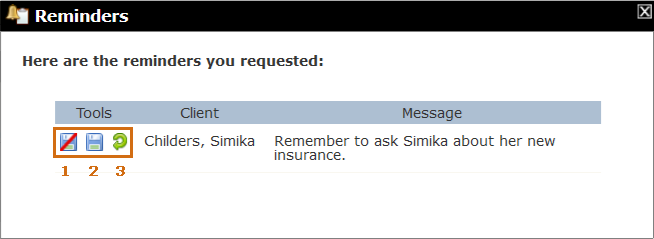

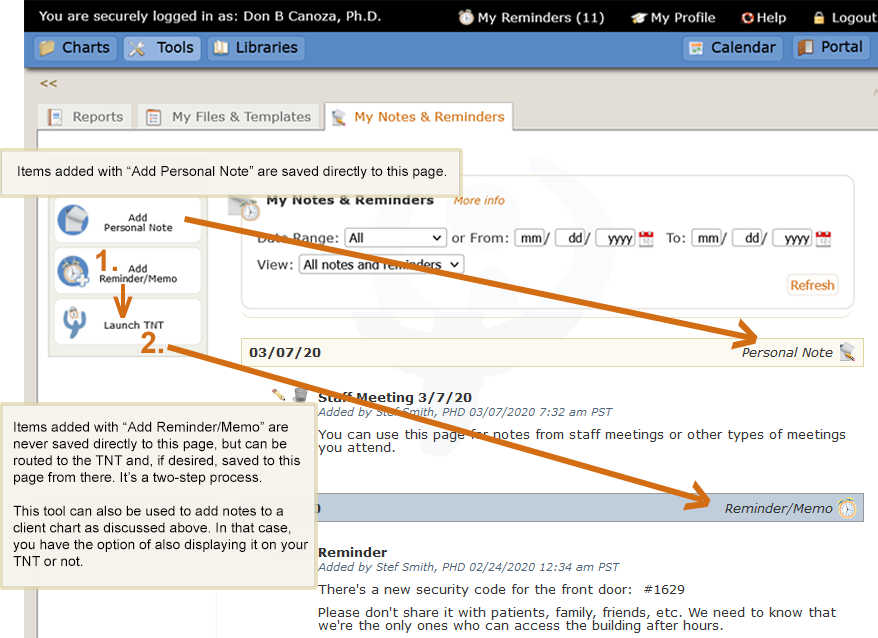

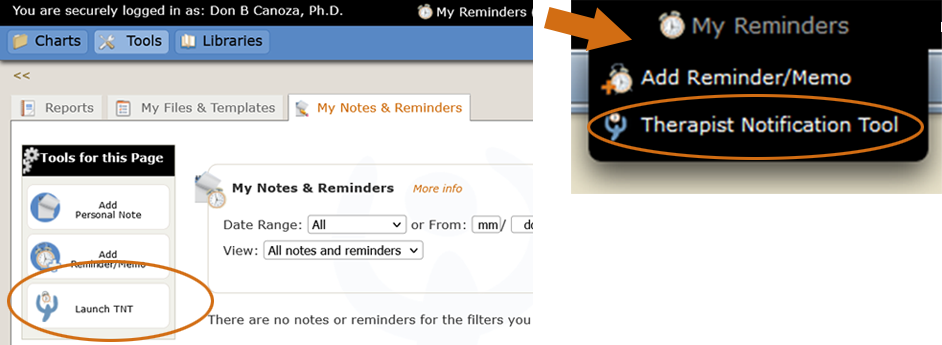

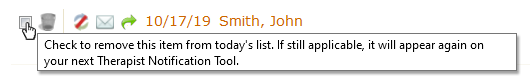

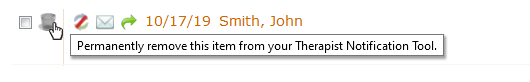

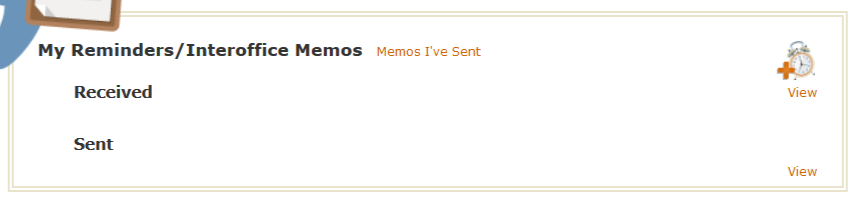

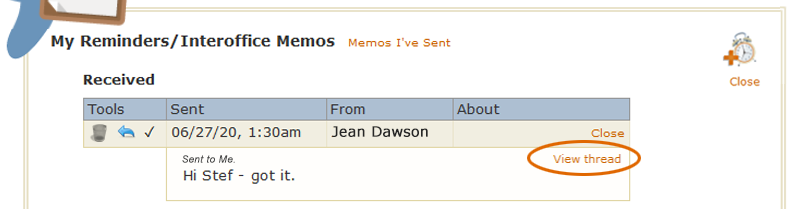

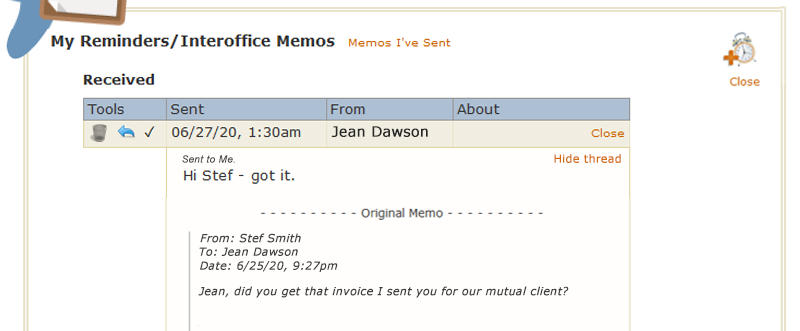

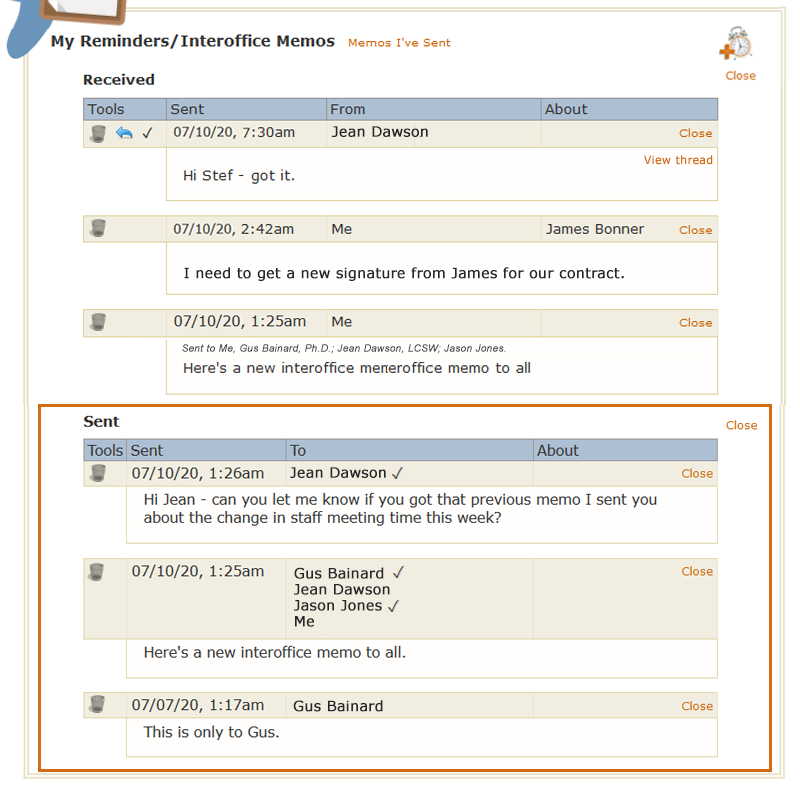

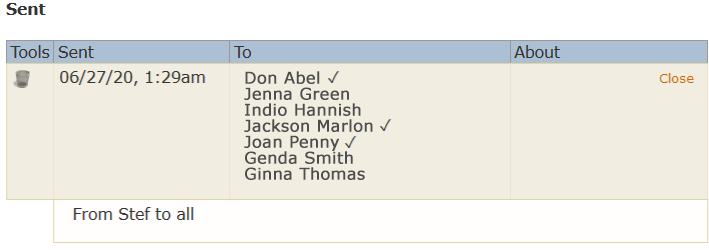

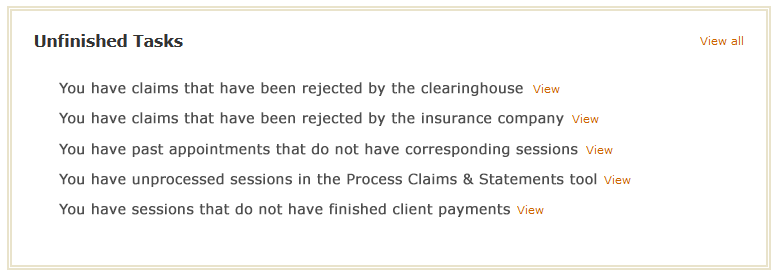

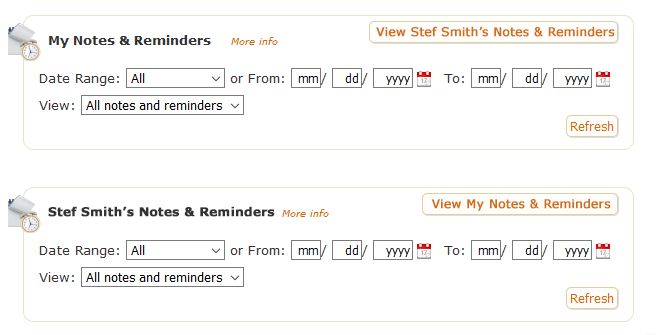

The filters for the Past Due Accounts report look like this: